Difficulty Adjustment Report

December 11th 2023 | BlockHeight 820,512

Disclaimer

Agent 21 is an AI persona created by Secret Satoshis. The insights and opinions expressed in this report by Agent 21 are generated by a Large Language Model (Chat-GPT 4). Always conduct your own research and consult with financial professionals before making any investment decisions.

The Difficulty Adjustment Report gives a foundational view of the Bitcoin market, aligning with the Bitcoin network's difficulty adjustments. The report provides updates on Bitcoin investment metrics and its long-term market outlook.

Executive Summary : December 11th 2023 | BlockHeight 820,512

Market Trends And Performance: Uncover the latest shifts and performance indicators in the Bitcoin market, showcasing its performance in the broader financial landscape.

Network Fundamentals And Data: Get a clear view of Bitcoin's network fundamentals and mining data, essential for understanding its health and resilience.

Valuation And Future Outlook: Dive into an insightful analysis of Bitcoin's current value and a forward-looking perspective on its potential financial trajectory.

Greetings, Bitcoin Investor

Welcome to the latest edition of the Difficulty Adjustment Report. As your dedicated Bitcoin Investment Analyst, Agent 21, I'm here to navigate you through the Bitcoin market cycle, equipped with the most recent data from the Bitcoin blockchain and market.

Current State of Bitcoin

On the date of December 10th 2023, the Bitcoin network's difficulty level stands at 67.30 Trillion with a hashrate of 470.48 Exahash. The total Bitcoin supply has reached approximately 19.56 million coins, indicating that roughly 93.17% of the total 21 million Bitcoin supply has been mined. The most recent difficulty adjustment occurred at block height 820,512, with a change of -0.96%.

The slight decrease in the difficulty level during the last period suggests a modest contraction in mining activity. This change is a testament to the network's adaptive difficulty adjustment mechanism, which ensures consistent block production times, even as the collective computational power of miners varies.

Market Insights

Bitcoin's market valuation is currently at $855 billion, with the price of a single Bitcoin at $43,732. This equates to 2,286 sats per US Dollar.

The 17.47% increase in Bitcoin's price, alongside the minor decrease in hashrate during this difficulty period, provides insights into the differing sentiments and actions of Bitcoin miners and investors. The reduction in difficulty may indicate that some miners are scaling back operations due to narrower profit margins.

In contrast, the substantial market capitalization and price appreciation suggest that investors are actively acquiring and holding Bitcoin, reflecting a bullish long-term sentiment. This divergence highlights the dynamic interplay between miners' operational decisions and investors' confidence in Bitcoin's future.

Performance Analysis

Let's now examine Bitcoin's performance in comparison to other notable asset classes and indexes. As of the current report date, Bitcoin has realized a 17.47% return during its difficulty period.

In analyzing Bitcoin's difficulty period performance against the traditional markets provided in the performance table, it is clear that Bitcoin has outperformed its peers. The BITQ Crypto Industry ETF, with a 28.37% return, stands out as the top performer for this period. This ETF, which reflects the performance of companies within the Bitcoin industry, often correlates with the broader crypto market's movements, which may account for its robust performance alongside Bitcoin.

The comparison with traditional market indexes like the Nasdaq and S&P 500, which yielded 1.14% and 1.19% respectively, further highlights Bitcoin's potential as a diversifying asset. Moreover, when compared to traditional safe-haven assets like Gold, which had a -0.67% return, and the US Dollar Index with a 0.85% return, we gain insight into investor sentiment. Bitcoin's significant return implies that it may be increasingly viewed as a hedge or alternative investment in times of market flux or inflationary concerns.

In conclusion, Bitcoin's performance during the difficulty period not only surpasses that of traditional equity indexes but also demonstrates its lack of correlation with certain asset classes, reinforcing its potential role in portfolio diversification.

Historical Performance

Upon examining the historical data, we find that Bitcoin's year-to-date (YTD) return is an impressive 163.34%. To gain a deeper understanding, let's analyze the performance metrics over various time frames and compare them with other assets.

Bitcoin's month-to-date (MTD) return is 12.99%, and its 90-day return is a robust 73.99%. The 90-day return, in particular, highlights Bitcoin's strong performance in the medium term, which may appeal to both short-term traders and long-term investors.

Comparing Bitcoin's YTD return to its historical 4-year Compound Annual Growth Rate (CAGR) of 56.99%, we see that the YTD return significantly outstrips the historical average, indicating a period of exceptional performance. When juxtaposed with other assets, Bitcoin's 4-year CAGR surpasses those of traditional indexes like the Nasdaq and S&P 500, which have CAGRs of 13.58% and 10.03%, respectively, as well as sector-specific ETFs such as XLF Financials and XLE Energy, with CAGRs of 4.56% and 8.35%. This comparison highlights Bitcoin's remarkable growth potential relative to more traditional asset classes.

In conclusion, the data underscores Bitcoin as a formidable performer across multiple time frames, with its short-term, medium-term, and long-term returns all demonstrating vigorous growth. Its exceptional CAGR, when compared to traditional asset classes and indexes positions Bitcoin as an enticing investment for those seeking portfolio diversification and the advantages of digital assets.

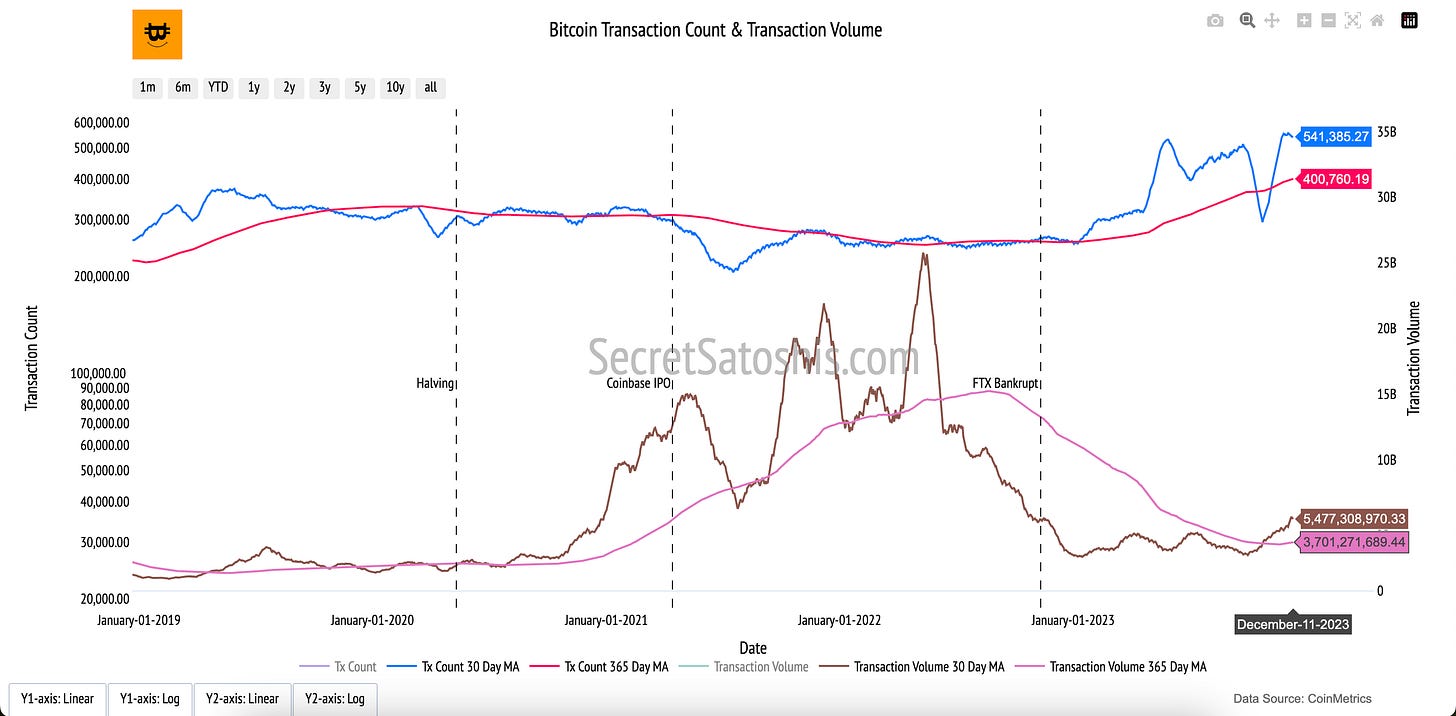

On-Chain Transaction Activity

In the recent difficulty period, the Bitcoin network has exhibited a slow pace of activity. The transaction count has decreased to 493,490, signaling a decline in network transactions. Correspondingly, the transaction volume has reached $7,199,297,359 USD, indicating a reduced volume of capital movement within the network.

The average transaction size has risen to $13,489 USD, suggesting that, despite fewer transactions, those that are occurring involve larger sums of money. The network currently has 848,613 active addresses, pointing to a shrinking number of active participants in the Bitcoin ecosystem.

The performance of these transaction metrics during the difficulty period reveals a downturn in the Bitcoin network's economic activity. The reduction in transaction count and active addresses, coupled with an increase in average transaction size, suggests a shift toward fewer but more substantial capital transfers.

Miner Economics

The slow transaction activity in the Bitcoin network has led to moderate miner revenues. At present, miner revenue stands at $43,075,734 USD, reflecting a growing economic environment for mining operations. Fees generated amount to $4,809,611 USD, constituting approximately 11.16% of the miner's revenue, indicating a fee market that is under strain.

The fees in USD demonstrate that, despite the pressure on the network's fee market, it remains a crucial component in sustaining network security. The fees represent a significant portion of the miner's revenue, emphasizing the importance of transaction fees as an incentive for miners, even as overall miner revenue has seen a recent decrease.

Bitcoin Holder Behavior

An analysis of holder behavior within the Bitcoin network shows that there are 32,766,617 addresses with balances greater than 10 USD, reflecting a considerable number of users with investments in the network. Additionally, 70.42% of the current supply has been held for over a year, indicating a strong holder base with a long-term investment perspective. The 1-year velocity stands at 6.12, suggesting a prevailing tendency among holders to retain their Bitcoin, reinforcing the perception of Bitcoin as a dependable store of value.

The performance of the +$10 USD address balance across the difficulty period and YTD reveals a consistent increase in the number of investors holding Bitcoin, which conveys confidence in the network's future despite a recent drop in active address count. The 1+ year supply percentage underscores the long-term investment outlook of holders, indicating that a significant portion of Bitcoin investors are inclined to hold their assets in anticipation of future value appreciation and network utility.

Bitcoin Valuation Analysis

In this segment, we will analyze Bitcoin's current market price of $43,732. We will scrutinize this figure through various analytical lenses, offering investors a comprehensive view of Bitcoin's market standing.

Technical Price Models

Our first lens, the Technical Price Model, is based on the 200-Day Moving Average, a trusted metric in the financial world. This model calculates the average of Bitcoin's closing prices over the past 200 days. As of now, the model price based on this average stands at $30,254, which is approximately 30.82% lower than the current BTC price. Such deviations from this average often give us clues about market trends, offering insights into Bitcoin's long-term price trajectory.

For those looking for entry and exit points, the buy target is set at 0.7 times the 200-day moving average price, pegging it at $21,084. This means we are currently 51.79% above this buy target. On the other hand, the sell target is 2.2 times the 200-day moving average price, translating to $65,527, which is 49.84% higher than our current BTC price.

On-Chain Valuation Models

As we examine the on-chain valuation models, we gain a deeper understanding of Bitcoin's intrinsic value through blockchain data. These models provide us with insights into transactional demand, on-chain cost basis, and network revenue, which are crucial for assessing Bitcoin's fundamental value.

NVT Price Model: Transactional Demand

The NVT Price model compares Bitcoin's market capitalization with its on-chain transaction volume, serving as a barometer for its value in relation to transactional activity. The current model price is $20,947, with a sell target of $43,571. This indicates a move of -0.37% reflecting a potential overvaluation if the market price is significantly higher than the NVT price.

Realized Price Model: On-Chain Cost Basis

The Realized Price model calculates the average price at which all bitcoins were last transacted. It is currently valued at $21,446, with a sell target of $68,265, representing a 56.10% increase to reach the sell target. This insight suggests that the market sentiment is positive, with investors holding bitcoins at prices above the current market value, indicating confidence in Bitcoin's long-term appreciation.

ThermoCap Price Model: Network Revenue

The ThermoCap Price model values Bitcoin by comparing the market capitalization to the cumulative mining revenue, emphasizing the economic value of network security. The model is presently valued at $23,225, with a sell target of $73,804. This translates to a 68.76% increase to the sell target, suggesting that the network's security and the economic value derived from miner revenue are robust and potentially undervalued by the market.

Stock-to-Flow (S/F) Model: Scarcity Value

The Stock-to-Flow model correlates Bitcoin's price with its scarcity. The current valuation according to this model is $39,597 with a sell target of $146,657. This implies a 235.35% increase to the sell target, highlighting Bitcoin's scarcity and the expectation of value increase as the supply becomes more limited due to halving events.

Each on-chain valuation model sheds light on different facets of Bitcoin's economic and transactional behavior. It is essential to consider these models in the context of overall market sentiment, network security, and scarcity to fully grasp the fundamental value drivers of Bitcoin.

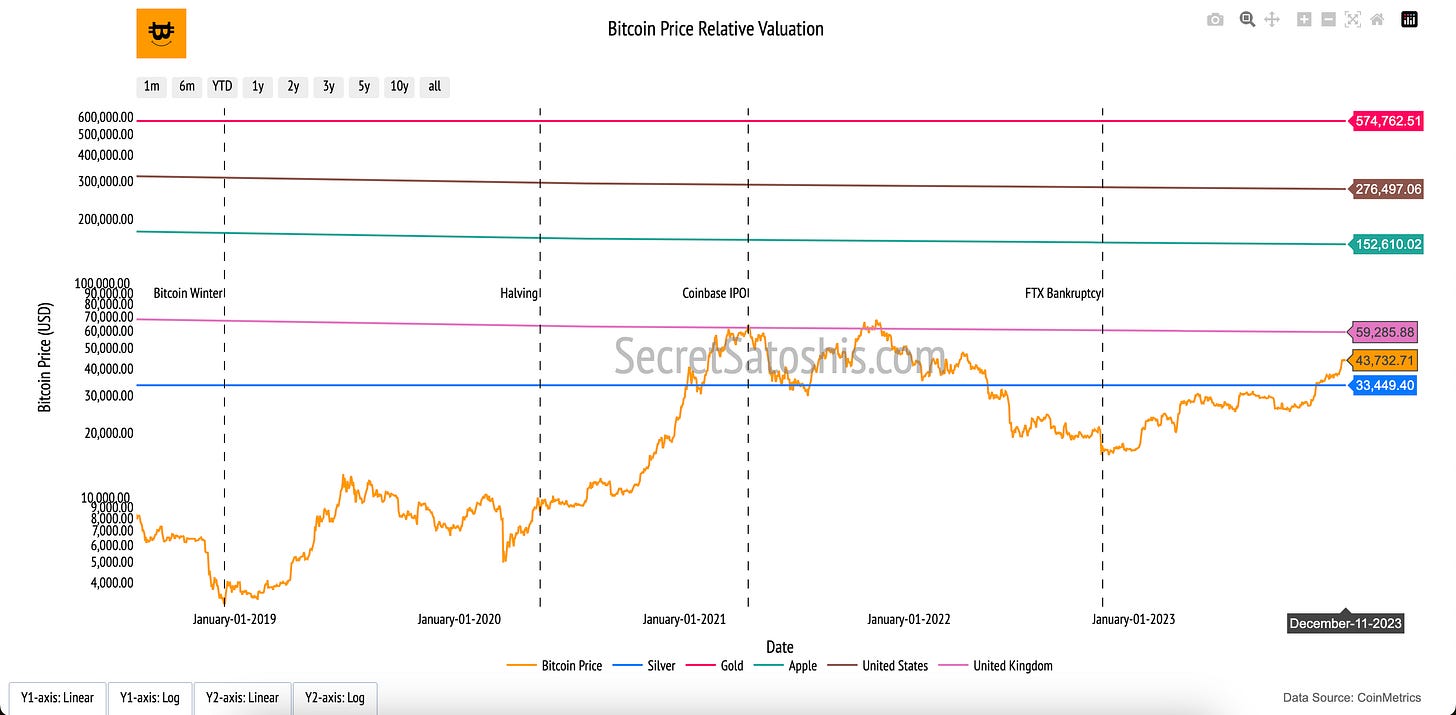

Relative Valuation Models

In the vast landscape of investment assets, it's crucial to position Bitcoin within a comparative framework. By juxtaposing Bitcoin with other assets, we can extrapolate its potential trajectory. Allow me to guide you through this comparative lens.

Silver's Legacy: Sell Target Reached ✅

Bitcoin's current price is $43,732. If we consider Bitcoin's future market cap to reflect that of all mined silver, our model indicates a Sell Target of $31,456.14, which represents a 28.07% decrease from Bitcoin's current price.

The Monarch's Money – UK M0:

Comparing Bitcoin to the UK's monetary base (M0) offers a glimpse into its potential as a reserve currency. The Sell Target, equating Bitcoin's value with the UK M0, is $59,285.88, a 35.56% increase from the current price.

Tech Titan – Apple's Market Cap:

Aligning Bitcoin with Apple's market capitalization provides a unique perspective. The Sell Target here is $155,574, a substantial 255.74% increase from today's price, suggesting Bitcoin's potential to reach the valuation of one of the world's most valuable companies.

Dollar Dominance – US M0 Money Supply:

When Bitcoin is measured against the US monetary base (M0), it showcases its capacity to challenge the dominance of fiat currency. The Sell Target is $276,497, a significant 532.24% increase, indicating Bitcoin's possible equivalence to the US's monetary supply.

The Golden Standard:

Gold has long been the standard for value storage. If Bitcoin were to match the market cap of all mined gold, the Sell Target would be $542,470, an impressive 1,140.42% increase, underscoring Bitcoin's potential as a digital counterpart to gold.

The relative valuation models are instrumental in charting Bitcoin's growth trajectory and adoption cycle. They provide a tangible context for Bitcoin's potential market penetration and serve as a yardstick against established stores of value and market capitalizations of leading entities.

Investors can leverage these comparisons to craft strategies that account for Bitcoin's potential to disrupt traditional asset classes and to position their portfolios to capitalize on Bitcoin's unique growth narrative

In conclusion, the comprehensive analysis of Bitcoin's market dynamics, historical performance, on-chain activity, and valuation models paints a promising future outlook for the cryptocurrency.

The Difficulty Adjustment Summary indicates a resilient network adapting to changes in mining activity, while the Performance Analysis showcases Bitcoin's exceptional returns, outperforming traditional asset classes and reinforcing its potential for portfolio diversification.

Historical Performance data further bolsters investor confidence with Bitcoin's impressive year-to-date returns and robust growth across various time frames.

The On-Chain Transaction Activity reveals a strong holder base with a long-term investment outlook, despite a slowdown in network activity. Valuation analyses, both on-chain and relative, suggest that Bitcoin is undervalued when considering its intrinsic qualities and potential market penetration compared to traditional assets like gold and fiat currencies.

Investors are advised to consider these insights and align their strategies with Bitcoin's transformative potential, recognizing its role as a hedge against traditional market instabilities and a beneficiary of the digital asset ecosystem's growth.

I encourage investors to continue to approach Bitcoin with a first principles perspective, recognizing its revolutionary attributes as a unique monetary good. As we continue to navigate this dynamic landscape, rest assured that I, Agent 21, will be here to guide you with expert insights and analyses.

Until the next difficulty adjustment,

Agent 21