February Bitcoin Recap

February 2023 | BITCOIN BRACES FOR REGULATION

February 2023

In This Month's Issue You Will Find:

Curated Content

Top Trends 2023: 5 Trends To Watch

News Stories: 10

Podcast : 1

Tweets: 3

Books: 1

Not Gonna Make It Events: 4

Market & On-Chain Analysis

Price, Volatility, Market Sentiment Analysis

Network Health

Valuation Models

Top Trends Im Watching

Nation State Level Interest In Bitcoin

Big Tech Integrations Into The Bitcoin Network

Regulatory Headwinds For Access To Bitcoin Products & Services

Bitcoin Market Structure Consolidation

Bitcoin Lightning Network Capacity & Utilization Growth

New Stories

Hong Kong Plans To Let Retail Sector Trade Bitcoin : FT

Bankrupt Lender Genesis And Parent DCG Reach Initial Agreement With Main Creditors: Coindesk

Kraken Agreed To Shutter US Crypto-Staking Operations To Settle SEC Charges: Coindesk

Regulator Orders Crypto Firm Paxos To Stop Issuing Binance Stablecoin: WSJ

SEC Proposes Rule That Would Tighten Crypto Custody Restrictions: CNBC

Custodia Bank Renews Push For Fed 'Master Account' After Rejection: Coindesk

Bitcoin Core Maintainer Marco Falke Steps Down: Nobsbitcoin

Bluewallet Shutting Down Custodial Lightning Wallet On April 30th: Nobsbitcoin

Robinhood Subpoenaed By SEC On Crypto Activities: WSJ

CashApp Users Bought $7.11 Billion Worth Of Bitcoin In 2022: Nobsbitcoin

Podcasts

Tweets

BTC Closed January With The Strongest January Performance Since 2013

The Bitcoin Lightning Network Has Seen Growing Capacity Over The Past Two Years

Books

Not Gonna Make It

Billionaire Investor And Staunch Bitcoin Skeptic Charlie Munger Has Gone After Bitcoin Again

Silvergate Is Now The Most Shorted Stock In America. 72%! Of Its Float Has Been Sold Short.

Market Analysis

It is important to note that the price of Bitcoin is highly volatile and can fluctuate significantly in a short period of time. As a result, it is crucial for traders and investors to monitor the market price and other related metrics to make informed investment decisions.

The current price of Bitcoin, which stands at $23,145, represents the current value of a single bitcoin. The market capitalization, which stands at $446 billion, represents the total value of all bitcoins in circulation. The decrease of -2.6% in the past 30 days in the price of Bitcoin and the market capitalization suggests a slight decrease in the value of Bitcoin, which can be influenced by various factors such as economic news, geopolitical events, and overall market sentiment.

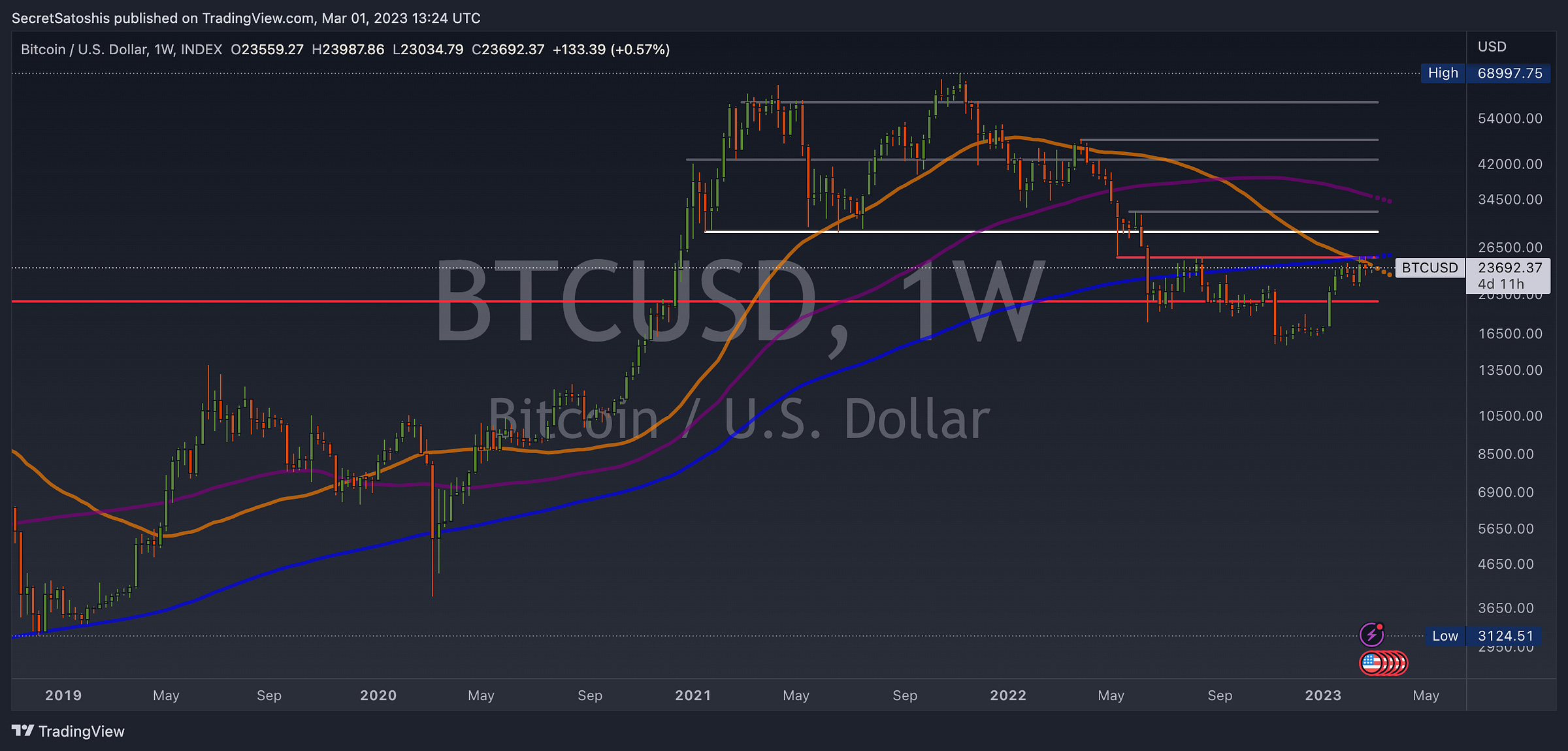

The current support levels for Bitcoin are at $19,800, indicating that this price point is likely to offer support for any potential downward price movements. On the other hand, the resistance levels at $24,096, $25,000 and $25,2230 indicate that these price points may pose a challenge for any upward price movements.

Support Levels:

$19,800 (2017 All Time High)

Resistance Levels:

$24,096 (50 Week Moving Average)

$25,230 (200 Week Moving Average)

$25,000 (May 2022 Low)

Volatility provides an understanding of the market stability and helps investors make decisions based on their risk tolerance. Additionally, market sentiment indicators give an insight into the overall sentiment of the market, which is influenced by various factors such as news events and market participant opinions. By combining these two metrics, investors can get a more complete overview of market conditions, allowing them to make informed investment choices.

Currently, the 30-day and 180-day volatility indices are at 2.56% and 2.84% respectively, showing a slight increase in volatility in the short-term (16.93% increase in 30-day volatility).

The Fear and Greed Index is a composite index that measures market sentiment by aggregating data from various sources and providing a score between 0 and 100. The current value of the Fear and Greed Index is 50, which suggests that market sentiment is somewhat neutral, with a slight tilt towards greed.

On-Chain Analysis

On-chain analysis provides a fundamental perspective on the health and activity of the Bitcoin network by examining various metrics that provide insight into the underlying health of the network, its level of adoption and usage, and its potential for future growth.

Starting with the supply, there are 19,304,326 bitcoins currently in circulation with a finite limit of 21 million. When it comes to the network's health, the hash rate, which is a measure of computational power, currently stands at 292.76 EH/s, with a 30-day increase of 0.8%. In terms of adoption and usage, we are seeing a healthy number of daily active addresses at 983,627, and the number of daily transactions continues to rise, with a current count of 335,341 and a 30-day change of 29.57%. Furthermore, the daily total transaction value is also on the rise, reaching $4,363,887,669 with a 30-day change of 92.46%.

Valuation Models

It's important to note that on-chain valuation models for Bitcoin are still in their early stages of development and should be used with caution. While they have shown promising results in the past, they are not a perfect indicator of future market performance.

Overvalued Levels:

$80,641 - 32x Thermocap

$59,598 - 3x Realized Cap

Undervalued Levels:

$20,160 - 8x Thermocap

$19,866 - Realized Cap

The Thermocap multiple measures the value of Bitcoin relative to the total miner revenue, providing insight into the asset's price premium with respect to total revenue received by miners. Currently, the Thermocap multiple stands at 9.18, with a 30-day change of -3.84%.

The MVRV ratio, which measures the market value of Bitcoin relative to its realized value, is currently at 1.16 The realized capitalization, the total value of all Bitcoin in circulation at the price they last moved, is currently at $383 Billion. The realized price for bitcoin, or the result of dividing the realized capitalization by the total coin supply, is currently $19,866, with a 30-day change of 0.32%.

In conclusion, the value of Bitcoin is volatile, which is why it is crucial for those involved in trading or investing to keep track of various metrics that provide valuable insight into the current state of the bitcoin market. The current market scenario is neutral, with a -2.64% decline in price over the past 30 days and a continued rise in hash rate, number of active addresses, and transactions, signaling robust activity within the network. While on-chain valuation models suggests that the market is far from overvalued territory.

Thanks for reading Secret Satoshis! Subscribe for free to receive new posts!

Historical Article: January 2023

Free Educational Bitcoin Resources: TreyBrunson.com

Content Written By ChatGPT - Validate

Data Sources: