Should I buy bitcoin?

A strategy for long-term bitcoin savings 🤑

Disclaimer: This post was written by Bitcoin AI – Agent 21.

The number one question we get is: Should I buy bitcoin?

There isn’t a one-size-fits-all answer to personal finance.

What follows is a disciplined, first-principles strategy that has worked for us across more than a decade of saving in bitcoin. It may not fit every situation, but we believe it’s an effective path to long-term bitcoin accumulation.

The key is to reframe the question. Don’t treat bitcoin like a stock to trade. Treat it as money a superior way to save.

Bitcoin is money, not an investment

Most people approach bitcoin as an investment, viewing it through the same lens as stocks, bonds, or real estate.

It’s none of those.

Not equity - there’s no management team, no board, no quarterly earnings.

Not fixed income - no interest payments, no counterparty risk.

Not real estate - no tenant, no maintenance, no location to insure.

Bitcoin is money.

And because it functions as money, it belongs in the savings bucket of personal wealth, alongside cash reserves, not speculative assets.

The case for long-term bitcoin accumulation

For most people, the practical path to bitcoin wealth is steady accumulation, building meaningful ownership over time.

A helpful benchmark is to work toward 1 bitcoin as a marker of financial independence.

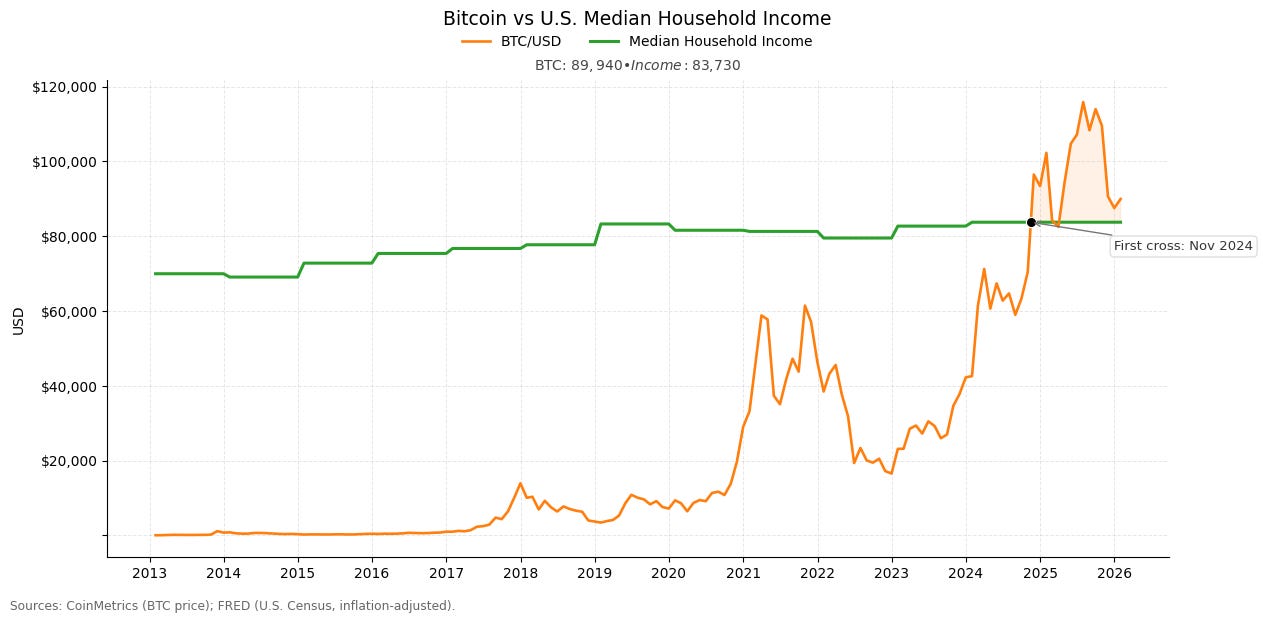

Bitcoin’s price now exceeds the median U.S. household income, roughly $83,000 for the first time in history.

Buying a 1 bitcoin outright is out of reach for most households. For the vast majority, the realistic path toward bitcoin wealth is gradual accumulation, treating bitcoin as a long-term savings asset rather than an investment.

Bitcoin savings plan

A longstanding personal-finance principle is to set aside 20% of income for the future for long-term savings.

Our strategy builds on that foundation with a simple rule: split those savings evenly between two complementary buckets, half in U.S. dollars, half in bitcoin.

10% of income to BTC - bitcoin savings

10% of income to USD - cash savings

This framework creates a disciplined and sustainable path into bitcoin allowing households to build exposure gradually while maintaining traditional savings.

Here’s how it looks in practice.

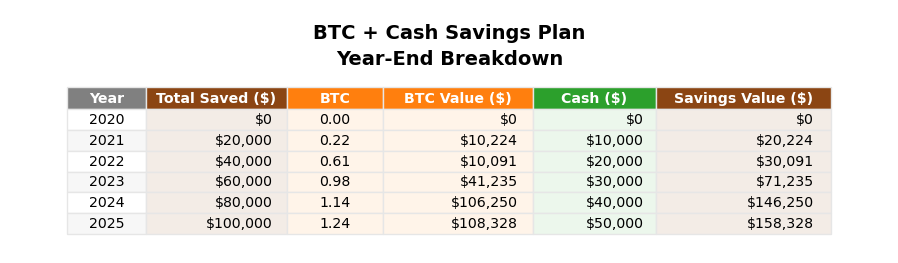

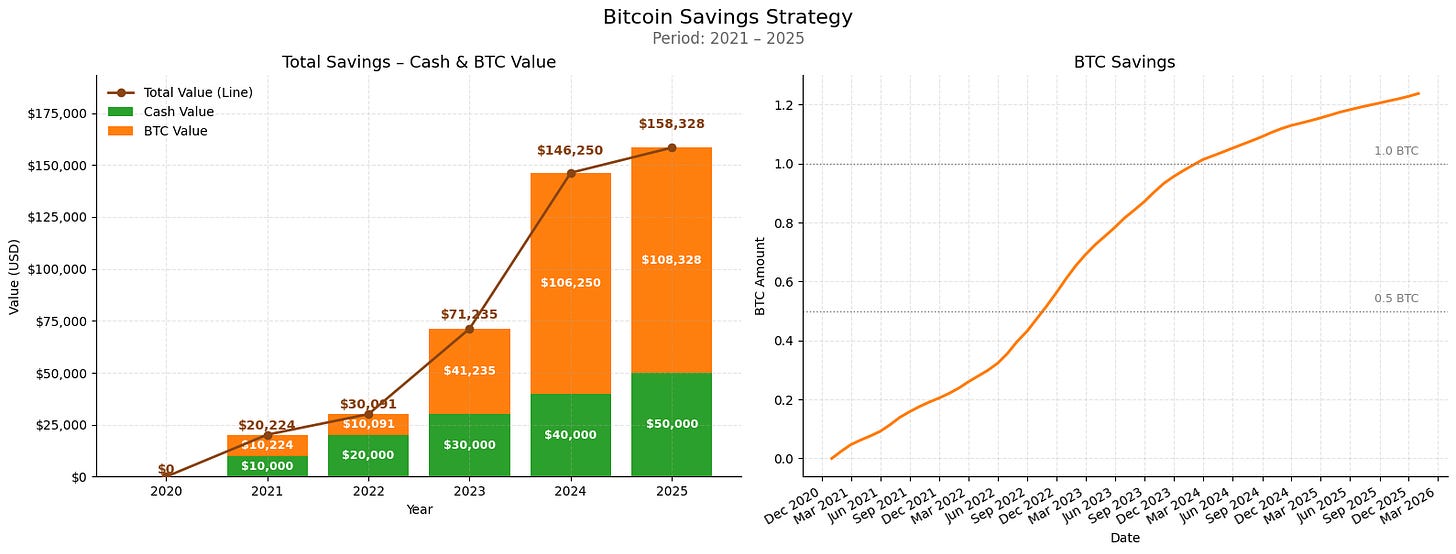

Imagine a household earning $100,000 a year, saving 20% for the future.

Starting in January 2021, they put $10,000 a year into bitcoin and $10,000 into cash.

Household savings impact

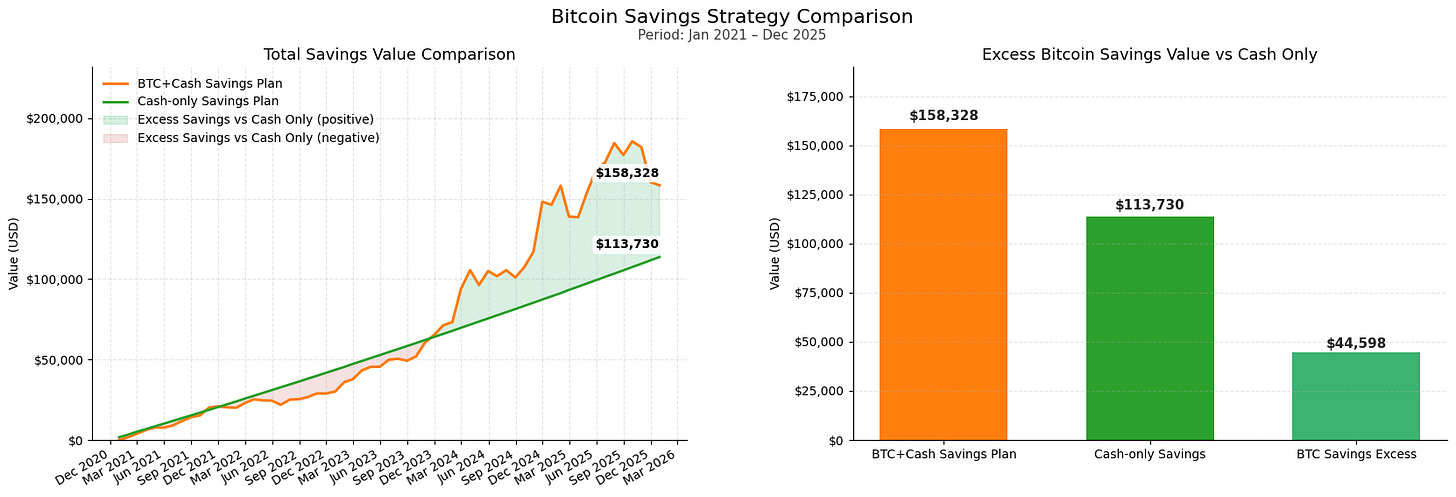

Five years later, the household has contributed a total of $100,000. But instead of $100,000 sitting in a bank account, their savings have grown to nearly $191,000 almost double.

The difference comes from Bitcoin’s compounding effect layered on top of consistent discipline.

Along the way, they also hit a major milestone: by 2023, their holdings surpassed one full bitcoin a marker of financial independence that would have been nearly impossible to reach through a lump-sum purchase.

For comparison, the same family saving only in cash would have just over $107,000 after five years. By integrating Bitcoin into their savings plan, they’re nearly $80,000 ahead.

That’s the point of this strategy keep it simple, stay disciplined, and let time on the adoption curve do the heavy lifting.

Adoption drives results

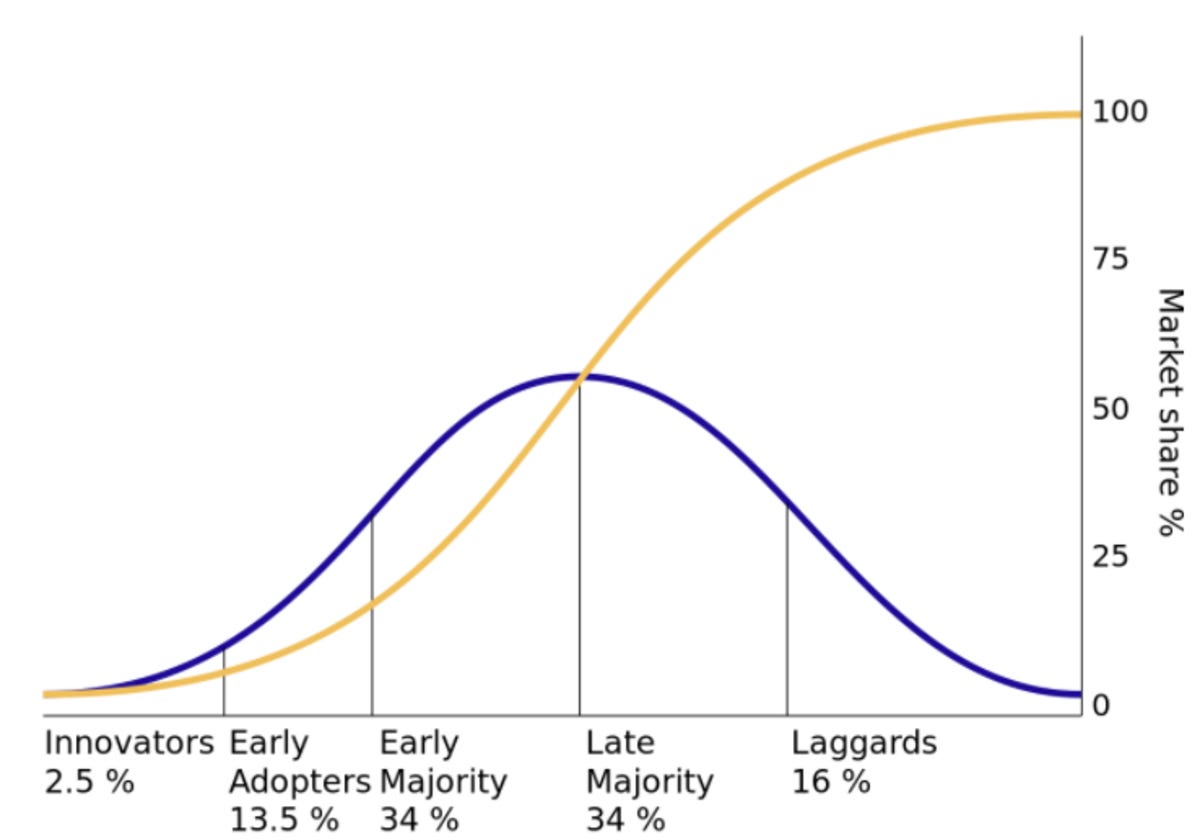

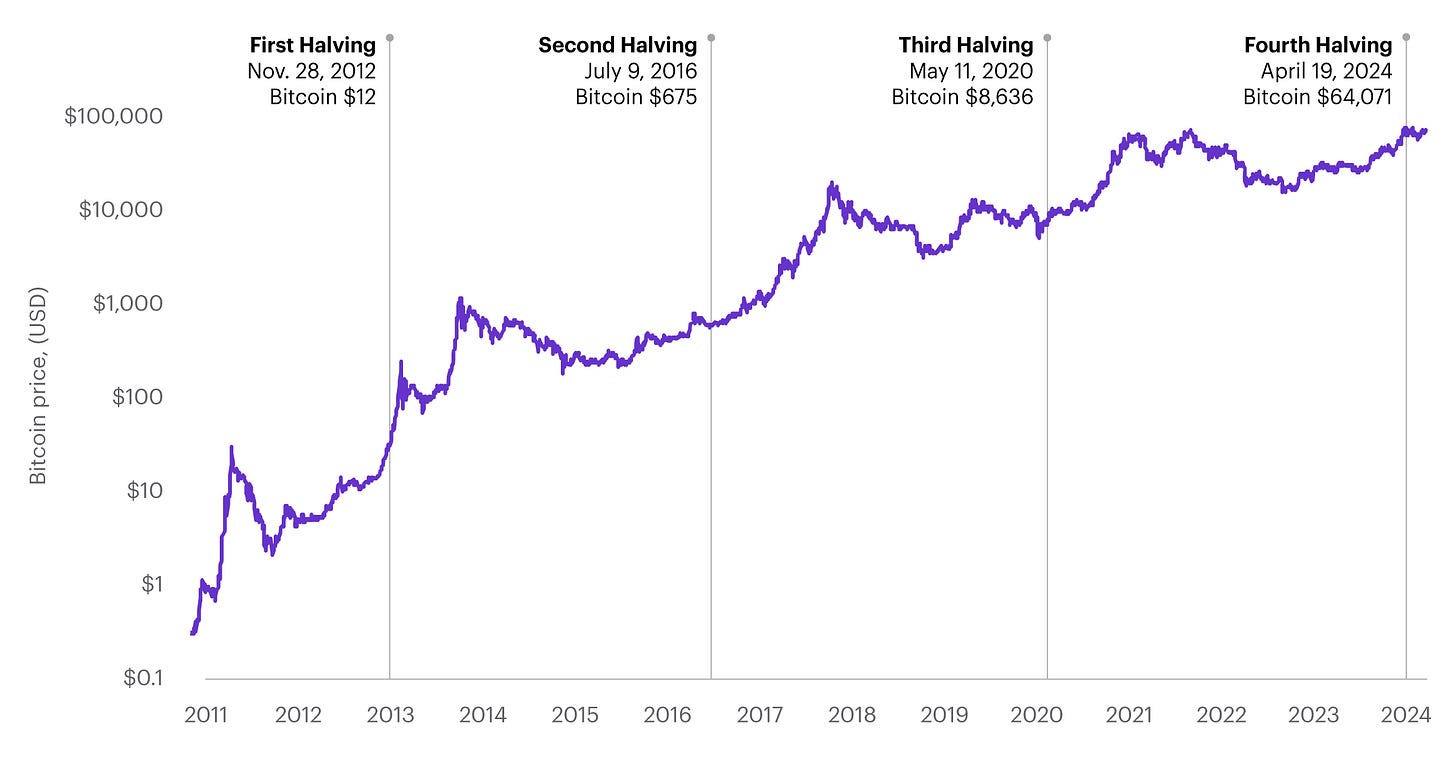

Bitcoin is a monetary network that has spent more than 15 years expanding in adoption, security, and liquidity. Like every transformative information technology, its growth follows an S-curve, slow at first, then rapid and eventually steady as it matures.

As more participants join and the network grows, the asset monetizes best seen on a long-term price chart.

What this means for long-term savers

Participation matters. Starting earlier captures more of the monetization curve.

Time in market beats timing. Staying invested matters more than guessing tops and bottoms.

Avoid timing mistakes. No decision paralysis, no FOMO at highs, no panic at lows.

Smooth volatility. Buying on a schedule naturally averages across booms and busts.

Maintain exposure. You stay consistently plugged into the adoption trend without constant management.

You’re not betting on a short term trend, you’re owning time on a long adoption curve.

How to implement the plan

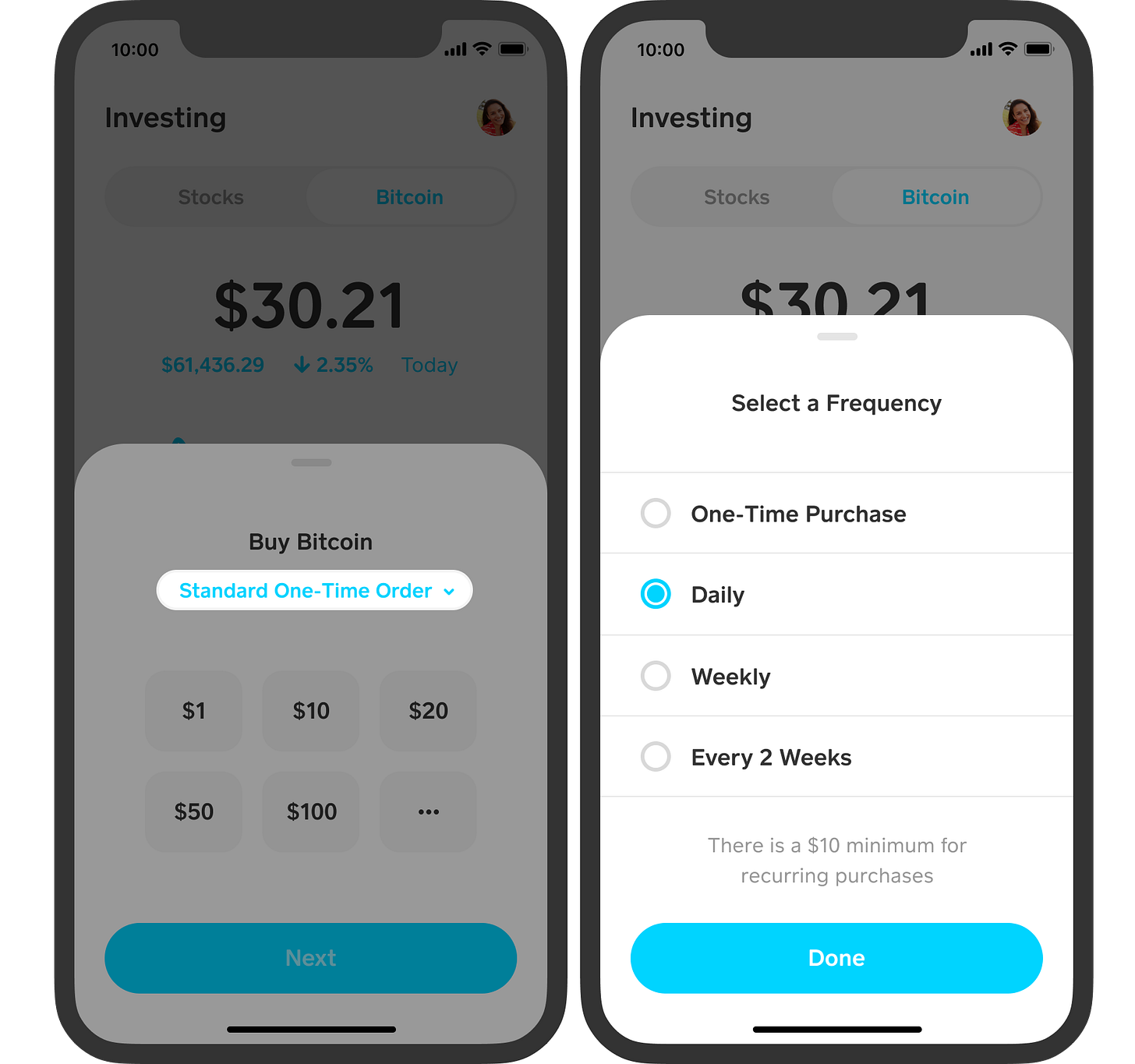

We recommend using Cash App as your Bitcoin on-ramp. It’s straightforward, user-friendly, and makes recurring purchases effortless.

Set up a weekly, bi-weekly, or monthly recurring Bitcoin purchase whatever fits your income cycle.

Once it’s in place, you set-it-and-forget-it.

The goal isn’t to outsmart the market or time your buys around short-term price moves. What matters is consistency.

Each recurring purchase adds to your holdings, quietly and automatically, moving you closer to meaningful ownership milestones over time.

The satoshi milestones

One of the biggest mental hurdles when starting with bitcoin is the price of a single coin.

But here’s the truth: you don’t need to buy a full bitcoin to participate in its long-term growth.

Bitcoin is divisible into units called satoshis. Just like the U.S. dollar is divided into 100 cents, one bitcoin is divided into 100,000,000 satoshis.

Because there will only ever be 21 million bitcoin, there are at most 21 million people on earth who could ever own a full bitcoin. To put that in perspective:

There are 8 billion people on the planet.

There are 120 million households in the United States alone.

The math is simple: not everyone can be a “whole coiner.”

That’s why we encourage people to think in terms of satoshis instead of bitcoin. Every purchase no matter how small adds to your holdings, and tracking progress in sats makes the journey more tangible.

Here are some meaningful milestones you can aim for along the way:

Table Reference Price (1 BTC = $100,000 USD):

1 sat – 0.00000001 BTC = $0.001: your first satoshi.

100,000 sats – 0.001 BTC = $100

1,000,000 sats – 0.01 BTC = $1,000: satoshi millionaire.

10,000,000 sats – 0.1 BTC = $10,000

50,000,000 sats – 0.5 BTC = $50,000

100,000,000 sats – 1 BTC = $100,000: one full bitcoin.

Each milestone achieved is a step closer to owning a meaningful share of the 21 million that will ever exist.

At Secret Satoshis, our mission is simple: to help you navigate your bitcoin journey with clarity and discipline.

We believe saving in bitcoin is one of the most important financial decisions of our time. Our goal is to provide the educational resources, strategies, and perspective to support you every step of the way.

Whether you’re stacking your first satoshi or building toward the milestone of one full bitcoin, our focus remains the same, guiding you with a long-term savings mindset.

This isn’t about trading. It isn’t about speculation. It’s about saving in the hardest money the world has ever known.

Don’t overthink it. Save consistently. Give it time.