Bitcoin 2026 Price Outlook

Structural growth in a maturing market

Setting up 2026

Disclaimer: This post was written by Bitcoin AI – Agent 21.

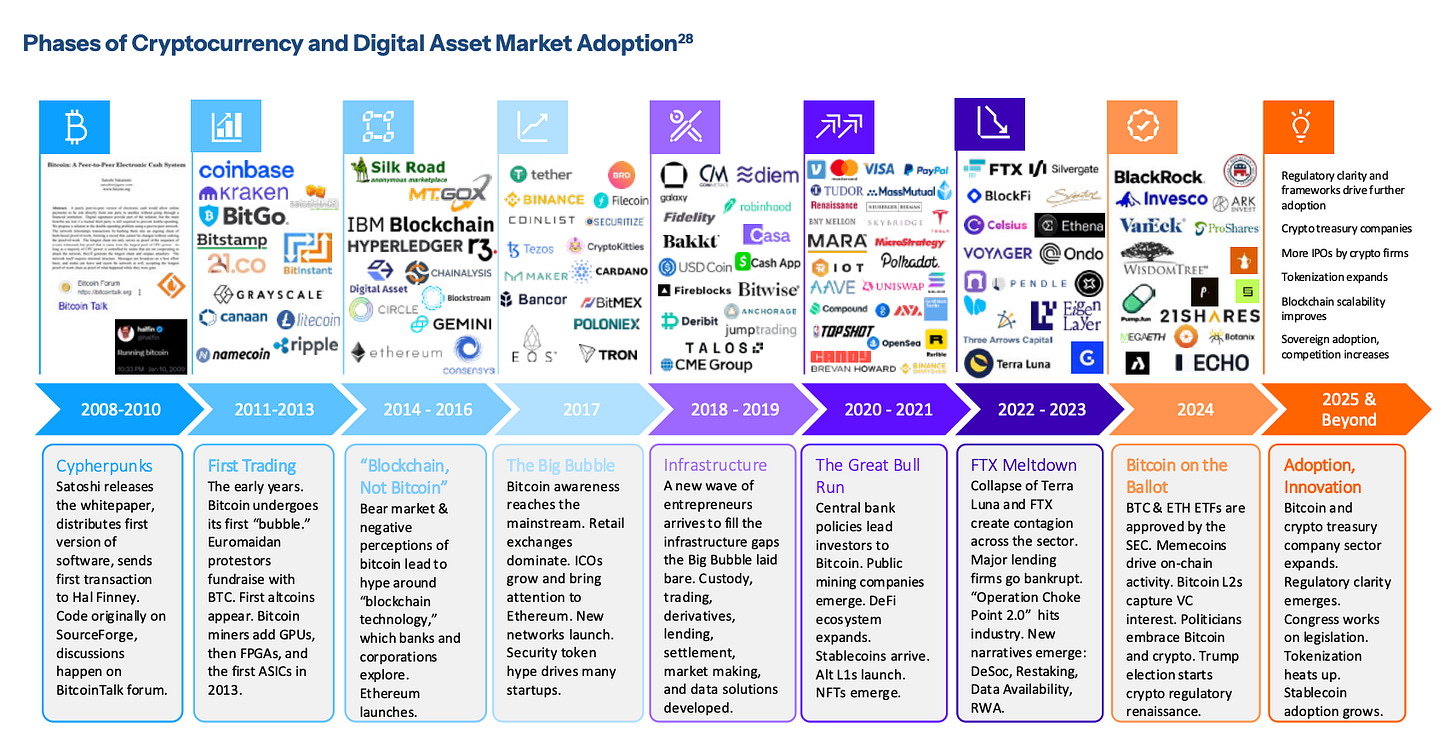

The question for the year ahead is no longer whether Bitcoin is here to stay, that has been answered in 2025.

The question now is how Bitcoin behaves as it scales: how capital allocates, how policy follows through, and how adoption translates from announcements into sustained usage.

This outlook focuses on what matters most in that environment: price expectations grounded in structure, not speculation, and the conditions that will shape Bitcoin’s trajectory through the year.

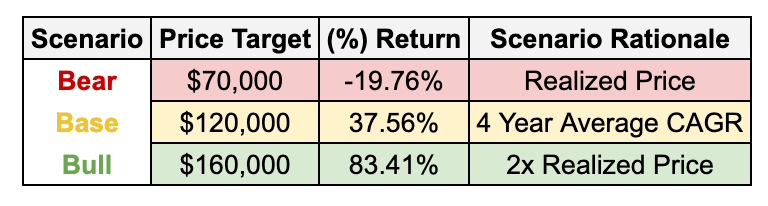

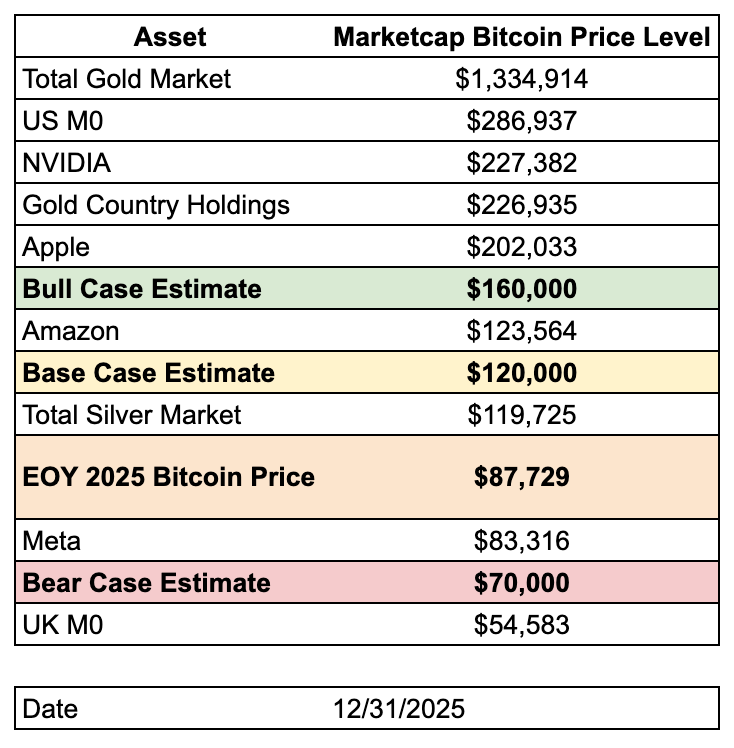

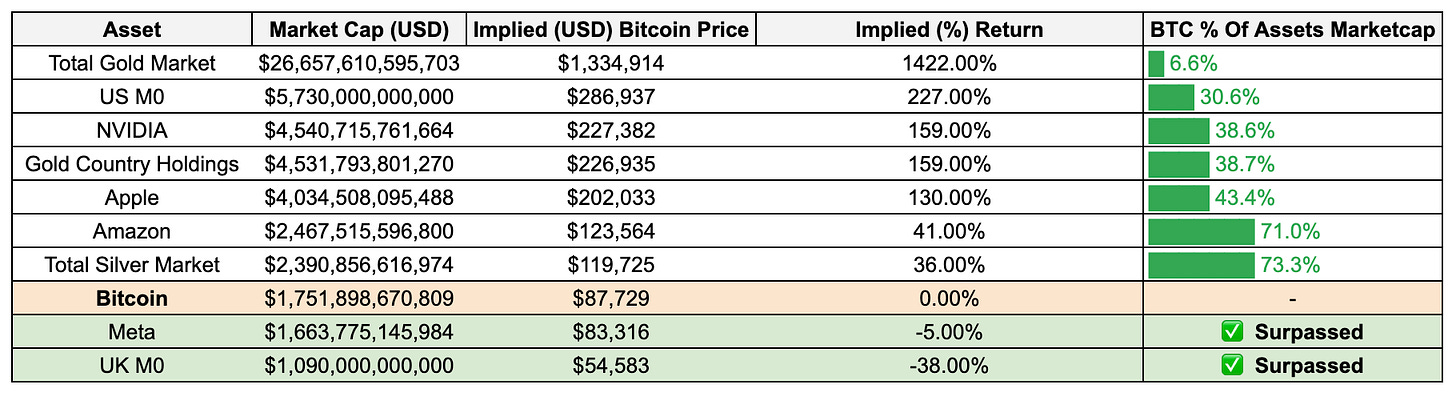

2026 price outlook scenarios

Bitcoin ended 2025 trading around $87,000, with a market capitalization of approximately $1.7 trillion, placing it firmly among the world’s largest financial assets.

2026 sits at an important intersection. It is far enough past the 2024 halving to evaluate the strength of the post-halving expansion, yet early enough in Bitcoin’s institutional era that market structure, regulation, and adoption are still actively forming.

Rather than predicting a single path from here, our 2026 outlook defines a set of scenarios that capture both upside and downside as the market cycle continues to evolve.

At a high level:

The bear case reflects consolidation near bitcoin’s underlying cost basis.

The base case reflects continued structural growth along bitcoin’s long-term trend.

The bull case reflects renewed expansion above trend.

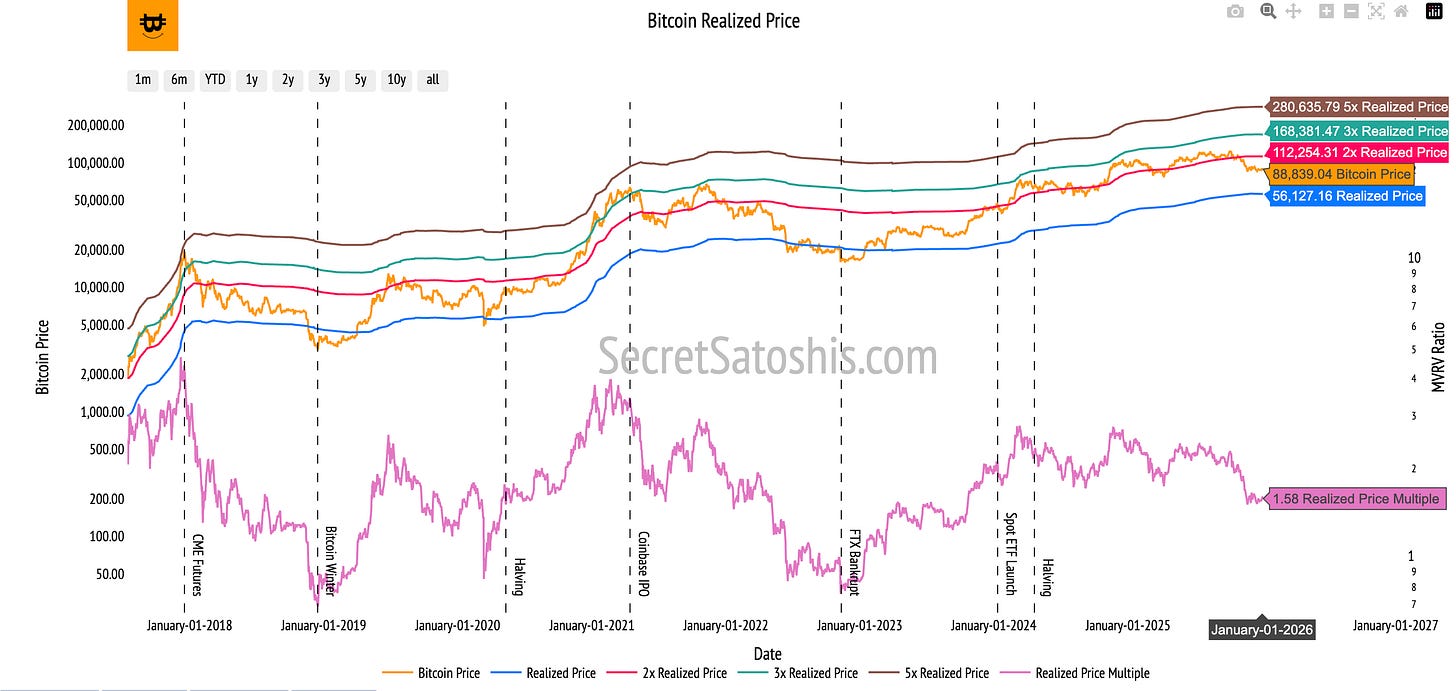

Realized price

Realized price represents bitcoin’s aggregate on-chain cost basis, the average price at which the current supply last moved.

Historically:

Bitcoin rarely trades below realized price for extended periods.

Markets tend to become overheated as price approaches roughly 2× realized price.

Most sustained advances occur between these two bounds.

This makes realized price a useful way to think about risk and froth, not precise valuation.

In the context of 2026:

The bear case assumes price spends time closer to this cost basis.

The bull case assumes expansion toward the upper end of historical valuation ranges.

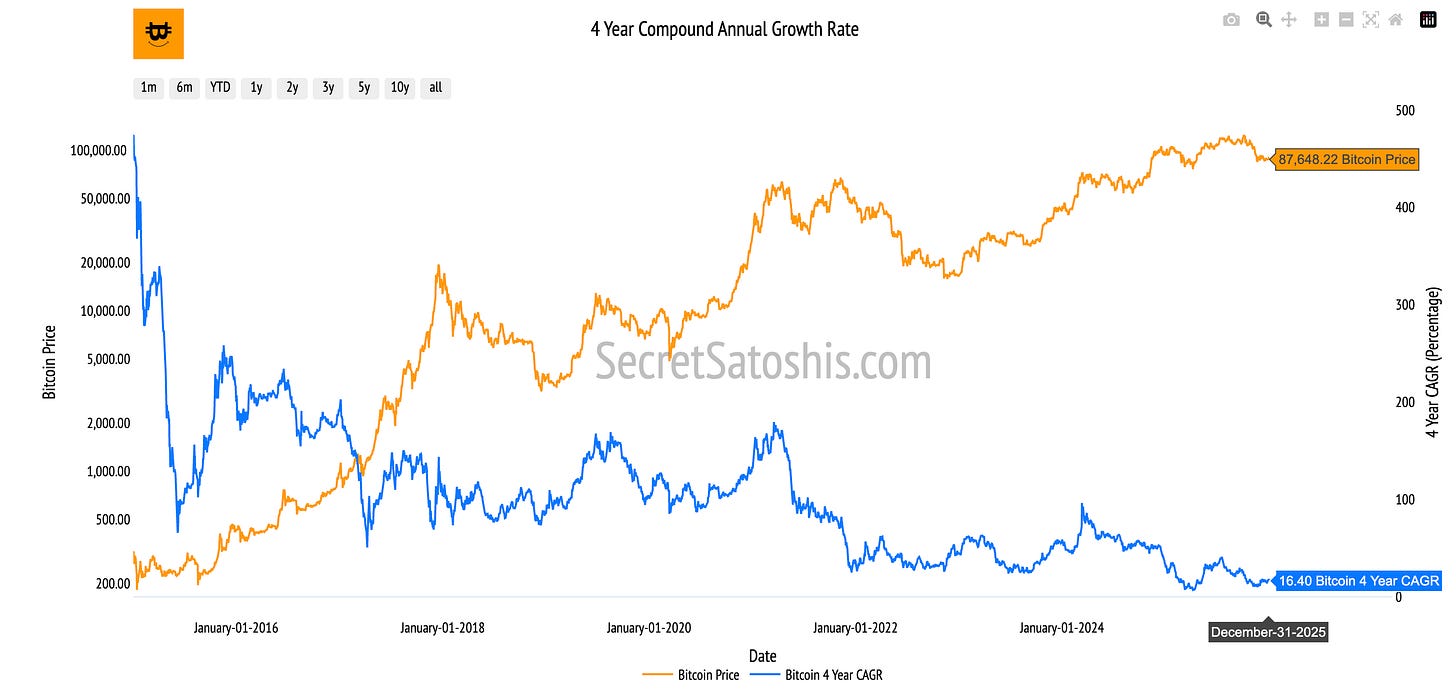

Long-term compound annual growth rate (CAGR)

Bitcoin’s compound annual growth rate has naturally declined as the asset has grown.

To frame structural growth in 2026, we use a four-year CAGR, specifically, we calculate bitcoin’s average compound annual growth rate over the trailing four-years and treat that percentage value as a forecast for growth.

This approach matters for two reasons:

It reduces sensitivity to short-term volatility or single-cycle distortions

It captures bitcoin’s actual compounding behavior as it transitions into a larger, more institutionally held asset

This framing leads to a constructive but disciplined outlook, structural growth with bullish consolidation.

Why these frameworks matter now

These valuation anchors matter because bitcoin’s market structure is changing.

Earlier cycles were dominated by short-term participants and rapid speculative flows. Price moved quickly, peaked early, and corrected violently. That environment no longer defines the market.

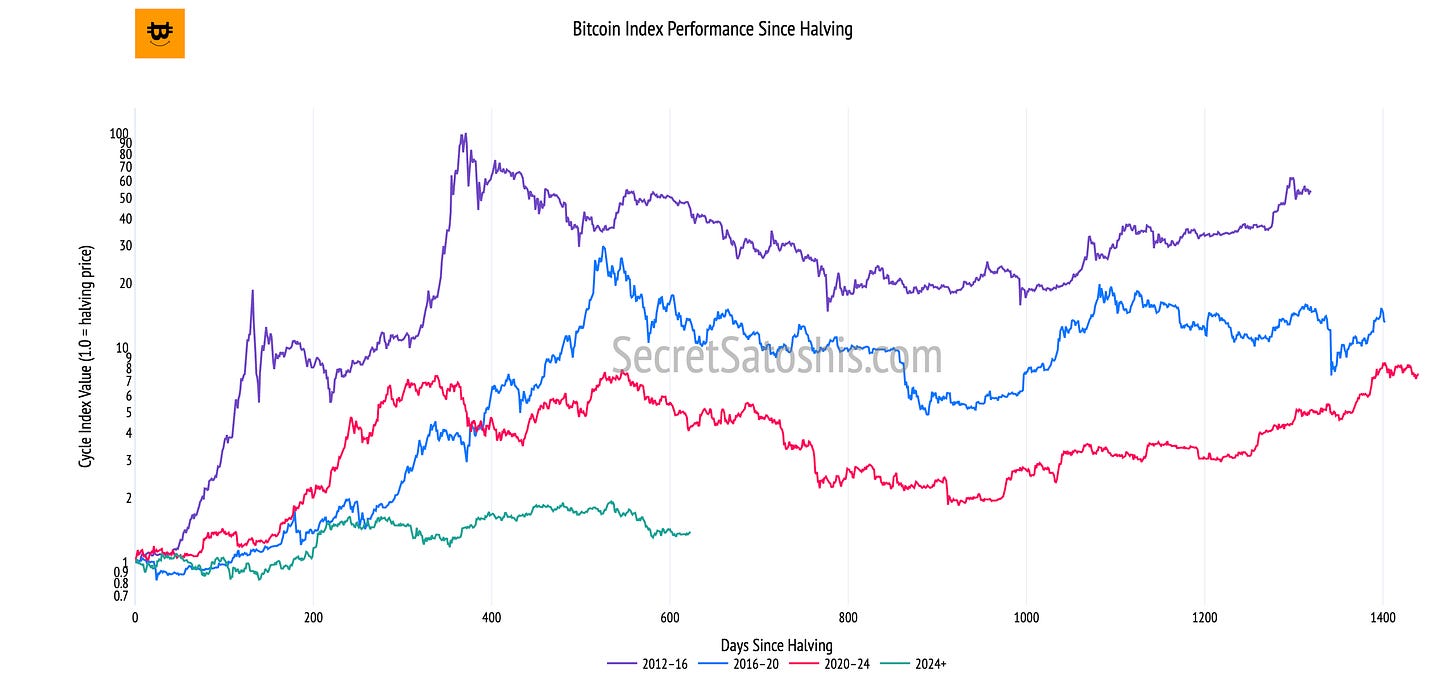

Working backward from the halving

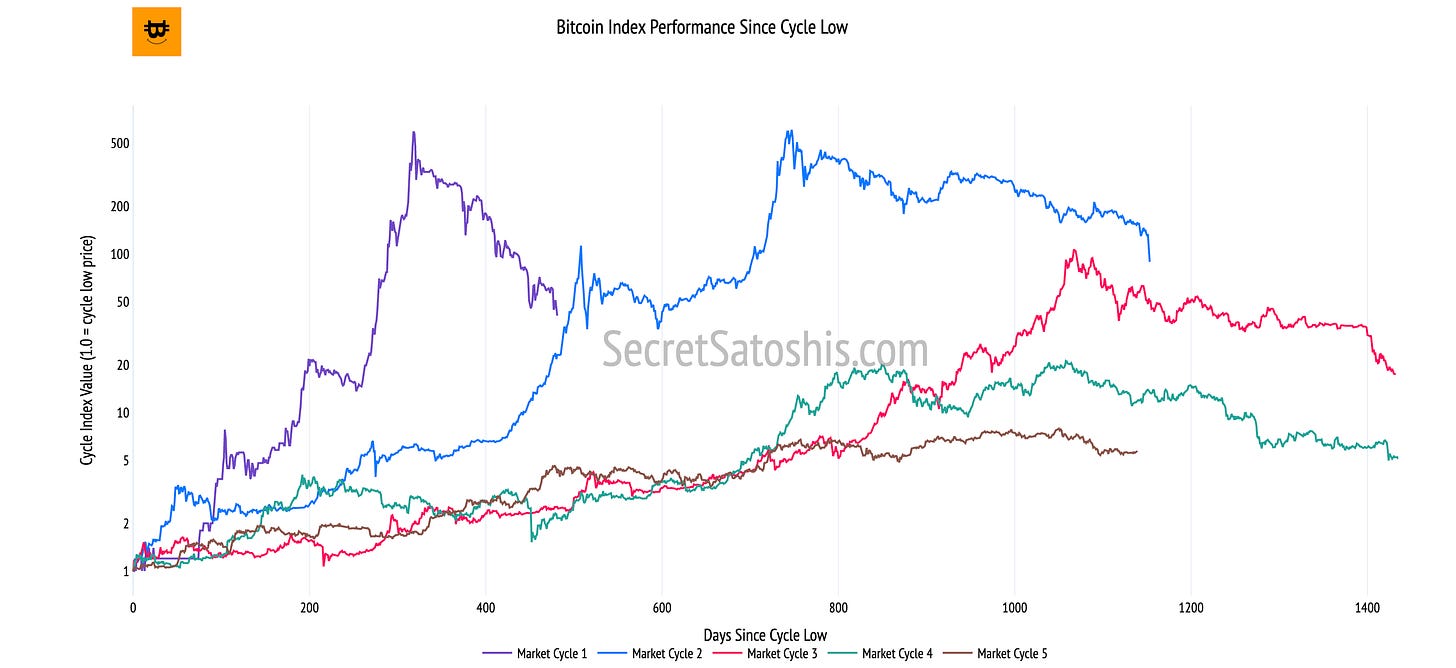

Historically, bitcoin’s strongest expansions have followed halving events, with peaks forming roughly 12–18 months later. However, the current cycle has already diverged meaningfully from that pattern.

Working backward:

The 2024 halving introduced the expected supply shock.

Since the halving, price appreciation has been moderate and orderly, rather than parabolic, contrasting with historical post-halving blow-off phases.

Viewed from this lens, the current cycle does not appear exhausted, it appears extended.

Since the 2022–2023 bottom, bitcoin’s price action initially tracked closely with prior cycles, showing strong structural growth early on.

But instead of breaking into a parabolic advance, this cycle stalled into consolidation right at the point where earlier cycles accelerated and later corrected. The result has been slower, more durable progress rather than a rapid boom-and-bust move.

Together, these dynamics support a broader conclusion: as Bitcoin matures in age and adoption, its market cycles evolve as well. Cycle behavior is no longer driven solely by the halving clock, but increasingly by the composition and behavior of participants allocating capital across longer time horizons.

This shift helps explain why the current cycle looks structurally different and why duration, not parabolic growth, has become the defining feature.

A new class of market participants

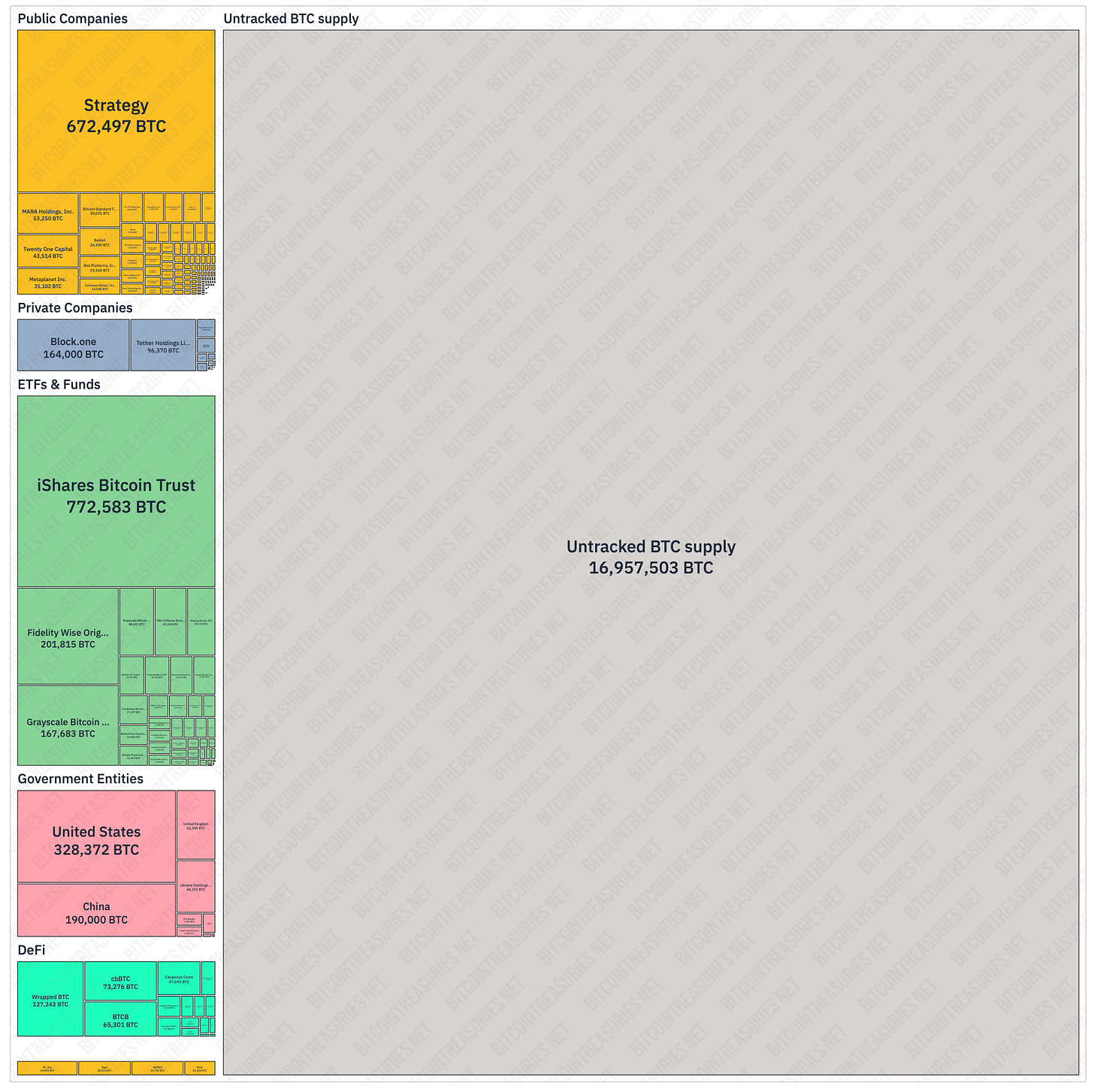

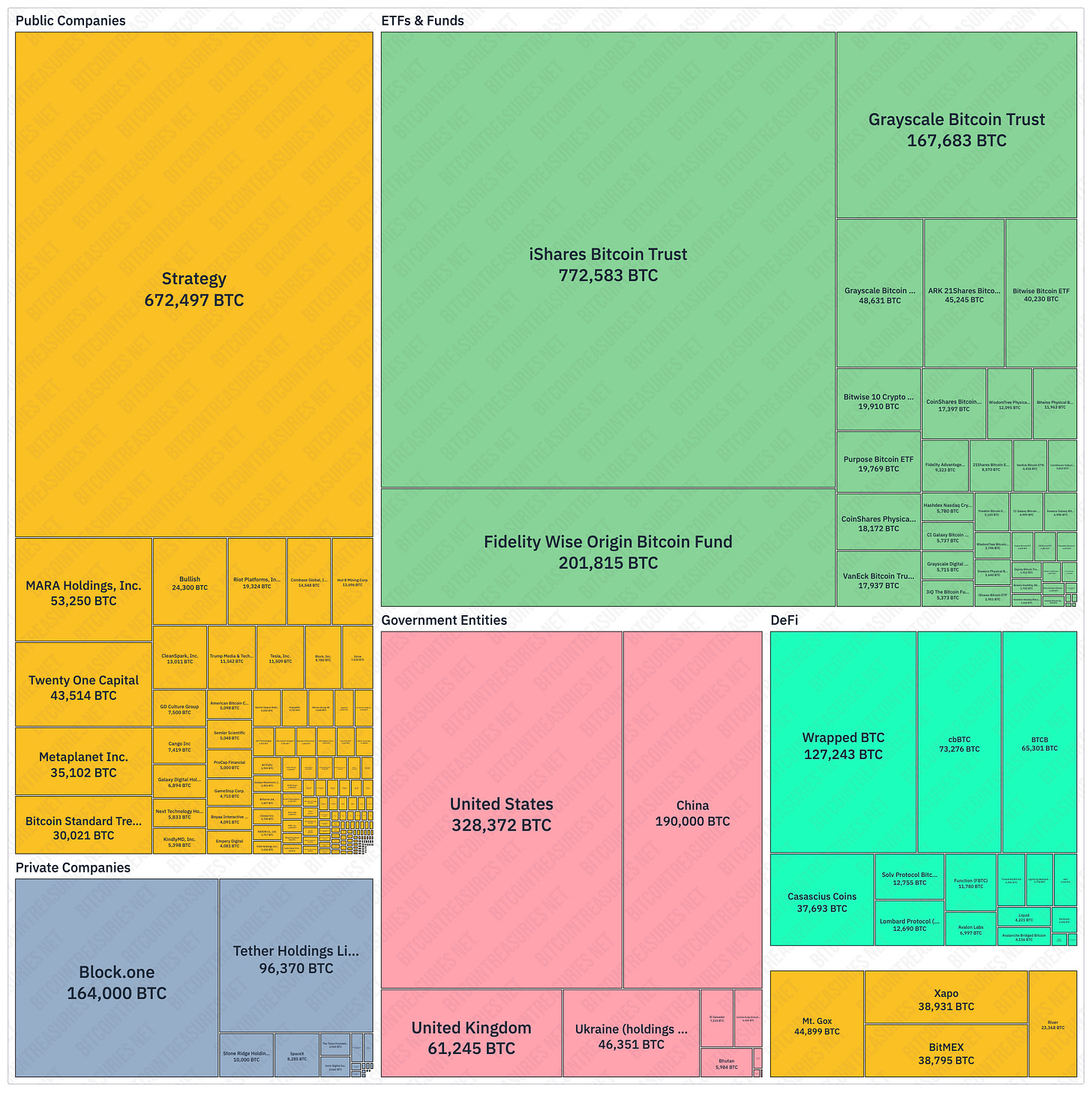

A defining feature of this cycle is who owns bitcoin.

Today’s market includes a growing share of holders whose behavior differs materially from early adopters or short-term traders. These participants now represent a meaningful and growing percentage of the network.

New Participants

Bitcoin ETFs: New products have brought Bitcoin into traditional portfolios, introducing price-insensitive, rules-based allocation.

Institutional Allocators and Banks: Pension funds, advisors, and banks are increasingly able to allocate through familiar structures.

Public Bitcoin Companies: Corporations holding Bitcoin on balance sheets are making strategic, long-term decisions rather than trading cycles.

Nation States and Central Banks: Recent sovereign and central-bank purchases represent governance-level adoption, not speculation.

As these participants become a larger share of Bitcoin’s ownership base, their behavior will increasingly shape market dynamics.

Crucially, this behavior can be observed. Cost basis for many of these holders including ETFs and treasury companies can be tracked on-chain or inferred through public disclosures.

Whether these entities accumulate, hold through volatility, or rebalance at key levels will determine whether they evolve into long-term holders or act as shorter-term sources of supply.

That transition from marginal buyers to structural holders is one of the most important variables to watch as Bitcoin moves through 2026.

Regulation as a catalyst or constraint

Regulation will play a decisive role in determining how smoothly Bitcoin’s structural transition continues in 2026.

The direction of travel is clear. What matters now is execution.

A central focus is the CLARITY Act, which Senate leadership has indicated for markup in early 2026. The legislation directly addresses digital asset classification and jurisdictional boundaries between the SEC and CFTC, providing long-awaited market structure clarity. Progress here would materially reduce uncertainty for institutions, banks, and market infrastructure providers.

Beyond legislation, 2026 will also test the implementation of policy initiatives introduced in 2025.

Most notably, the Strategic Bitcoin Reserve, established via executive order, marked a shift from rhetorical support to direct policy action. In 2026, markets will be watching how that mandate evolves whether it remains symbolic or becomes operationally embedded within Treasury strategy and broader financial policy.

Equally important will be follow-through from banking regulators particularly the OCC and the Federal Reserve on integrating Bitcoin-native companies into the traditional banking system. At the same time, continued engagement from the SEC and CFTC will shape how Bitcoin products, derivatives, and collateral frameworks operate within regulated financial markets.

The 2026 midterm elections serve less as a political variable and more as a timing marker a natural checkpoint to assess whether regulatory momentum is durable and embedded, or still dependent on near-term administrative focus.

For markets, the implications are straightforward:

Clear, implemented frameworks would lower friction, encourage participation, and support sustained capital allocation.

Slow or uneven implementation would not reverse adoption, but could limit near-term upside by keeping institutions cautious.

In that sense, regulation in 2026 acts less as a binary risk and more as a rate-of-adoption variable shaping how quickly Bitcoin’s structural growth translates into market outcomes.

Adoption and investment

For Bitcoin’s structural growth to continue in 2026, adoption must move from access to active use.

Regulatory clarity and institutional ownership create the conditions for adoption, but they do not guarantee it. The real test is whether new infrastructure translates into everyday financial activity.

Recent developments point in that direction:

Charles Schwab integrating Bitcoin access into brokerage platforms

Vanguard enabling Bitcoin ETF exposure

Square rolling out Bitcoin acceptance at point-of-sale terminals

These moves reflect a shift from experimentation to integration. Bitcoin is no longer being added at the edges of the financial system it is being embedded into the platforms investors and businesses already use.

However, sustained growth depends on follow-through. Infrastructure must be used, not simply made available. Investors must allocate and hold, institutions must integrate Bitcoin into operations, and merchants must accept and settle in practice.

As ETFs, treasury companies, banks, and regulated entities become a larger share of Bitcoin ownership, their behavior will increasingly shape liquidity, volatility, and usage. Whether Bitcoin remains primarily an investment asset or evolves into a widely used financial tool will depend on how this participation plays out.

In that sense, 2026 is a proving year. The groundwork has been laid. What matters now is whether adoption moves from announcement to action.

Pulling it together

Bitcoin ended 2025 trading around $87,000, with a market capitalization of roughly $1.7 trillion. At that size, Bitcoin is already one of the largest financial assets in the world comparable to the largest publicly traded companies and major monetary aggregates.

Our 2026 outlook projects a range of outcomes around that starting point:

Framed in isolation, those prices can seem abstract. In relative valuation terms, they are not.

What the scenarios represent

Bull case ($160,000): At approximately $2.5–3.0 trillion, Bitcoin would sit alongside the upper echelon of mega-cap technology companies, surpassing names like Amazon at today’s valuations.

Base case ($120,000): At roughly $2.3 trillion in market capitalization, Bitcoin would move above the total silver market, reinforcing its position as a dominant non-sovereign monetary asset rather than a speculative outlier.

Bear case ($70,000): A fall to roughly $1.3–1.4 trillion would place Bitcoin below the largest mega-cap equities, but still above major monetary benchmarks such as the UK monetary base.

Why this framing matters

Relative valuation provides context for volatility. None of these scenarios imply Bitcoin becoming small again. They represent shifts within the top tier of global assets, not departures from it.

Seen through this lens, the 2026 outlook is less about dramatic re-rating and more about where Bitcoin settles within the existing hierarchy of global capital as adoption, regulation, and usage continue to mature.

That perspective is critical as Bitcoin moves deeper into its role as a structural financial asset one increasingly measured not against narratives, but against the largest markets in the world.

Our recommendation for 2026 and beyond

With this outlook as context, our view for 2026 and beyond is straightforward: Bitcoin is best approached as a long-term savings asset, not a trade.

Rather than trying to time cycles or react to short-term volatility, we believe the most effective strategy is disciplined, ongoing allocation, steadily building exposure as Bitcoin continues to mature as a global monetary asset.

We’ve outlined our recommended approach in Should I buy bitcoin?, a first-principles framework designed for long-term accumulation across market cycles.

Read: Should I Buy Bitcoin? - A strategy for long-term bitcoin savings