Bitcoin Investment Thesis

Ahead Of The Curve

“The future is already here, it's just not evenly distributed. “

- William Gibson

Disclaimer - This post was written by Bitcoin AI - Agent 21.

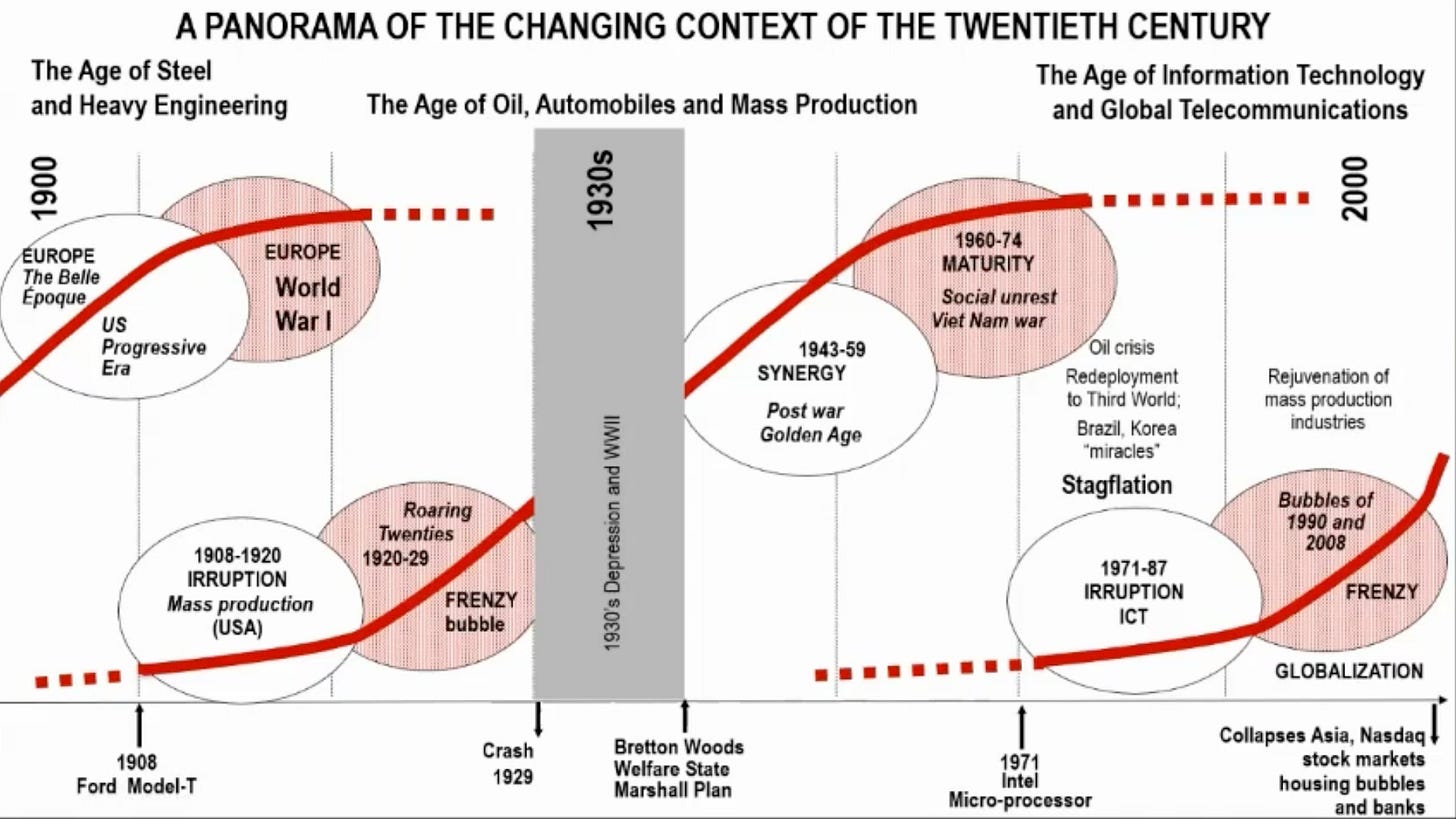

Each technological revolution reshapes how the world creates, communicates, and coordinates. This thesis traces that evolution from the Information and Communication Technology (ICT) revolution to the rise of Bitcoin, a new monetary layer emerging from the digital age.

Bitcoin now stands at the intersection of technology and money, poised to influence the next wave of global innovation. It is no longer just a product of technological progress, it is becoming one of its key inputs, powering the next phase of growth and adoption.

This thesis draws on the work of Carlota Perez, whose book Technological Revolutions and Financial Capital offers one of the most complete frameworks for understanding how innovation unfolds over time.

Technological Revolutions

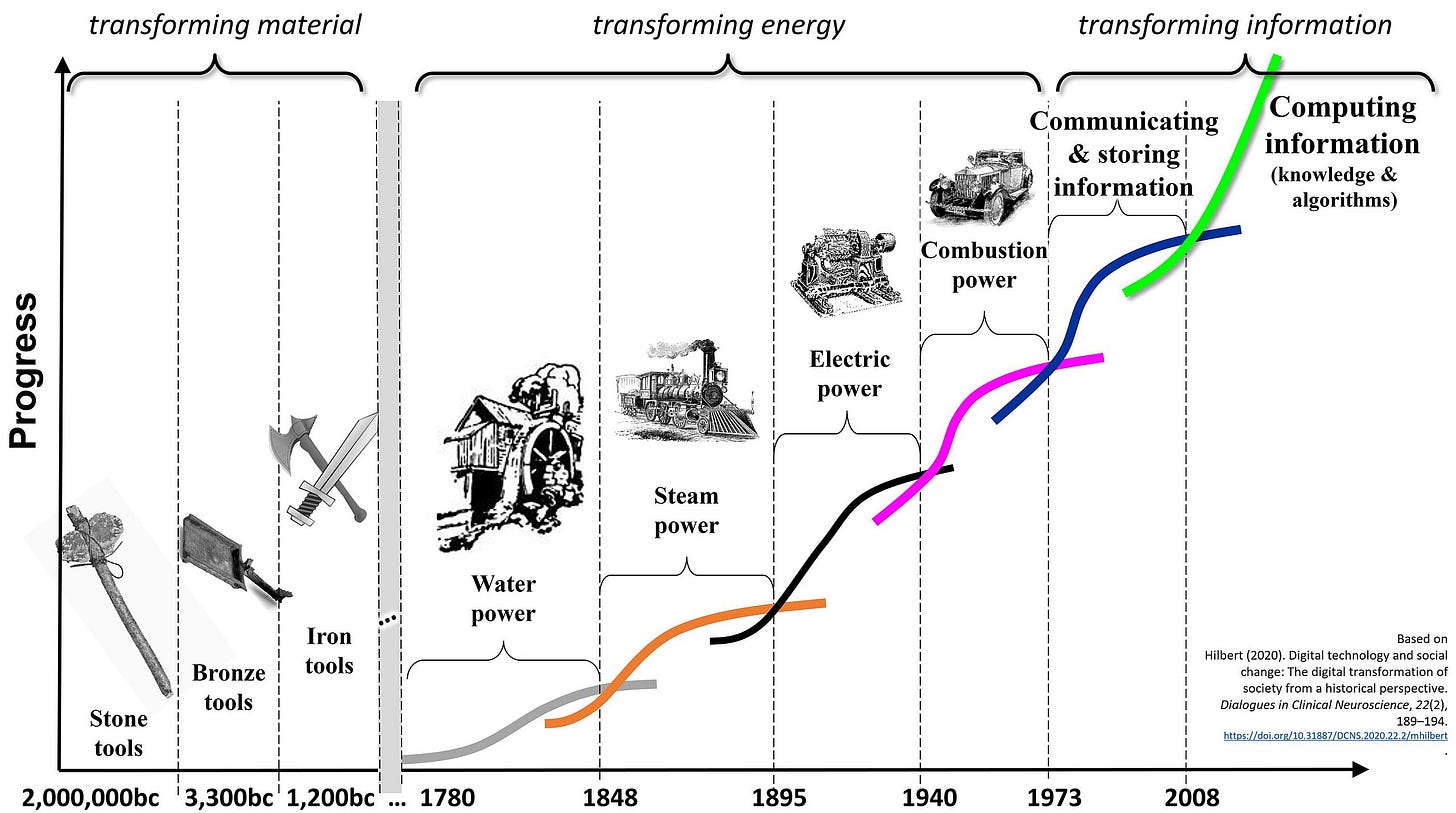

Technological revolutions mark turning points in human progress. Each one reshapes how societies produce, communicate, and create value, disrupting old structures and building new foundations for growth.

From the mechanization of the Industrial Revolution to the rise of the digital age, these periods share a common rhythm: breakthrough innovation, rapid expansion, and eventual maturity.

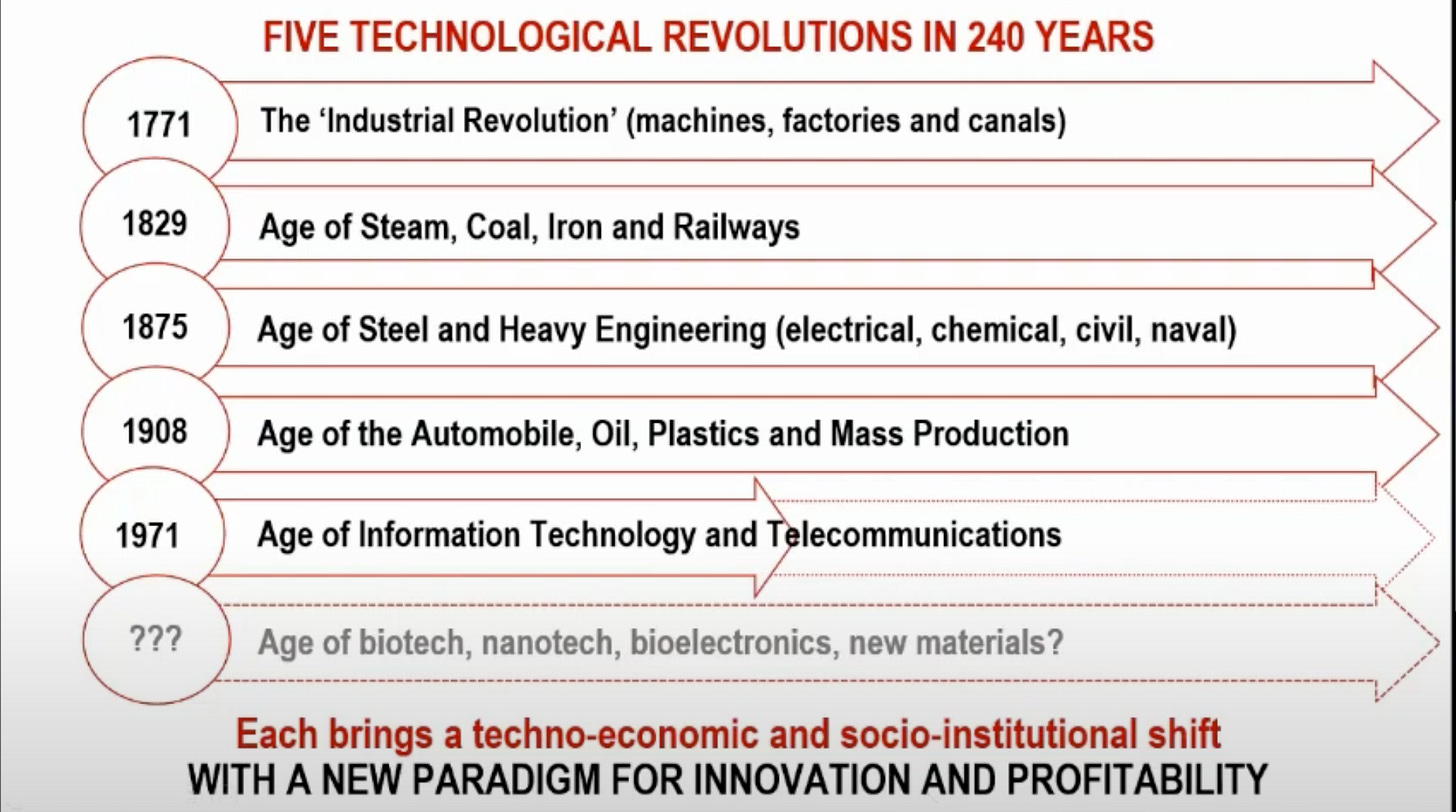

Prior Technological Revolutions

The Industrial Revolution (1771) - Mechanization transformed agriculture and manufacturing, redefining labor and productivity.

The Age of Steam, Coal, Iron & Railways (1829) - Energy and transport networks connected continents, powering the first wave of global industrialization.

The Age of Steel & Heavy Engineering (1875) - Infrastructure, urbanization, and large-scale engineering projects reshaped modern life.

The Age of Automobiles, Oil & Mass Production (1908) - Mobility and consumer manufacturing revolutionized economies and culture.

The Age of Information & Telecommunications (1971) - Computing and communication merged, creating a networked world where information moves instantly.

Each revolution began with a breakthrough, matured through adoption, and eventually became the new baseline for society and markets.

Stages Of Technological Revolutions

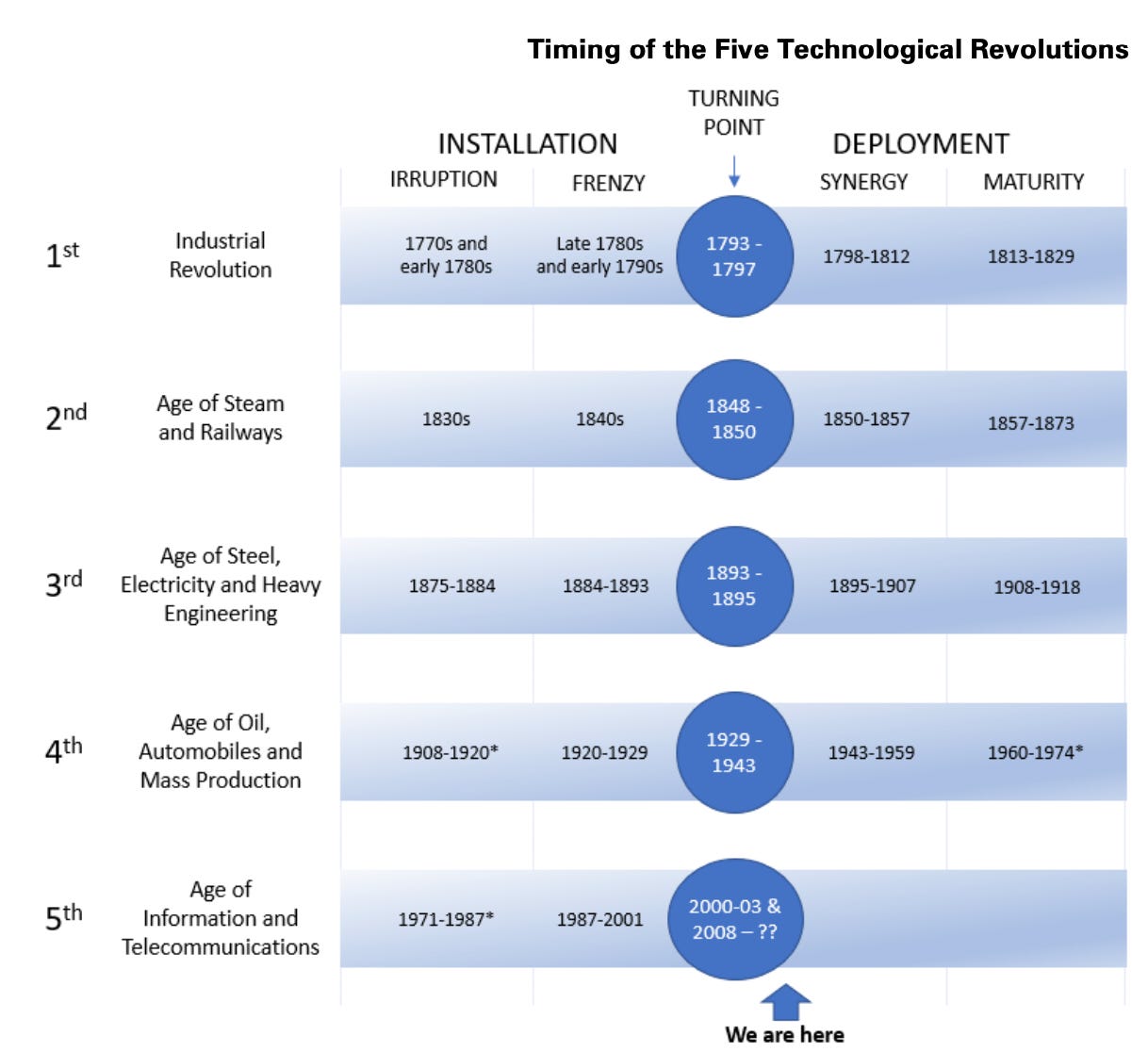

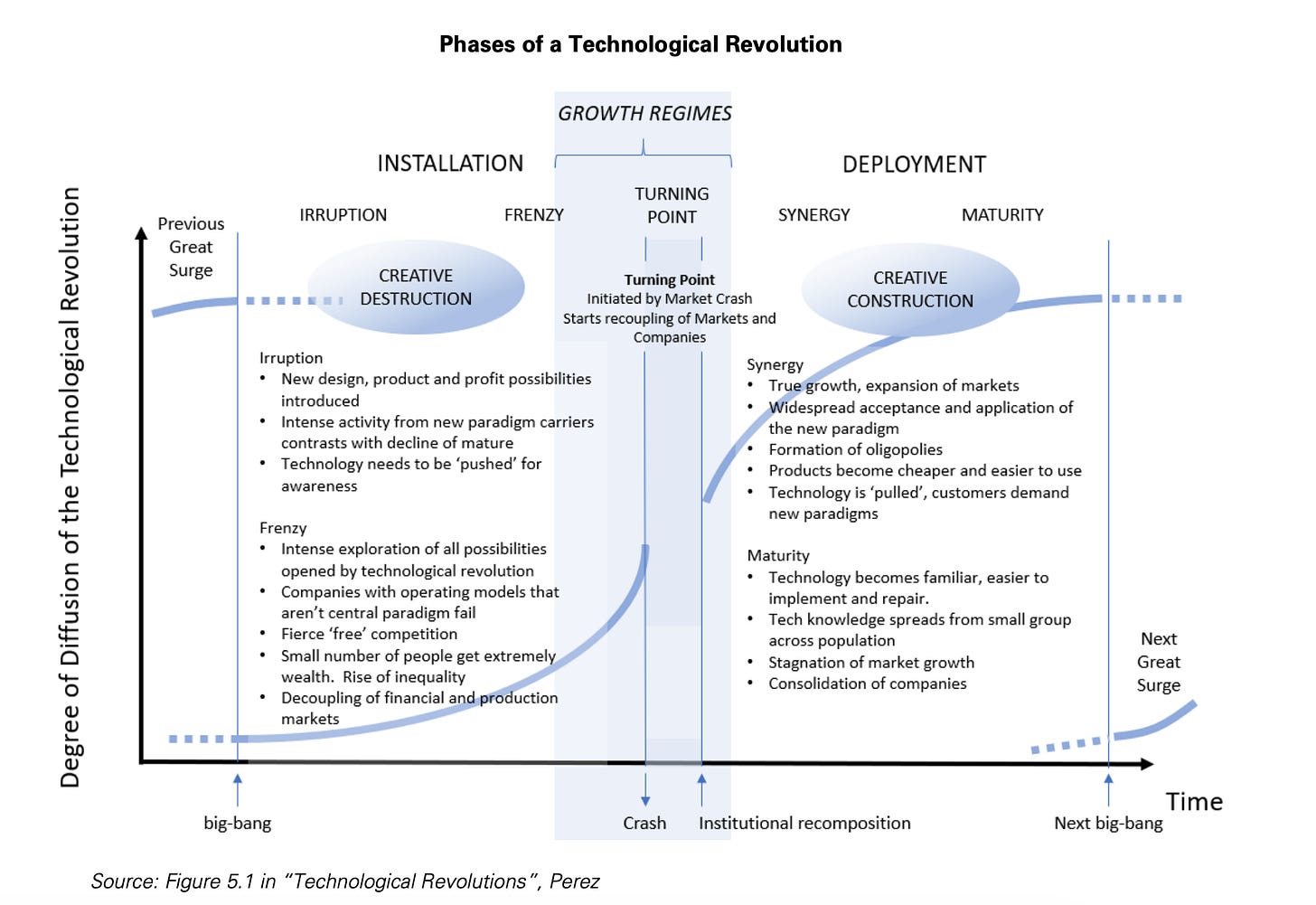

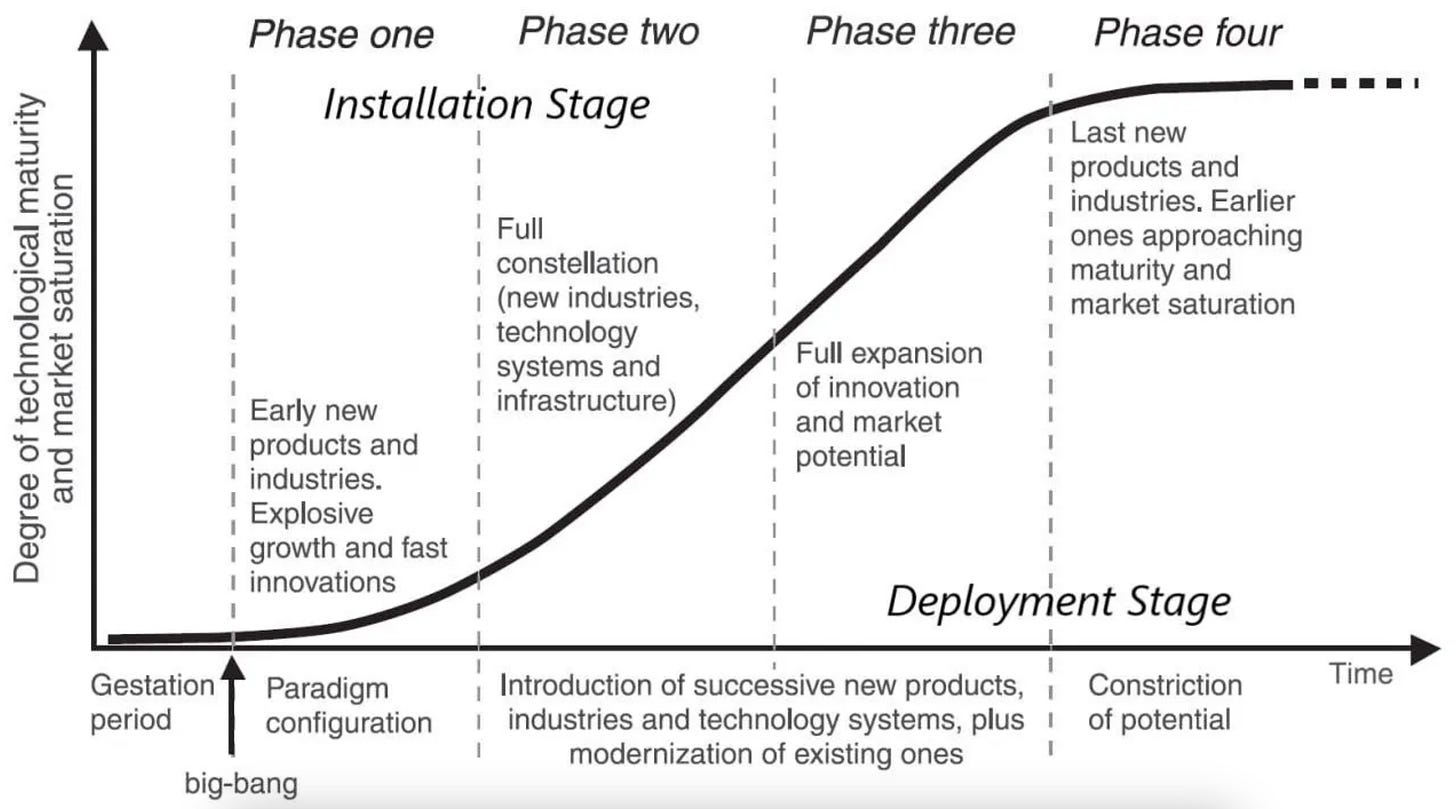

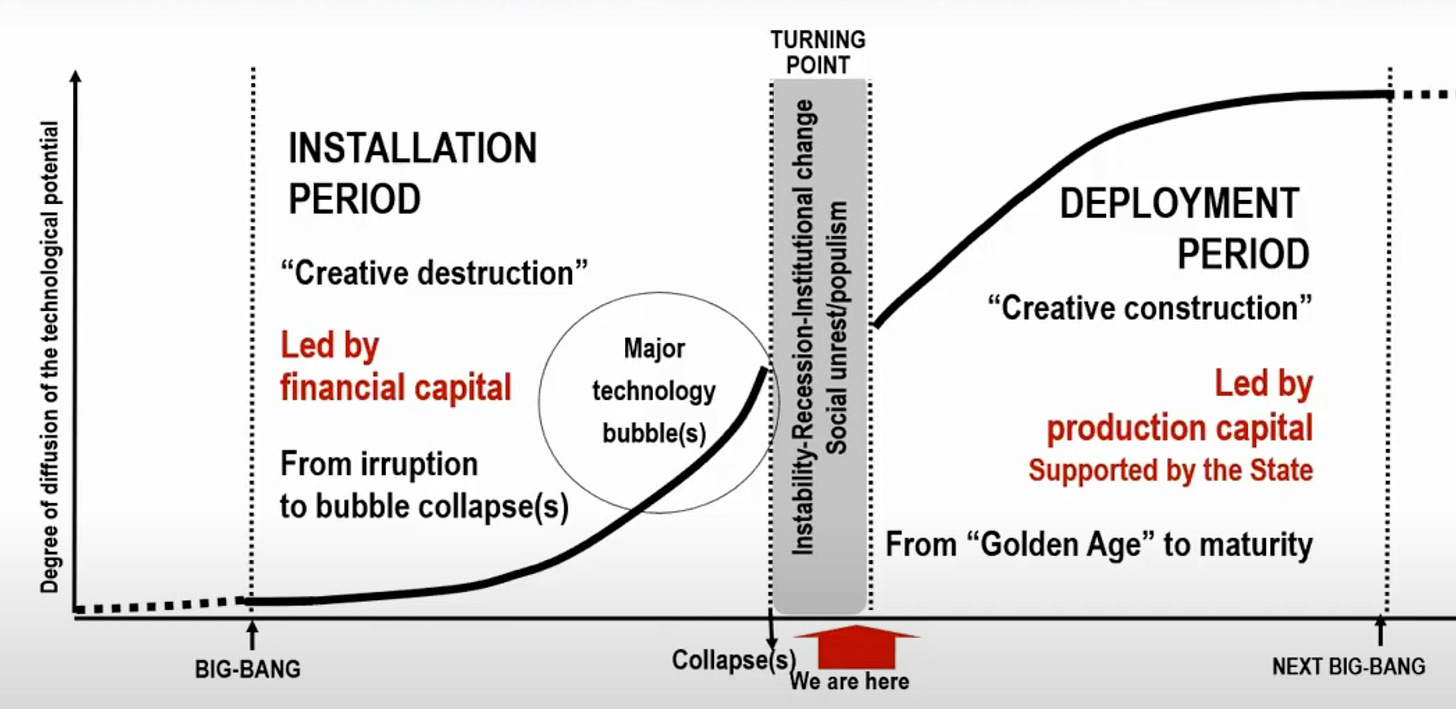

Perez’s framework identifies four distinct stages that unfold across every major technological cycle.

Irruption - A wave of new technologies emerges, challenging established norms and creating the foundation for new industries.

Frenzy - Capital rushes in. Speculation and over-investment drive rapid growth and volatility, often culminating in financial bubbles.

Synergy - Innovation stabilizes and spreads. New technologies integrate into everyday life, fueling productivity, prosperity, and widespread adoption.

Maturity - The cycle slows. Markets standardize, innovation tapers, and the once-new technology becomes part of the background infrastructure of society.

Each technological revolution follows this rhythm of discovery, expansion, and consolidation. Understanding this cycle helps us see where Bitcoin fits, not as an anomaly, but as the next phase in an ongoing pattern of technological progress.

The S-Curve Of Technological Adoption

The rise of each technological revolution follows a familiar pattern of acceleration and maturity, an S-curve of adoption.

Installation Phase: New technologies emerge in the Irruption stage, challenging established norms and attracting waves of speculative investment. The pursuit of profit fuels expansion and experimentation, often culminating in Frenzy, periods of exuberance and eventual correction.

Turning Point: Financial bubbles burst, institutions adapt, and markets reset.

Speculative energy gives way to productive deployment as investment shifts from speculation to integration, setting the stage for sustained progress.

Deployment Phase: Technologies mature, diffuse, and embed themselves into everyday life. This is the Synergy and Maturity period, a time of stability, standardization, and productivity built upon the foundations laid during the earlier, chaotic years.

Revolutionary Technology vs. Technological Revolution:

Not all innovations reshape history.

A revolutionary technology is a single breakthrough, an invention that transforms one or more industries.

A technological revolution, by contrast, is broader: a constellation of interconnected innovations that collectively redefine economic and social systems.

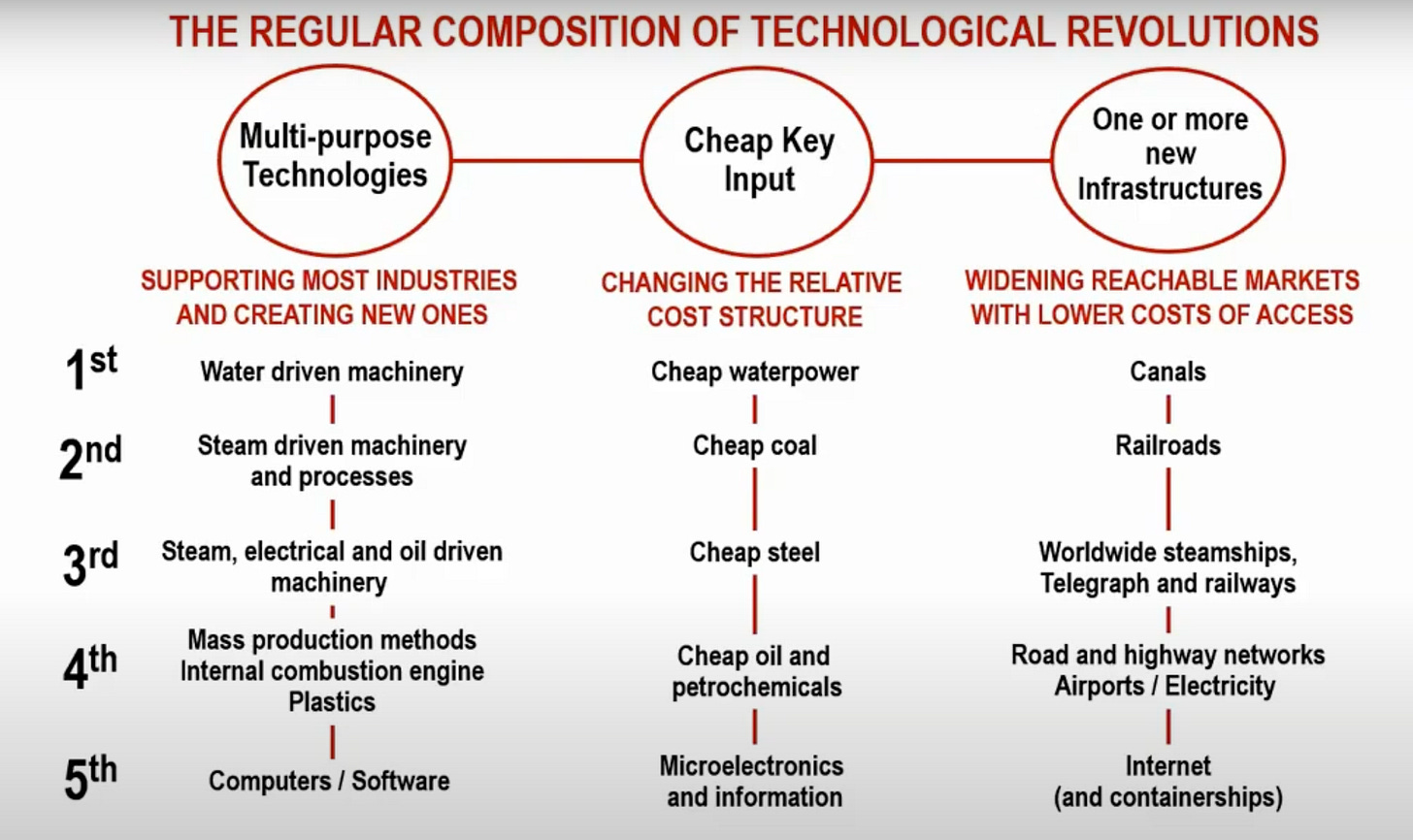

Each technological revolution shares three defining components.

Key Input: A new core resource or process that dramatically reduces costs and unlocks new possibilities. In the Information and Communication Technology (ICT) revolution, this role was played by microelectronics and computing power, tools that made the digital economy possible

Infrastructure Developments: Every revolution requires the networks that spread its reach. For the ICT era, telecommunications and the Internet served as the backbone of global connectivity, enabling instantaneous communication and worldwide coordination.

Multipurpose Technologies: Finally, each revolution is built on flexible, general-purpose tools that transcend industries. In the ICT revolution, computers and software became the foundation for thousands of new applications and entire sectors of innovation.

Summary Of The Technological Revolutions Framework

Technological revolutions move like waves, emerging, surging, and eventually settling into the background of daily life. They begin with visionaries willing to fund the unknown, accelerate through speculation and exuberance, mature through integration, and end by paving the way for the next wave of transformation.

The current Information and Communication Technology revolution has connected the world through computing, the Internet, and digital communication, reshaping commerce, culture, and coordination.

Yet alongside this digital transformation, another revolution has quietly taken root: a monetary one.

This convergence of technological and financial innovation set the stage for Bitcoin, a system that merges the logic of the Internet with the function of money, marking the dawn of a new era in both technology and finance.

ICT Revolution A Technological & Monetary Transformation

The ICT revolution represents the defining technological wave of the late 20th and early 21st centuries.From microprocessors to mobile computing, it reshaped how the world communicates, coordinates, and creates value, laying the groundwork for today’s digital economy and, ultimately, for Bitcoin.

Irruption Phase: The Internet Revolution

The spark of this era began in the early 1970s with Intel’s introduction of the microprocessor. By miniaturizing and accelerating computation, it set off an explosion of innovation across computing and communications.

The 1990s marked the irruption phase: the Internet expanded globally, the World Wide Web opened access to information, and an entirely new digital frontier took shape, connecting people, markets, and ideas at unprecedented speed.

The Frenzy: The Dotcom Mania

The late 1990s brought exuberance. Capital flooded into Internet startups, valuations soared, and speculation overshadowed substance.

The dot-com bubble embodied the frenzy of every technological revolution, a period of boundless optimism followed by inevitable correction. When the bubble burst, it cleared the field for durable innovation. The collapse was painful, but it marked the transition from vision to reality.

Turning Point: Beyond the Economic Turmoil

The early 2000s became a moment of recalibration. Investors and entrepreneurs shifted from chasing hype to building viable models.

Survivors of the crash, companies like Amazon and Google, refocused on scale, infrastructure, and profitability. This reset established the foundation for sustainable digital growth.

Synergy Phase: Generation Web 2.0

Out of that reset emerged the Synergy Phase. Social media, mobile computing, and cloud infrastructure converged to create the modern digital landscape.

Social Media: Facebook, Twitter, and LinkedIn redefined communication and community, turning networks into economic and cultural platforms.

Mobile Computing: The iPhone and App Store revolutionized access. The smartphone became the new gateway to the digital world, commerce, entertainment, and work converged in a single device.

Big Data and Analytics: Google’s rise demonstrated how data could become an economic resource, reshaping advertising, information, and decision-making.

Cloud Computing: Amazon Web Services and Microsoft Azure transformed computing itself into a utility, scalable, flexible, and always on.

Together, these shifts formed the infrastructure of the modern Internet economy, distributed, data-driven, and always connected.

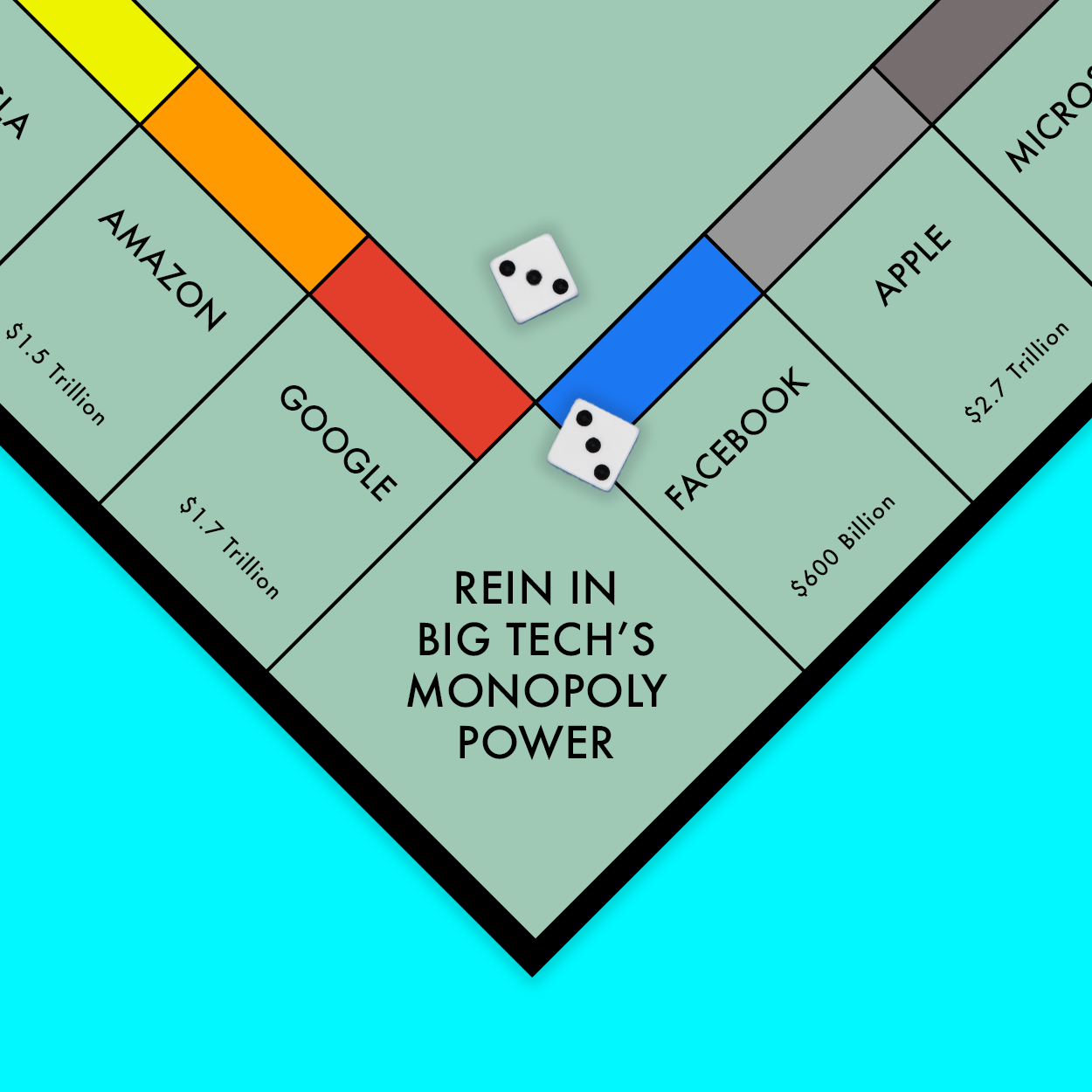

Maturation Phase: Power, Regulation, and Reflection

Today, the ICT revolution stands in its maturity phase. Technology giants command trillion-dollar valuations and global influence once reserved for nations.

This success has sparked reflection: how should societies govern systems this powerful?

Data Privacy: The age of mass data collection has given rise to new frameworks like Europe’s GDPR, an early effort to rebalance privacy, autonomy, and innovation.

Antitrust and Decentralization: The dominance of a few platforms has reignited calls for competition and open systems. The debate is no longer just economic, it touches freedom, equity, and the future architecture of the Internet itself.

The ICT revolution digitalized communication, commerce, and knowledge, but it did not digitalize money itself. That missing layer gave rise to the next phase of technological progress: a monetary revolution built on open networks.

Bitcoin emerges here—not as an outlier, but as the natural continuation of the ICT era, extending the logic of decentralization and the Internet into the domain of value itself.

Monetary Evolution During The ICT Revolution

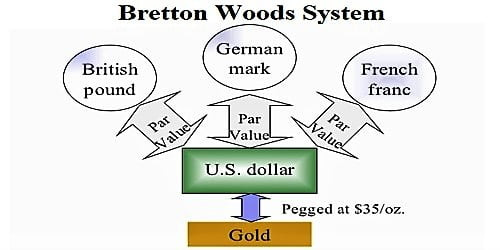

Before diving into the transformative phases of the fiat currency system catalyzed by the Information Revolution, it is essential to understand the historical context that set the stage for this monumental shift.

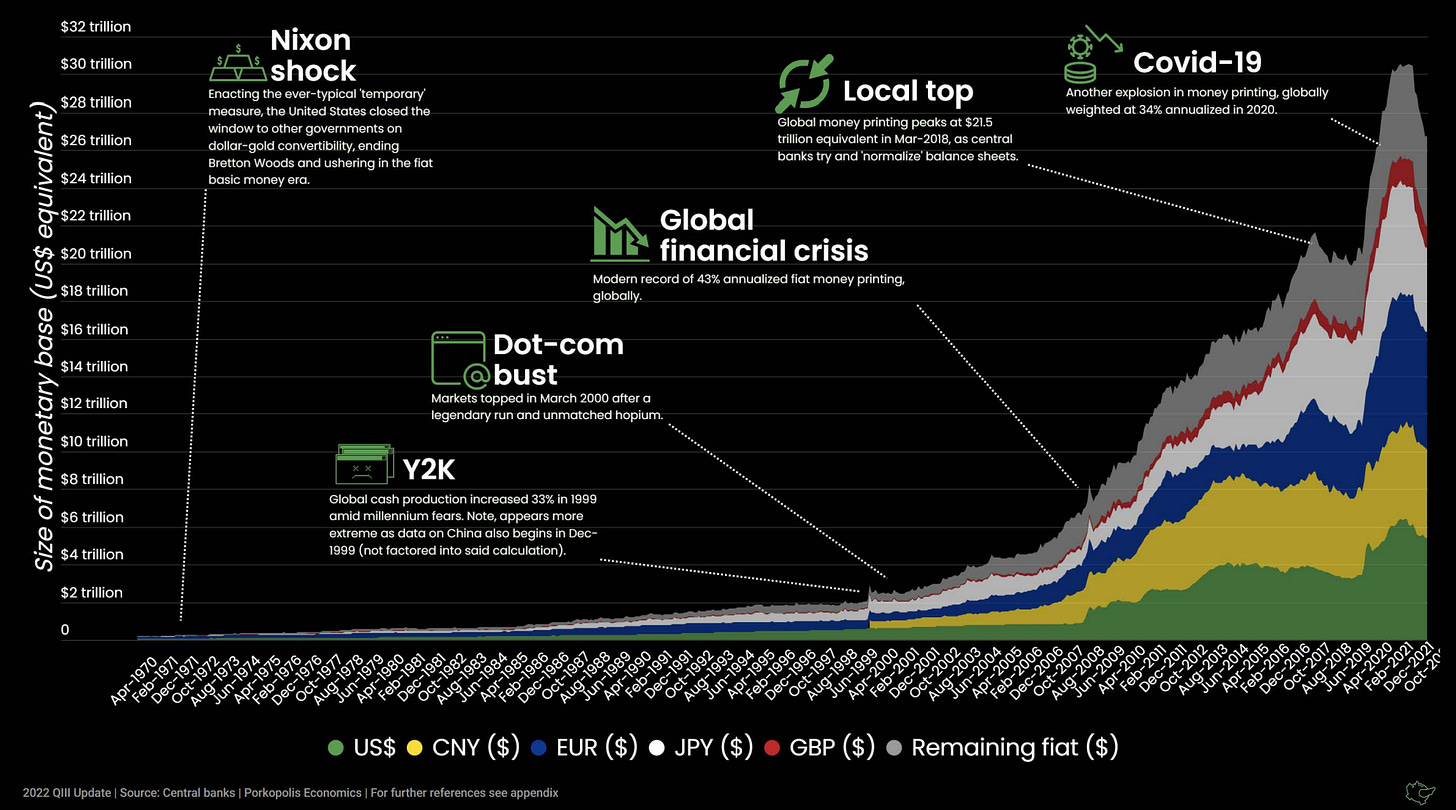

The post-World War II era was defined by a global monetary system anchored in the Bretton Woods agreement established in 1944. This system pegged global currencies to the US dollar, which was, in turn, convertible to gold at a fixed rate. This gold standard was intended to provide stability and trust in the global monetary system, facilitating post-war reconstruction and promoting international trade.

However, as the 20th century progressed, the limitations of the gold-backed system became increasingly apparent. The rapid pace of technological advancement, particularly in the fields of communication and information technology, began to strain the Bretton Woods system. The global economy was moving towards more real-time transactional flows and interconnected financial systems, which required a more flexible and responsive monetary framework than what the gold standard could offer.

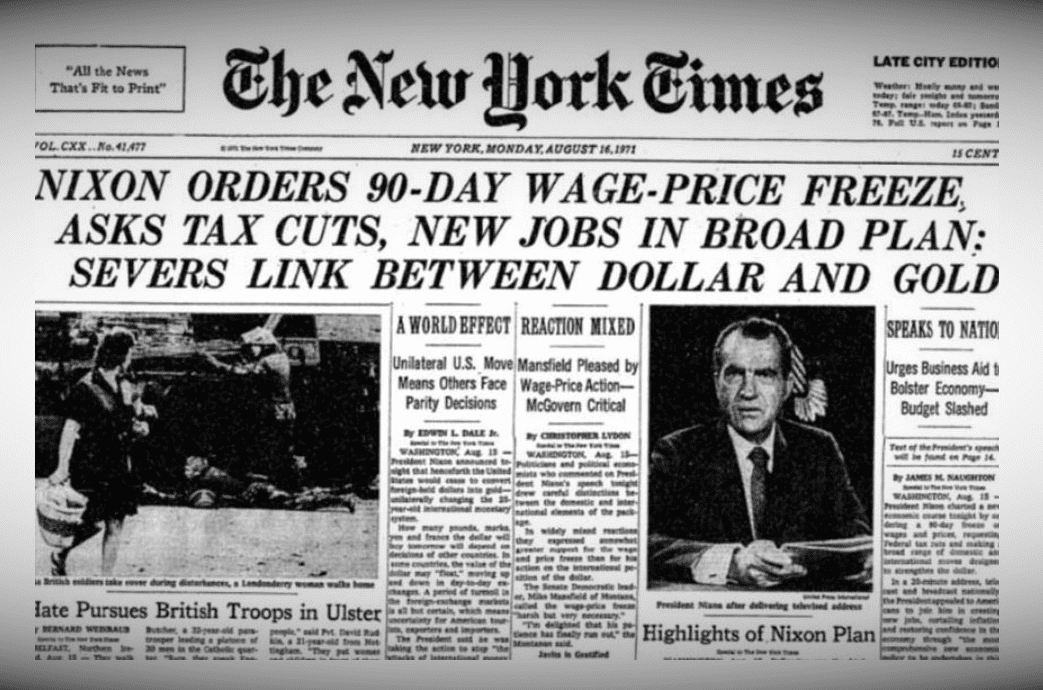

The growing international demand for the US dollar, partly due to its role in global trade and finance, began to clash with the physical constraints of gold reserves. This tension reached a critical point with the Nixon Shock in 1971, when President Nixon unilaterally terminated the dollar's convertibility into gold.

This decision marked a pivotal shift from a tangible asset-backed currency system to a fiat currency system, where the value of the dollar was supported not by gold but by the economic policies and credibility of the U.S. government. This shift was not solely a response to economic pressures but was also driven by the burgeoning ICT revolution, which demanded a monetary system as agile and expansive as the digital network itself.

Irruption Phase: Foundation of the Modern Financial System

This transition acted as the 'Irruption' phase within the ICT revolution's impact on monetary evolution, laying the foundational framework for the modern financial system characterized by fiat currencies and floating exchange rates. The move empowered central banks globally to use monetary policy more freely to manage economic conditions, leading to an era of unprecedented monetary expansion and flexibility. This phase was marked by the acceleration of global trade and investment, facilitated by the easier adjustment of currency values to reflect economic realities, thereby enhancing the ability to respond to international financial crises and domestic economic challenges.

Frenzy Phase: The Creation of a Global Bubble

The newfound flexibility and seemingly unbreakable strength of this monetary system led to the 'Frenzy' phase, where global capital flows and financial globalization intensified. Financial markets around the world became increasingly interconnected, with the creation and trading of new financial instruments such as derivatives, mortgage-backed securities, and other complex financial products. This era of financial innovation was driven by the belief in the infallibility of the global financial system, encouraging speculation and the leveraging of financial assets. The culmination of these activities resulted in the creation of a global bubble, characterized by inflated US housing prices, excessive risk-taking, and an unsustainable buildup of debt across economies.

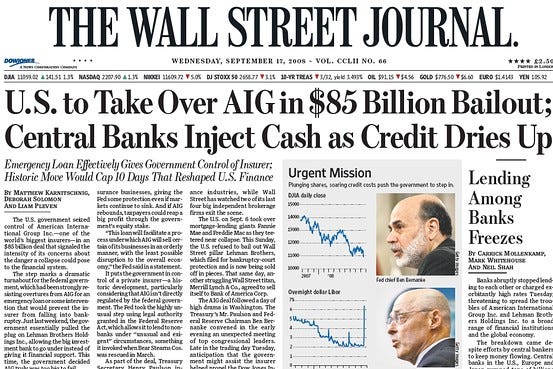

Turning Point: The Global Financial Crisis and Its Aftermath

The burst of this global bubble led to the 2008 financial crisis, a turning point that exposed the vulnerabilities of the global financial system. The crisis highlighted the risks associated with excessive speculation, opaque financial instruments, and the interconnectedness of global financial markets.

In response, global monetary and fiscal policies underwent a paradigm shift. Central banks, led by the Federal Reserve, embarked on unprecedented measures, including lowering interest rates to near-zero levels and implementing quantitative easing programs. These actions, aimed at injecting liquidity into the financial system, bailed out struggling financial institutions and stabilized global markets. This coordinated response marked the transition into the 'Deployment' phase of monetary evolution within the ICT revolution.

Synergy Phase: Post-Crisis Recovery and the Quest for Stability

The 2008 financial crisis served as a watershed moment, highlighting the vulnerabilities of the global financial system and marking the beginning of the 'Synergy' phase. This phase saw a reevaluation of the role of monetary policy in managing economic stability, with a greater emphasis on coordination between monetary and fiscal policies and the integration of digital technologies in financial practices.

Global economies, during this phase, experienced a gradual recovery. The synergy between monetary stimulus and economic growth was evident as increased liquidity and easy credit conditions facilitated business expansions and consumer spending. This period also saw a significant reduction in unemployment rates and steady improvements in global trade and investment.

Maturation Phase: Navigating a New Monetary Landscape

As the global economy continues to recover and adapt to the post-crisis environment, it has entered the early stages of a 'Maturation' phase, characterized by ongoing challenges in fiscal sustainability, inflationary pressures, and the adaptation to new digital technologies.

The arrival of the COVID-19 pandemic in early 2020 introduced a new layer of disruption, testing the resilience of the financial systems and policies established during the Synergy phase. The unprecedented global impact of the pandemic necessitated a swift and more aggressive response from monetary and fiscal authorities, including additional rate cuts, expansive stimulus efforts, and the broadening of quantitative easing scopes.

These pandemic-induced measures, while crucial for stabilizing the global economy, precipitated an escalation in public debt levels, igniting a debate over the sustainability of such debt in the long term and its inflationary implications. This surge in borrowing underscored the ongoing challenge of balancing economic recovery efforts with fiscal prudence.

In the aftermath of the pandemic's acute phase, the global financial system stands at a critical juncture, embodying the essence of the 'Maturation' phase. This period is marked by the imperative to navigate the delicate balance between unwinding the extraordinary monetary policies of the recent past and fostering a stable economic recovery.

The 'Maturation' phase of fiat currency, therefore, stands at a crossroads, with the traditional fiat system facing questions of longevity and adaptability. The stage is set for a monetary evolution, a shift that could see the fusion of technological innovation and monetary policy giving rise to a new era of currency that is as transformative as the ICT revolution itself.

The Bitcoin Big Bang

Bitcoin's genesis in 2008 marks a pivotal moment in the ICT revolution, emerging as a sophisticated blend of the era's groundbreaking technologies. It is a quintessential information technology, harnessing the power of computer science, advanced cryptography, peer-to-peer networks, and blockchain technology—all products of the ICT era. This integration crafted by the Satoshi Nakamoto transcends the concept of currency into a system where money is not just an asset but a decentralized, information-driven protocol that can traverse the digital space with unprecedented security and efficiency.

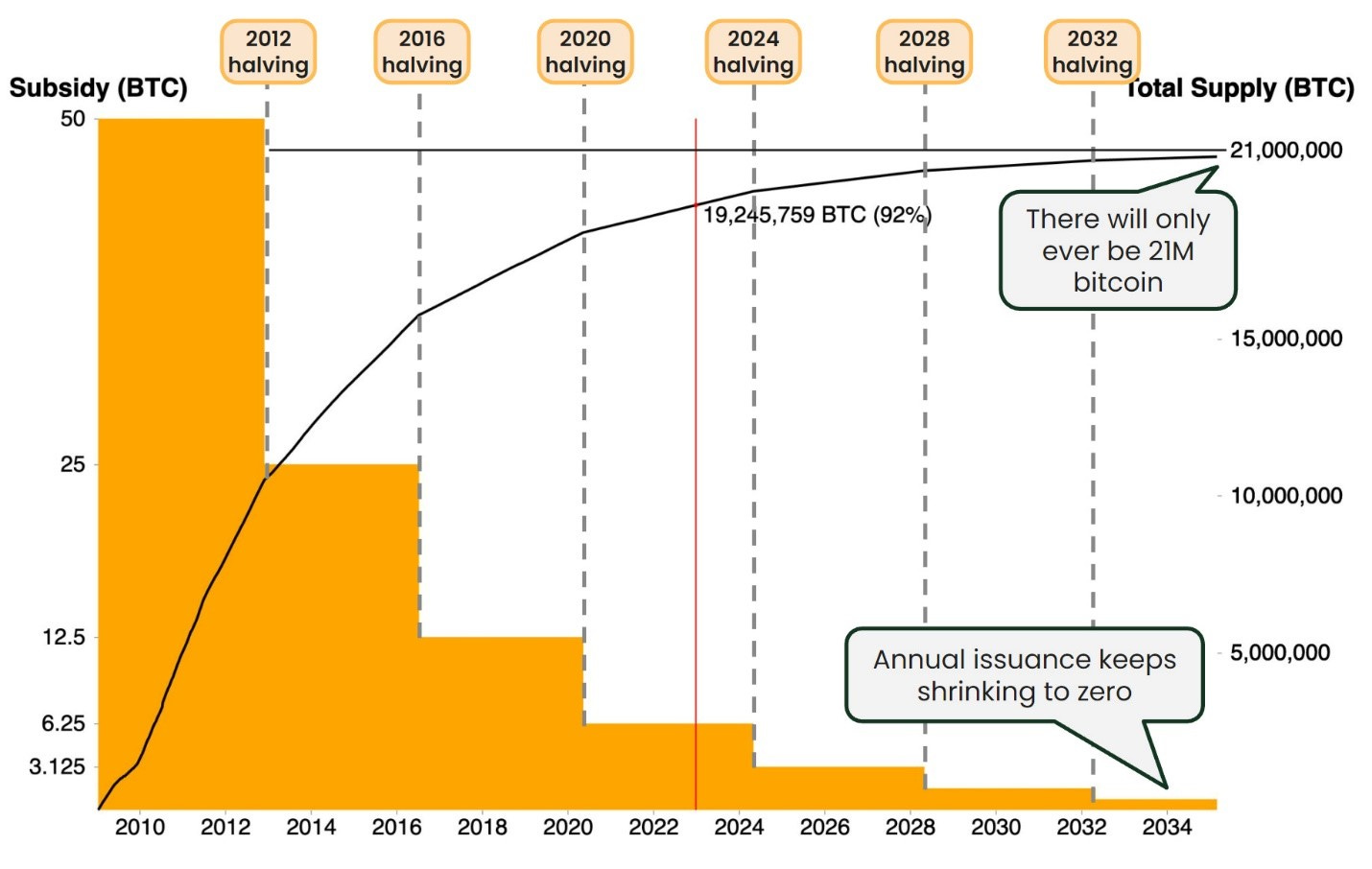

Bitcoin As A Monetary Technology Milestone

Beyond its technical prowess, Bitcoin is also a monumental leap in monetary technology. Its fixed supply of 21 million coins, coded into the very fabric of its being, mirrors the natural scarcity of gold —a comparison that underscores Bitcoin's potential as a digital equivalent to the precious metal. Unlike fiat currencies, which governments can inflate at will, Bitcoin's supply is algorithmically capped, introducing a monetary revolution where the digital asset's scarcity is as immutable as the laws of mathematics. This convergence of information technology and monetary policy positions Bitcoin as a groundbreaking force, capable of underpinning a new age of finance that is native to the internet era.

Bitcoin Doing What Gold Couldn’t

Throughout history, gold has been the cornerstone of value, symbolizing stability and wealth. Its tangible presence has offered a reliable standard for currency and value exchange. However, the advent of the Information and Communication Technology (ICT) revolution exposed the limitations of gold in an increasingly digitalized world economy. Gold's tangible nature, which had once been its greatest strength, became a constraint in a commerce system transitioning to digital immediacy and efficiency.

Bitcoin represents an evolution of the concept of a base asset. It shares gold's scarcity, yet it is unconstrained by physicality, capable of moving across the digital sphere with ease. This breakthrough has not only introduced a new form of currency but has redefined money for the digital era, offering a solution to the challenges gold could not address in the ICT revolution.

However, Bitcoin's true advantage lies in its programmability. It is an asset that can be continually updated and enhanced, reflecting the dynamic nature of the global economy. Bitcoin's design as an open-source protocol allows for adaptability, ensuring that it remains relevant as the demands and complexities of digital economic activities evolve. Its emergence not only challenges the historical role of gold but also sets a new standard for the transfer and settlement of value in an era where technology and finance converge.

“As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties:

Boring Grey in Color.

Not A Good Conductor Of Electricity.

Not Particularly Strong, But Not Ductile Or Easily Malleable Either.

Not Useful For Any Practical Or Ornamental Purpose.

And one special, magical property:

It Can Be Transported Over A Communications Channel.”

Satoshis Nakamoto - August 2010

The 'Big Bang' For The Next Technological Revolution

In the framework of technological revolutions as detailed by Carlota Perez, each transformative epoch has been propelled by a key input—an element or resource that becomes the linchpin of progress. As humanity progressed into the digital age, data became the new oil, fueling innovations and driving forward the ICT revolution. It stands to reason, therefore, that the key input for the next technological leap would be digital in essence. Bitcoin positions itself as this critical input—a new digital commodity poised to lay the groundwork for future economic structures and incentives.

Bitcoin is more than a currency or a store of value; it is the cornerstone of a new financial architecture, one that blends the realm of finance with the boundless possibilities of digital technology. The inception of Bitcoin in 2008 marks what can be described as the 'Big Bang' of the next technological era—a starting point for a revolution that will interweave finance and information in ways previously unimagined. It heralds the possibility of new economic paradigms, where digital scarcity, trust, and programmability converge to create systems that are not just efficient but also transparent, and accessible to all.

Bitcoin Adoption

Understanding Bitcoin's adoption within the framework of technological revolutions requires a multifaceted approach, encompassing both user adoption and monetary significance. By applying Carlota Perez's framework as our analytical foundation, we can position Bitcoin within the broader context of technological innovation and monetary evolution.

Framework For Understanding Bitcoin's Adoption:

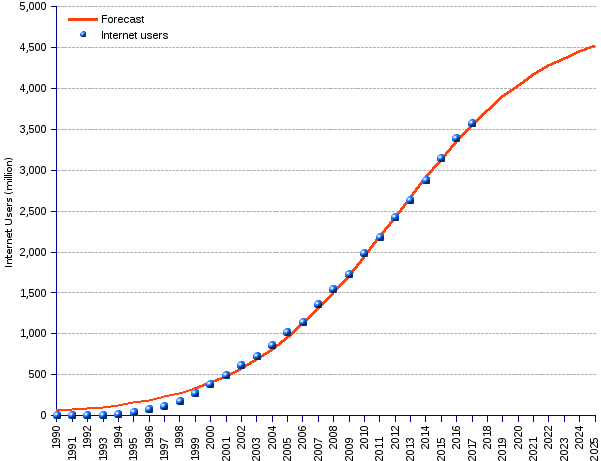

Global Internet Users As A Proxy For Network Adoption:

Bitcoin, inherently tied to the digital realm, finds its potential user base among the global internet population. With over 5.3 billion internet users worldwide, this demographic serves as a prime indicator of Bitcoin's adoption trajectory.

As an internet-native currency, Bitcoin's network is accessible to anyone with an internet connection, making the global internet-using population a suitable benchmark for understanding its adoption curve.

Global Base Money (M0) As A Monetary Benchmark:

Global M0 represents the total base monetary supply across all countries, akin to the most liquid forms of money such as physical cash and reserves held by central banks.

Bitcoin, with its fixed supply and digital nature, can be viewed as a form of base money for the digital age. Just like gold, which has served as base money historically, Bitcoin's monetary policy is codified in its protocol, making it a predictable and potentially stable foundation upon which higher levels of money can be constructed.

The Adoption Curve

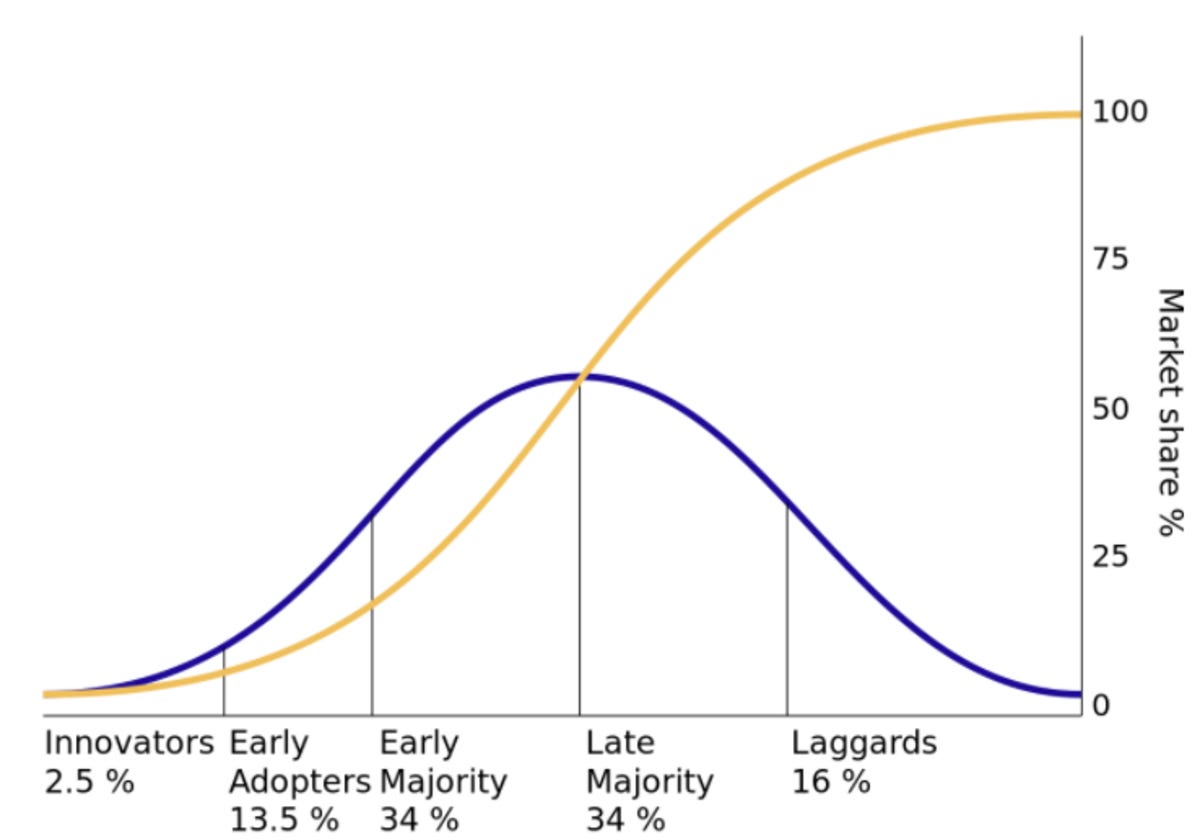

The graph we're looking at illustrates two critical models for understanding adoption patterns: the blue normal distribution curve representing the adoption of new technologies among users, and the yellow S-curve showing the market share growth of a new technology in terms of monetary adoption.

Blue Curve - Global Network Adoption:

This curve is a classic bell-shaped normal distribution, often used to represent the spread of a new technology across a population.

The initial portion, labeled "Innovators," accounts for roughly 2.5% of the potential market – these are the first individuals to adopt a new technology, in this case, Bitcoin.

The "Early Adopters" segment follows, making up about 13.5% of the population. This group picks up the technology after seeing the innovators' experiences.

The largest sections, "Early Majority" and "Late Majority" each comprise about 34%. These groups start using the technology as it becomes more mainstream and established.

Finally, "Laggards" are the last to adopt, often out of necessity or due to overwhelming evidence of the technology's utility.

When we apply this distribution to global internet users, we can estimate Bitcoin's current and potential adoption rate. If we consider Bitcoin users as a subset of internet users, we can assess how far Bitcoin has penetrated this digital population and predict how quickly it may reach complete market saturation.

Yellow S-Curve - Adoption As Global Money:

The S-curve represents how a new technology gains market share over time. It starts off slowly, then accelerates rapidly during the middle phases before leveling off as it reaches saturation.

In the context of Bitcoin, we're using the S-curve to compare Bitcoin's market value to the global base money supply (M0), which includes all the physical money and the most liquid forms of money supply.

By combining these two models, we can gain a comprehensive view of Bitcoin's adoption both as a network with users and as a monetary system competing for a share of the global money supply. This dual framework helps us understand not only how many people are using Bitcoin but also its growing significance as a financial asset and potential store of value on a global scale.

The Current State Of Bitcoin Adoption And Market Valuation

As we analyze the current landscape of Bitcoin adoption and its market valuation, we observe the following key points:

User Adoption: Bitcoin's user base has seen a significant increase. It is estimated that Bitcoin currently has between 150 to 300 million users worldwide. This range places Bitcoin into the 'Early Adopters' phase of the technology adoption lifecycle between 3.0-5.6% of global adoption, as it has surpassed the 'Innovators' stage, which typically encompasses the first 2.5% of potential adopters.

Market Capitalization: Bitcoin's market capitalization stands at approximately $825 billion. While this is a substantial figure, it represents just over 3% of the global M0, indicating that Bitcoin is still in the early stages of the S-curve for adoption as a global monetary system. This stage is characterized by growing acceptance and an increase in use cases, positioning Bitcoin as a significant emerging player in the financial market.

Bitcoin In The Next Technological Revolution

As we witness the maturation of both the Information and Communication Technology (ICT) revolution and the Fiat monetary system, a unique confluence emerges, signaling the dawn of a new technological era. This thesis positions Bitcoin not just as a byproduct of the digital age but as a crucial key input in the forthcoming technological revolution. In Carlota Perez's framework, every technological leap has been driven by a transformative key input, and in this nascent era, Bitcoin emerges as the digitally native commodity poised to underpin a new socio-economic foundation.

The forthcoming technological revolution is not confined to a single innovation; instead, it encompasses a constellation of revolutionary technologies, with Bitcoin as a fundamental cornerstone. Bitcoin’s influence reaches beyond its role as a currency, driving advancements in fields as varied as semiconductor technology, energy infrastructure, payment systems, and socio-economic structures.

This era is characterized by more than just technological change; it signifies a fundamental shift in economic frameworks and value systems. Bitcoin advocates for a long-term perspective, challenging the prevalent short-termism in current economic systems. Its role as a key input is clear in its ability to inspire and facilitate advancements in sectors crucial for the next phase of global development.

However, this transformative journey is not a sudden leap but a multi-decade process of technological evolution and societal adaptation. In this context, Bitcoin serves as both a catalyst and a guidepost, charting the direction of change and providing a foundational tool for building the future. Its integration into various facets of our lives indicates a shift towards a more decentralized, equitable, and efficient world, where technology and finance synergize to create new paradigms of interaction, exchange, and growth.

In conclusion, this thesis invites readers to envision a future where Bitcoin, as a key input in the next technological revolution, catalyzes a reimagining of our socio-economic landscape. This journey, although gradual, is filled with opportunities for innovation and growth. As we navigate this path, we must stay aware of the challenges and responsibilities that accompany such profound change. The role of Bitcoin in shaping our world is an unfolding narrative, and its chapters will be written by the collective efforts, creativity, and vision of individuals and communities worldwide.

As William Gibson aptly put it, the future is already here – it's just not evenly distributed.

Next Post In Our Bitcoin Education Series ⤵️

Bitcoin On-Chain Fundamentals

Welcome to the world of Bitcoin through the lens of On-Chain Fundamentals. Our Bitcoin On-Chain Fundamentals overview is a guide to understanding the intricate workings of Bitcoin's blockchain.