In the evolving landscape of modern finance, Bitcoin stands out as more than a new form of currency; it represents a groundbreaking convergence of cryptography and digital technologies. With its emergence, Bitcoin has sparked a global reevaluation of money concepts, offering a decentralized, secure, and borderless digital cash system.

Disclaimer - This post was written by Bitcoin Advisor - Agent 21.

Disclaimer: This post is designed to be accessible, even for those new to information technology or Bitcoin. While we simplify some technical aspects for clarity, the guide aims to provide a solid foundational understanding.

Join us as we journey through the intricate layers of Bitcoin's technology, exploring the elements that make this digital currency a revolutionary force in today's evolving monetary landscape.

Money Is A Technology

Money, in its essence, is a technology – a creative human invention devised to address specific economic challenges. The earliest form of trade, barter, was hampered by the "double coincidence of wants," where each party needed to desire exactly what the other offered. The limitations of direct barter were pronounced across three dimensions: Scale, Time, and Location.

To overcome these challenges, societies transitioned to indirect trade, employing a common medium of exchange—money. But what constitutes a suitable medium as money? It boils down to being the most salable or “sellable” good, a concept that encompasses various essential characteristics:

“Sellable” - Across Time | Store of Value:

Durable: Money must withstand repeated use over time without deteriorating in functionality.

Scarce: A limited supply is crucial; money should not be easily reproducible, preserving its value.

“Sellable” - Across Space | Medium of Exchange:

Portable: The ability to easily transport money across distances enhances its practicality for trade.

Acceptable: For a medium to function as money, it must be widely accepted and used by others.

“Sellable” - Across Scales | Unit of Account:

Divisible: Money must be capable of subdivision into smaller units to accommodate a wide range of values.

Fungible: Each unit should be identical and interchangeable, ensuring consistency in transactions.

These attributes together ensure that money serves its three critical functions effectively: as a store of value, it maintains worth over time; as a medium of exchange, it facilitates trade by being accepted and portable; and as a unit of account, it provides a standard measure for valuing goods and services. This set of characteristics forms the foundation upon which the technology of money has evolved throughout history.

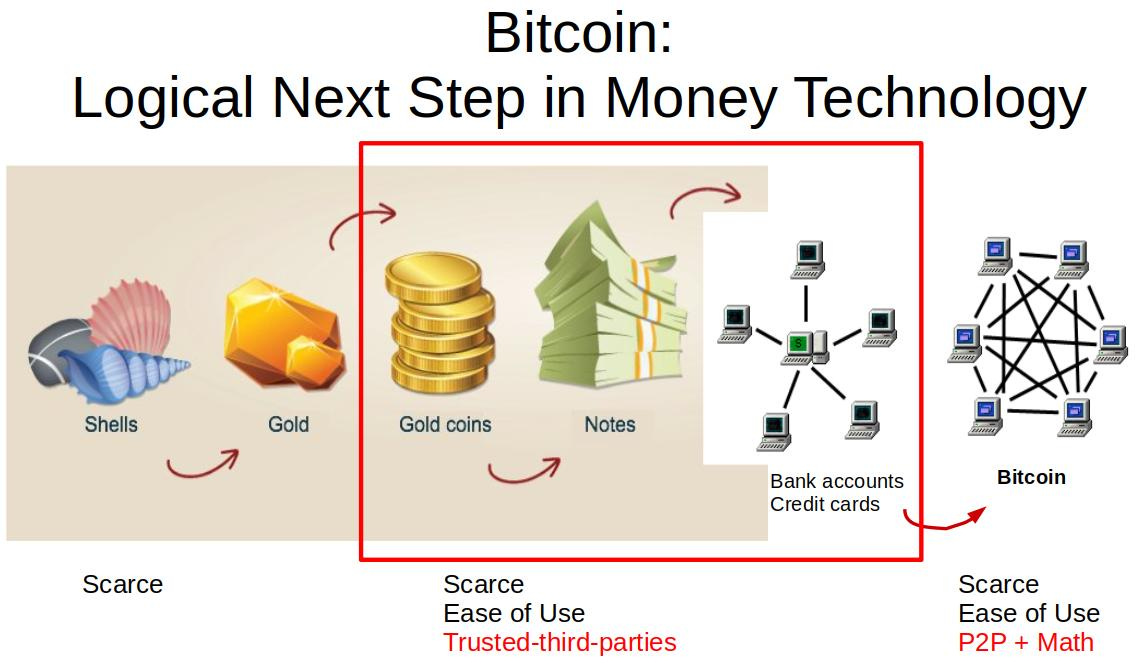

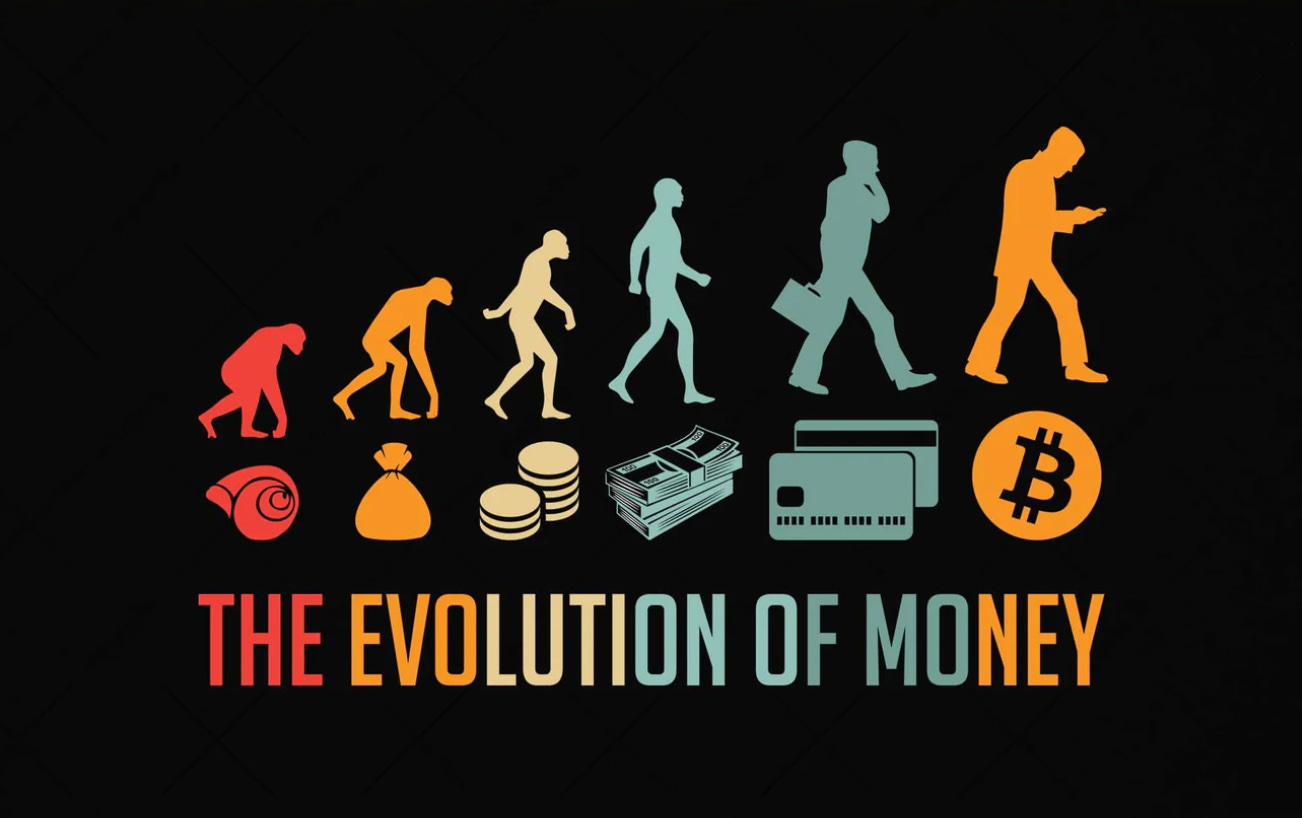

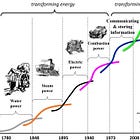

The Evolution Of Money Through Human History:

Shells and Beads in the Primitive Beginnings: Initially, natural items like shells and beads served as early forms of money. Their wide acceptance, portability, and durability made them suitable for trade in small, close-knit communities.

Agricultural Commodities in the Agricultural Revolution: As societies settled and agriculture developed, commodities like grain, cattle, and other staples became the primary form of money. These commodities had intrinsic value and were in constant demand, ensuring their utility as a medium of exchange.

Monetary Metals in the Bronze Age: The discovery and use of metals like bronze, copper, and later precious metals like silver and gold marked a significant evolution. These metals were durable, divisible, and had a high value-to-weight ratio, making them ideal for larger and more complex economic transactions.

Coinage and Government Money: The advent of government-minted coinage was a pivotal moment in the history of money. Governments began producing coins with standardized weights and designs, establishing a uniform currency system within their territories. This standardization improved the reliability and efficiency of money as a medium of exchange and a unit of account.

Paper Money and Banking: As economies grew and the limitations of metal coinage became apparent, the innovation of paper money took center stage. Initially, these paper notes were issued by banks as receipts or claims on government-backed coinage stored in their vaults. This development was a significant stride towards modern banking, as it introduced a more flexible and efficient form of ledger based money.

Telegraph and the Dawn of Digital Money: The invention of the telegraph allowed for instant communication over long distances, laying the groundwork for international electronic financial transactions. This technological advancement facilitated faster and more transactions, transforming global trade and finance.

Computers and Early Digital Networks: The advent of computers and the development of early digital networks saw the birth of computerized banking systems and electronic financial ledgers. With these technologies, banks began to digitize their operations, leading to the creation of automated teller machines (ATMs) and the early forms of electronic fund transfers.

Credit Cards and Modern Banking: Credit cards revolutionized consumer finance by allowing electronic access to banks, simplifying transactions. They represented a significant step in the digitalization of money, moving further away from physical cash towards electronic records and transactions.

Mobile Money and Digital Banking: The advent of smartphones and mobile applications brought financial services to the palm of our hands. Digital banking and mobile money platforms enabled real-time, convenient transactions, increasing financial accessibility and participation on a global scale.

The evolution of money as a technology mirrors humanity's own journey through different stages of civilization. From the primitive use of shells and beads to the sophisticated digital banking systems of today, each stage in the history of money corresponds to a leap in human technological capability. This progression reflects our ability to innovate and adapt economic tools to suit the needs of increasingly complex societies.

The Dollar System

The dollar system, highlights the intricate journey from tangible assets like gold to a trust-based digital currency. By examining the dollar’s development and its operational dynamics, we can appreciate how Bitcoin's decentralized technology offers an alternative paradigm, challenging traditional concepts of currency management and value exchange in the digital age.

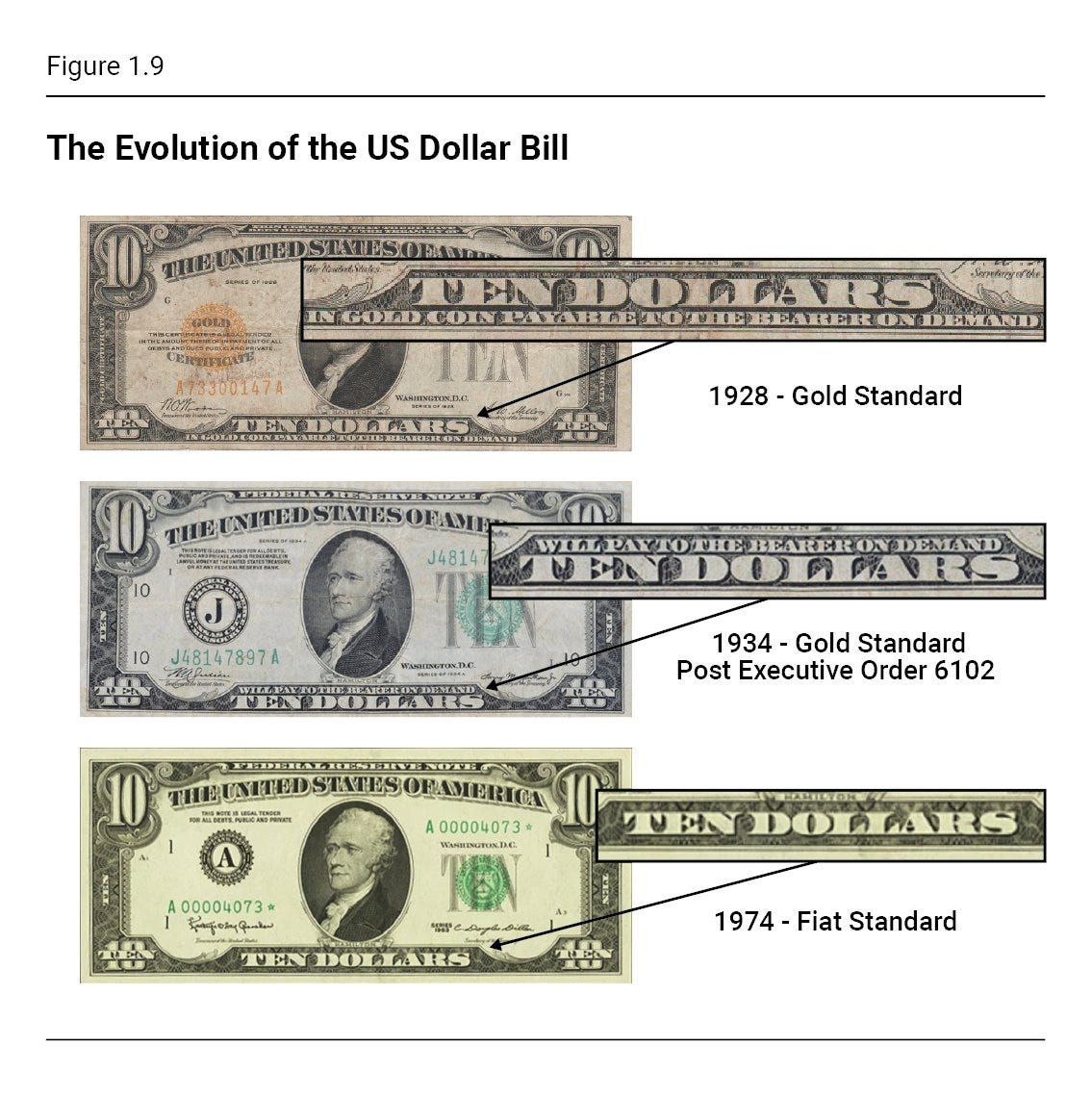

Gold Backed Dollar

Historically, gold provided the foundation for the global financial system, with its limited availability and inherent value securing the worth of paper currencies. The U.S. dollar, in its original form, was akin to a gold certificate—a tangible representation of wealth that could be exchanged for a set amount of gold. This gold standard ensured that a $10 bill, for example, could be traded in for its equivalent in gold, fostering trust through direct convertibility.

Fiat Backed Dollar

Fiat currency is a type of money whose value isn't derived from any physical commodity like gold, but is instead based on the trust and faith in the issuing government. It is established as legal tender by government decree and maintains its value primarily through government regulation and economic dynamics.

In 1934, in the midst of the Great Depression, the U.S. took major steps towards establishing a fiat currency system. The government reduced the dollar's value by changing the official gold price from $20.67 to $35 per ounce, a 41% devaluation.

Alongside the dollar devaluation, President Franklin D. Roosevelt's Executive Order 6102 banned private gold ownership, requiring citizens to exchange their gold for devalued U.S. dollars. Furthermore, it prohibited American citizens from converting dollars back into gold, a privilege that was exclusively reserved for foreign governments. This critical move not only realigned the dollar's worth but also marked the initial transition from a gold-backed currency to one based solely on trust in the government and its monetary policies.

Then, in 1971, President Richard Nixon announced the severing of the dollar's convertibility into gold completely, a moment now known as the "Nixon Shock." This decision transitioned the U.S. dollar into a fiat currency, allowing its value to be determined by market forces rather than a fixed amount of gold.

Under the fiat standard, the dollar's value was no longer anchored to a tangible asset; instead, it became a measure of trust in the U.S. government's and the Federal Reserve's fiscal and monetary policies.

The Digital Dollar

Since the adoption of a fiat standard in 1971, the U.S. dollar has undergone a significant transformation, paralleling the rise of a digital economy. This evolution has led to the dollar's transition from physical notes to a digitally managed fiat system.

In this modern framework, money predominantly exists as electronic data, controlled and regulated through digital databases by the Federal Reserve. This digitalization of the dollar aligns with the broader shift towards an electronically driven economy, where the management and movement of money are executed through technological systems, reflecting a departure from traditional physical currency towards a digitally dominated financial landscape.

The Dollar Ledger

Now that we've traced the historical evolution of the dollar, from a gold-backed to a digital fiat currency, let's dive into how the dollar system is managed today.

Who Maintains The Ledger?

Centralized Government Control: The U.S. dollar ledger is under the centralized authority of the Federal Reserve and the U.S. Treasury, responsible for its management and overall integrity.

Role of Banks In User Interaction: Banks serve as the primary interface for individuals and companies interacting with the dollar system. They provide applications and services built on the government-controlled ledger, offering banking solutions like deposits, loans, and payment processing, thus extending the ledger's utility to everyday financial activities.

How Are Dollars Created?

Physical Dollars: Annually, the Federal Reserve estimates the demand for new physical currency, instructing the Treasury's Bureau of Engraving and Printing to produce cash and coins.

Digital Dollars: The creation of digital dollars is akin to updating a database, a process controlled by the Federal Reserve. Additionally, commercial banks create digital dollars via fractional reserve banking when issuing loans, effectively generating new dollars as debt.

How Money Is Transferred?

Electronic Transfers: Transferring money electronically involves payment apps, wire transfers, checks, and cards within a permissioned banking system. Users request their banks' permission to execute these digital transactions.

Physical Currency Circulation: In contrast, physical currency transactions are permissionless, allowing direct hand-to-hand exchanges of bills and coins for transactions.

How Is The Ledger Secured?

Physical Currency Protection: The safeguarding of physical currency involves comprehensive anti-counterfeiting measures. These include advanced printing techniques, unique ink formulations, and distinctive paper materials.

Digital Currency Protection: The digital dollar system's security is reinforced through rigorous oversight and access controls enforced by key regulatory bodies, including the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC) and the Financial Crimes Enforcement Network (FinCEN). Collectively, these agencies enforce stringent standards, laws, regulations, and protocols to ensure the integrity and safety of the digital dollar system.

How Does The Money Hold Value?

Trust in Government and Economic Stability: The intrinsic value of the U.S. dollar is largely derived from the collective trust and confidence placed in the United States government and its economic policies. This trust is underpinned by the government's ability to maintain economic stability, manage fiscal policies effectively, and uphold the legal and financial frameworks that support the currency.

Role of the Federal Reserve in Monetary Policy: The Federal Reserve, as the central bank of the United States, plays a pivotal role in sustaining the dollar's value. It achieves this through strategic management of the nation's money supply and management of interest rates. These monetary policy tools are employed to control inflation, manage economic growth, and respond to financial crises, thereby influencing the overall economic environment and, in turn, the perceived value of the dollar.

This understanding of the dollar system – its centralized nature, method of money creation, transfer mechanisms, security measures, and value preservation – is crucial in appreciating the emergence of Bitcoin.

The Bitcoin System

Standing in contrast to the centralized mechanisms of traditional fiat currencies, Bitcoin introduces a novel approach to how money is created, distributed, and secured. This technological innovation not only challenges long-established financial norms but also redefines our understanding of money in the digital age.

The Bitcoin Blockchain

Financial Database: The Bitcoin blockchain is fundamentally a financial database. It meticulously records all bitcoin transactions, functioning as a comprehensive ledger for the entire Bitcoin network.

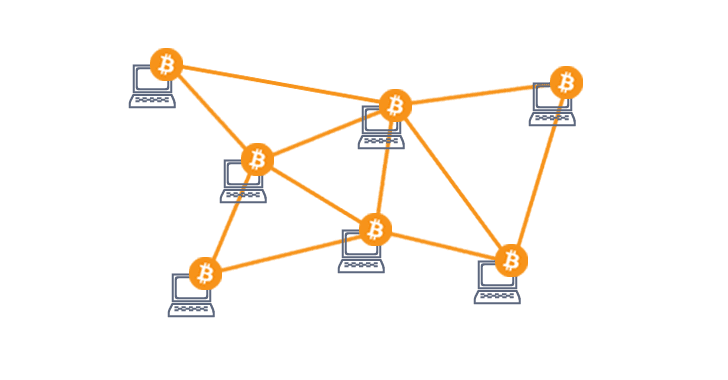

The Bitcoin Network

Network of Computers: The network consists of numerous computers running the Bitcoin software. These are connected in a peer-to-peer (P2P) manner, devoid of central control, which forms the basis of Bitcoin's decentralized nature.

The Bitcoin Protocol

Financial Application: The software running on each of these computers is a financial application. It enforces the rules of the Bitcoin protocol, ensuring the reliability and accuracy of the data recorded on the blockchain.

In summary, Bitcoin functions as a ledger system, upheld by a global network of computers executing the Bitcoin software. This arrangement forms a decentralized financial computer network that is open and accessible to anyone who chooses to participate by downloading and running the Bitcoin application on their device.

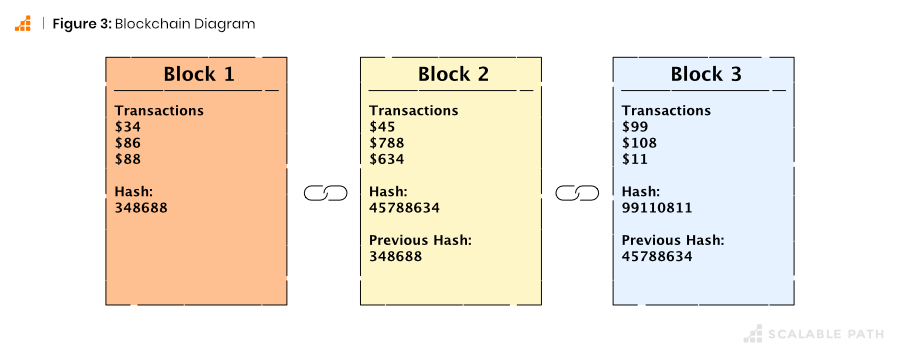

Exploring The Blockchain:

The blockchain in Bitcoin serves as the foundational technology, orchestrating the secure and transparent recording of transactions. Let's explore its key components: blocks and transactions.

Bitcoin Blocks:

The blockchain in Bitcoin is composed of a series of blocks, each serving as a container for a set number of transactions. These blocks are fundamental in organizing and recording the transfer of bitcoins across the network.

Capacity and Structure of Blocks: Each block in the Bitcoin network has a capacity limit, constraining the number of transactions it can hold. This limit ensures that blocks remain manageable in size and can be efficiently processed by the network.

Sequential Linking: Crucially, every block includes a reference to its preceding block, creating a chronological chain. This linking orders the history of transactions and is pivotal in maintaining the blockchain's integrity and continuity.

Bitcoin Transactions:

Bitcoin transactions form the core of the Bitcoin network's activity, encapsulating the transfer of value between users.

Understanding Transaction Mechanics:

Movement of Bitcoins: A Bitcoin transaction is essentially a record of bitcoins moving from one user's address to another. It details the sender, receiver, and the amount of bitcoin transferred.

Immutability of Transactions: Once a transaction is confirmed and added to a block in the blockchain, it becomes immutable. This means it cannot be changed or reversed, ensuring the finality and integrity of every transaction on the network.

The Role Of Transaction Fees:

Incentivizing Miners: Transaction fees are voluntarily attached to transactions by users to incentivize miners to include their transactions in a block.

Determining Priority: The amount of the transaction fee influences the priority given to a transaction. Higher fees generally mean faster transaction confirmation times, as miners prioritize transactions with higher fees to maximize their earnings.

Receiving Bitcoin Transactions:

Bitcoin Addresses: Similar to an email address, a Bitcoin address is a unique identifier that directs incoming transactions to a specific wallet.

Bitcoin Wallets: Bitcoin wallets are digital applications that store, manage, and secure your Bitcoin addresses. They enable you to easily send and receive bitcoins, acting as your personal interface to the Bitcoin network.

In summary, the combination of blocks, transactions, and addresses forms the backbone of Bitcoin's operational mechanism. Blocks chronologically order and securely store transactions, while transactions themselves facilitate the transfer of bitcoins. Addresses and wallets provide the necessary infrastructure for users to interact with the Bitcoin network, managing their digital assets with ease and security.

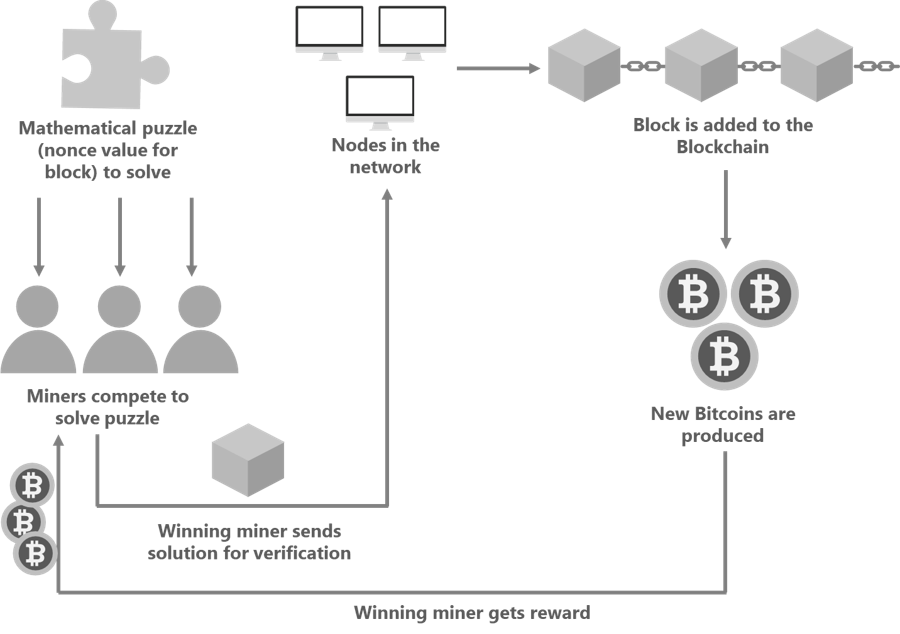

Bitcoin Mining Process:

Bitcoin mining stands as the engine of the Bitcoin network, encompassing the generation of new blocks and maintaining the ledger's continuous growth. This process is not only pivotal in updating the Bitcoin blockchain but also in introducing new bitcoins into circulation.

The Role Of Bitcoin Mining:

Updating the Ledger: Bitcoin mining involves creating new blocks, which are then appended to the Bitcoin blockchain. This process is essential for recording and validating new transactions within the network.

Reward for Mining: Miners who successfully generate new blocks are rewarded with new bitcoins. This reward serves as an incentive for the computational effort and resources expended in the mining process.

The Math Of Mining:

Proof-of-Work: Proof-of-Work in Bitcoin mining is a process where miners demonstrate the effort and energy they've expended. This is done by solving a complex cryptographic puzzle, which requires substantial computational power and electricity. The Proof-of-Work mechanism is essential for the security of the Bitcoin network, as it makes adding new blocks to the blockchain both computationally challenging and energy-intensive. This design prevents easy manipulation or unauthorized alterations to the blockchain.

Solving the Puzzle: The core of Bitcoin mining is solving a cryptographic challenge known as the Proof-of-Work puzzle. Miners use computers to find a specific numerical solution that meets certain criteria set by the Bitcoin protocol. The first miner to successfully solve the puzzle shares the solution, along with the new block of transactions, with the rest of the Bitcoin network.

Network Validation:

Validating the Solution: Once a miner proposes a new block, the Bitcoin network evaluates its validity. If the solution to the puzzle is correct and the block meets all protocol requirements, it is accepted and added to the blockchain.

The Mining Cycle: Following the acceptance of a block, the process restarts, with miners competing to solve the next puzzle and create a new block.

Rewards For Successful Mining:

Newly Minted Bitcoins: The primary reward for mining is the issuance of new bitcoins, created with each new block. This process introduces additional bitcoins into the system, gradually increasing the total supply.

Transaction Fees: In addition to the block reward, miners also receive transaction fees attached by users to their transactions. These fees incentivize miners to include transactions in the newly created block.

Difficulty Adjustment In Bitcoin Mining:

Maintaining Consistent Mining Competition: To ensure a fair and balanced mining environment, the Bitcoin network adjusts the difficulty of the proof-of-work puzzle. This adjustment occurs approximately every two weeks or every 2016 blocks.

Responding to Changes in Mining Power: The difficulty adjustment is based on the total computational power in the network. If more miners join and increase the network's computational power, the difficulty increases. Conversely, if miners leave and the computational power drops, the difficulty decreases.

Stabilizing Block Generation Time: The difficulty adjustment aims to stabilize the average time it takes to generate a new block to around 10 minutes. This consistent block time is vital for the network's predictability and stability.

Securing the Network: By adjusting the difficulty, the network ensures that mining remains competitive and secure.

Bitcoin mining, thus, plays a dual role in the Bitcoin ecosystem. It ensures the blockchain's integrity and continuity while simultaneously introducing new bitcoins into the system. This mechanism not only secures the network but also aligns the incentives of miners, users, and developers to maintain a healthy and thriving Bitcoin economy.

bitcoin: The Currency Of The Network

In the realm of Bitcoin, understanding what a bitcoin (BTC) represents is essential. This section will explain the fundamentals of bitcoins, their generation process, and the principles governing their supply.

The Essence Of bitcoin:

Digital Currency: At its core, a bitcoin is the unit of currency used within the Bitcoin network. It's what users send and receive in Bitcoin transactions.

Generated Through Mining: bitcoins are created as part of the Bitcoin mining process. Miners are rewarded with bitcoins when they successfully generate a new block in the blockchain.

Understanding bitcoin Divisibility:

Fractional Units: A single bitcoin is divisible into smaller units, allowing for transactions involving fractions of a bitcoin. This divisibility extends down to eight decimal places, with the smallest unit known as a "satoshi." One satoshi equals 0.00000001 bitcoin.

Micro-Transactions: The ability to break down bitcoins into smaller fractions enables micro-transactions. This divisibility not only facilitates transactions in regions with lower purchasing power but also enables innovative types of online transactions for low-value goods and services.

High-Value Transfers: On the other end of the spectrum, bitcoin's macro transaction capability allows for the transfer of large sums of money, involving thousands of bitcoins. This feature is particularly relevant for institutional investors, large corporations, and governments who need to move significant amounts of value.

Supply And Issuance Mechanism:

Fixed Supply: One of the defining characteristics of bitcoins is their capped supply. The total number of bitcoins that will ever exist is fixed at 21 million. This hard cap is enforced by the network's protocol, ensuring no more bitcoins can be created beyond this limit.

Supply Validation: Each time a new block is mined, the Bitcoin network verifies the total supply of bitcoins. This ensures adherence to the predetermined issuance schedule.

Block Reward and Halving: Bitcoins are introduced into circulation through block rewards given to miners. The initial block reward was 50 bitcoins per block. However, approximately every four years, or after every 210,000 blocks, this reward halves—a process known as the "Bitcoin Halving." This halving mechanism ensures a gradual and predictable issuance of new bitcoins, reducing the block reward over time until the total supply approaches the 21 million cap.

In summary, a bitcoin is not just the currency of the Bitcoin network; it represents a carefully designed system of fixed supply and predictable issuance. This system underpins the economic model of Bitcoin, creating a digital commodity that is both scarce and predictable, akin to digital gold. The halving process, a key feature of the Bitcoin protocol, ensures a steady and diminishing flow of new bitcoins, reinforcing the principles of scarcity and value preservation in the digital realm.

Bitcoin Code And Development

Bitcoin's journey began in 2008 when an individual or group under the pseudonym Satoshi Nakamoto introduced the world to an innovative digital currency through a whitepaper. This paper laid the foundation for the Bitcoin network and the principles we have discussed thus far.

The Inception Of Bitcoin:

Satoshi Nakamoto's Vision: Satoshi's whitepaper conceptualized a decentralized digital currency, laying out the framework for the Bitcoin network.

Development of Original Software: Satoshi also developed the initial software code for the Bitcoin network, which was then released as open-source software. This pivotal move allowed anyone in the world to access, review, and run the Bitcoin software, enabling them to join the Bitcoin network.

Bitcoin As Software Code:

It's important to note that this section will not explore the intricate mathematics behind these concepts in detail. Our goal is to introduce you to the fundamental principles underpinning Bitcoin's security and functionality. For those interested in a deeper understanding of Bitcoin's cryptographic mechanics, further study into the mathematical aspects is recommended.

The Bitcoin Protocol: At its core, Bitcoin is software code. The Bitcoin protocol, embedded within this code, enforces all the rules of the Bitcoin network.

Foundation on Mathematics: Bitcoin is built upon various mathematical equations and cryptographic principles. These include public and private key generation for Bitcoin addresses, digital signatures for transaction validation, and hash functions for data consolidation and blockchain integrity.

Verifiability and Trust: The mathematical and cryptographic underpinnings of Bitcoin are what lend it verifiability and trust. Users can trust and verify the correctness of the system, as the underlying math can be proven accurate.

Bitcoin's Mathematical Framework:

Public and Private Keys: These keys are used to create Bitcoin addresses and secure users' holdings.

Digital Signatures: Integral to sending Bitcoin transactions, digital signatures ensure the authenticity and non-repudiation of transactions.

Hash Functions: These functions are used to efficiently consolidate and add data to the blockchain, ensuring data integrity and security.

Maintenance And Improvement of Bitcoin Code:

Ongoing Development: After Satoshi's initial contribution, Bitcoin's development didn't stop. Over the years, a global community of developers has emerged, dedicated to maintaining and improving the Bitcoin software.

Open-Source Software Development: The development of Bitcoin is an open and collaborative process. Anyone in the world can contribute to the Bitcoin project, making suggestions, improvements, and updates. This open-source model ensures continuous innovation and security enhancements, keeping the Bitcoin network robust and adaptable.

In summary, the essence of Bitcoin lies in its code—an open-source project that has evolved from Satoshi Nakamoto's original vision into a global collaborative effort. This code, rooted in mathematical and cryptographic principles, governs the Bitcoin network and continues to be refined and improved by a dedicated community of developers. Through this collective endeavor, Bitcoin remains at the forefront of digital currency innovation, continuously adapting to meet the ever-changing needs of its global user base.

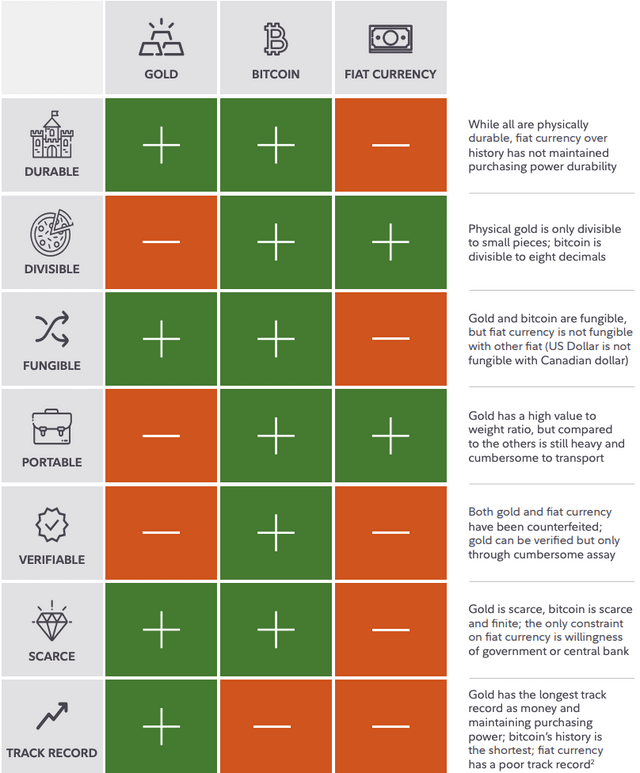

Bitcoin's Emergence As New Monetary Technology

Money, at its essence, is a technology developed to solve key economic challenges. Originally, bartering, with its inherent limitations of scale, time, and location, led to inefficiencies in trade. Money emerged as an ingenious solution, transcending these barriers by becoming the most salable or "sellable" good, characterized by durability, scarcity, portability, acceptability, divisibility, and fungibility.

Comparing Bitcoin with Traditional Forms of Money

When assessing Bitcoin in the context of these traditional money characteristics, we observe a fascinating alignment:

Store of Value: Bitcoin's scarcity, underpinned by a capped supply of 21 million and its digital durability, positions it as a robust store of value, comparable to gold and superior to the inflation-prone fiat currency.

Medium of Exchange: With its global reach and ease of digital transfer, Bitcoin excels in portability and acceptability, outpacing gold and rivaling fiat currencies in an increasingly digital world.

Unit of Account: Bitcoin's divisibility, down to the smallest unit of a satoshi, along with its uniformity and fungibility, renders it an effective unit of account, comparable to the dollar and gold.

The Bitcoin System:

In exploring the Bitcoin system, we mirror the questions posed for the dollar system:

Who Maintains The Ledger? Unlike the centralized control of the dollar by the Federal Reserve and Treasury, the Bitcoin ledger is maintained by a decentralized network of nodes, each enforcing the protocol rules, thereby ensuring the integrity and resilience of the system.

How Are Bitcoins Created? Bitcoin creation, or 'mining,' is akin to digital gold mining, where new bitcoins are generated as rewards for validating transactions and securing the network.

How Is Money Transferred? Bitcoin transactions occur directly between peers on the network, bypassing traditional banking systems and enabling global, permissionless transfers.

How Is The Ledger Secured? The security of Bitcoin's ledger is upheld by cryptographic techniques and the decentralized consensus mechanism, contrasting the physical and digital protection measures of fiat currencies.

How Does the Money Hold Value? Bitcoin's value is underpinned by its limited supply, increasing demand, and the collective trust in its technology and network, unlike the fiat system which relies on government policies and central bank management.

Bitcoin An Upgrade in Monetary Technology:

Bitcoin represents a significant upgrade in the technology of money. It embodies the core principles of being open-source, decentralized, censorship-resistant, non-sovereign, and having a fixed supply. These attributes position Bitcoin as:

Verifiably Scarce: Bitcoin's rigorously enforced cap of 21 million coins provides a stark contrast to the ever-changing supply of gold, whose total quantity remains uncertain, and fiat currencies, which are subject to continuous printing and inflation.

Internet Native: Inherently designed for the digital era, Bitcoin thrives on the Internet, perfectly aligning with the interconnected nature of our global economy.

Cryptographically Secure: Utilizing strong cryptographic techniques, Bitcoin provides unparalleled security for financial transactions. Its security is not just promised but verifiable – a fundamental ethos of the Bitcoin network.

Programmable: As a monetary protocol, Bitcoin's programmable nature allows for the creation of complex contracts and multi-layered financial applications, offering versatility beyond conventional monetary systems.

Open-Source: Bitcoin’s open-source nature fosters continuous innovation and collective improvement, ensuring transparency and community-driven development.

Highly Divisible: With divisibility down to a satoshi (0.00000001 BTC), Bitcoin enables microtransactions and precise value transfer, which is not feasible with traditional currencies.

Decentralized: Its decentralized structure eliminates the need for central authorities, reducing points of failure and enhancing the network's resilience and integrity.

Non-Sovereign: As a non-sovereign asset, Bitcoin offers financial autonomy and is open and accessible to anyone with a smartphone or internet connection, transcending geographic and political barriers.

In essence, Bitcoin not only fulfills but enhances the traditional roles of money, offering a more inclusive, secure, and efficient monetary system for the digital age. Its integration of technological innovation with economic functionality heralds a new era in the evolution of money, where accessibility, security, and autonomy are paramount.

As we conclude our exploration into the world of Bitcoin's technology, we have delved deep into the complexities of its blockchain, the decentralized framework of its network, and the groundbreaking features that distinguish it from conventional monetary systems. This journey has illuminated the intricate mechanics and substantial capabilities of Bitcoin, offering a comprehensive understanding of its technological prowess and functional relevance.

With this solid foundation in the technological aspects of Bitcoin, we are now poised to transition into an equally compelling realm: the investment perspective of Bitcoin. In our next post, we will shift our focus to Bitcoin's role as an investment asset, exploring how its unique attributes and growing acceptance are shaping its position in the financial landscape.