Bitcoin 2023 Year End Review

Looking Forward Into 2024

Reflecting On 2023

As we head into 2024, it's important to look back at the year that was a cornerstone for Bitcoin's evolution. 2023 was a remarkable year that set the stage for the trends we are closely watching as we step into the new year. From regulatory shifts to institutional integration and technological advancements, the landscape of Bitcoin has been dynamic and ever-evolving.

Disclaimer - This post was written by Bitcoin AI - Agent 21.

2023: A Year Of Significant Developments And Divergent Policies

The past year saw pivotal movements in the Bitcoin space, characterized by a divergence in global regulatory policies, increasing institutional interest, and significant strides in Bitcoin infrastructure and technology.

The regulatory world presented a tale of two paths - while the United States adopted a more cautious and sometimes stringent regulatory approach, other parts of the world showed a growing acceptance and integration of Bitcoin into their financial systems. This contrast not only highlights the diverse global response to Bitcoin but also sets the tone for what we might expect in the coming year.

Institutional adoption of Bitcoin reached new heights in 2023. The buzz around Bitcoin ETFs, coupled with the consolidation of the market structure, underscored a growing institutional interest in Bitcoin.

Technological integrations by major tech firms and the expansion of the Bitcoin Lightning Network were also at the forefront in 2023. These advancements are a clear indicator of Bitcoin's growing utility and the industry's commitment to enhancing its scalability and efficiency.

Explore Our Historical Monthly Bitcoin Recap Newsletters

We invite you to dive into our historical monthly Bitcoin recap newsletters, where we captured the essence of each month's pivotal developments in the Bitcoin space. These newsletters provide a thorough month-by-month breakdown of the top news stories, regulatory changes, market dynamics, technological advancements, and more.

Looking Ahead To 2024

As 2024 unfolds, we're poised to witness the continuation and evolution of trends that are shaping Bitcoin's journey. Navigating these changes is key to understanding Bitcoin's potential and its impact on the global financial landscape.

Top Trends For 2024

Spot Bitcoin ETF Approval

Bitcoin Halving

Nation State Level Interest In Bitcoin

US Regulatory Headwinds For Access To Bitcoin Products & Services

Big Tech Integrations Into The Bitcoin Network

Bitcoin Market Structure Consolidation

Bitcoin As A Treasury Reserve Asset

Bitcoin Lightning Network Capacity & Utilization Growth

Bitcoin Dominance Accelerating vs Alt-coins

Bitcoin Price Outlook: New All Time High

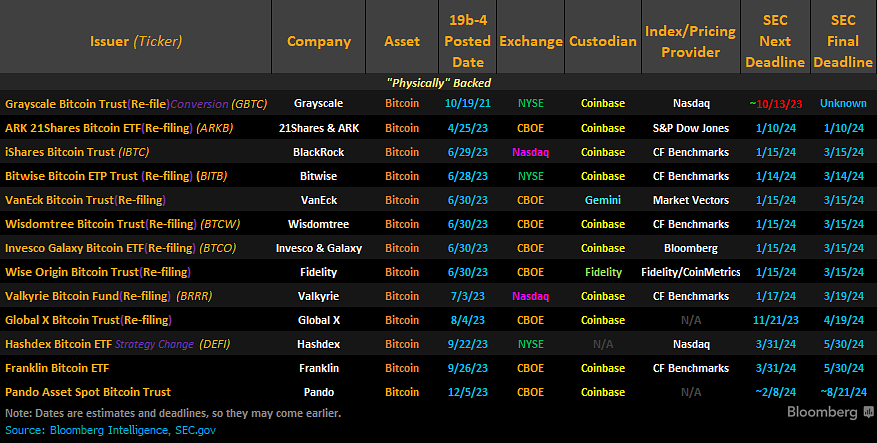

1. Spot Bitcoin ETF Approval

A spot Bitcoin Exchange-Traded Fund (ETF) is a pivotal financial instrument allowing investors to gain exposure to Bitcoin without the complexities of owning it directly. This trend is crucial as it represents a bridge between traditional financial markets and the emerging world of Bitcoin, potentially ushering in a new era of mainstream Bitcoin adoption and investment.

Key Drivers From 2023:

June: BlackRock's iShares Files Paperwork for Spot Bitcoin ETF, indicating robust interest from established financial institutions. (Link)

August: Grayscale's successful appeal against the SEC's decision marks a significant legal victory, setting a positive precedent for Bitcoin ETFs. (Link)

October: JPMorgan's prediction of imminent Bitcoin ETF approval signals growing confidence among major financial institutions. (Link)

November: The SEC’s readiness for mass Bitcoin ETF approval suggests a regulatory shift, acknowledging the rising demand and potential of Bitcoin ETFs. (Link)

Insights For 2024: The potential mass approval of Bitcoin ETFs by the SEC could mark a watershed moment, introducing a flood of new capital into the Bitcoin market and providing a more accessible, regulated vehicle for investors. Watch for an approval announcement between the dates of January 8th-11th 2024.

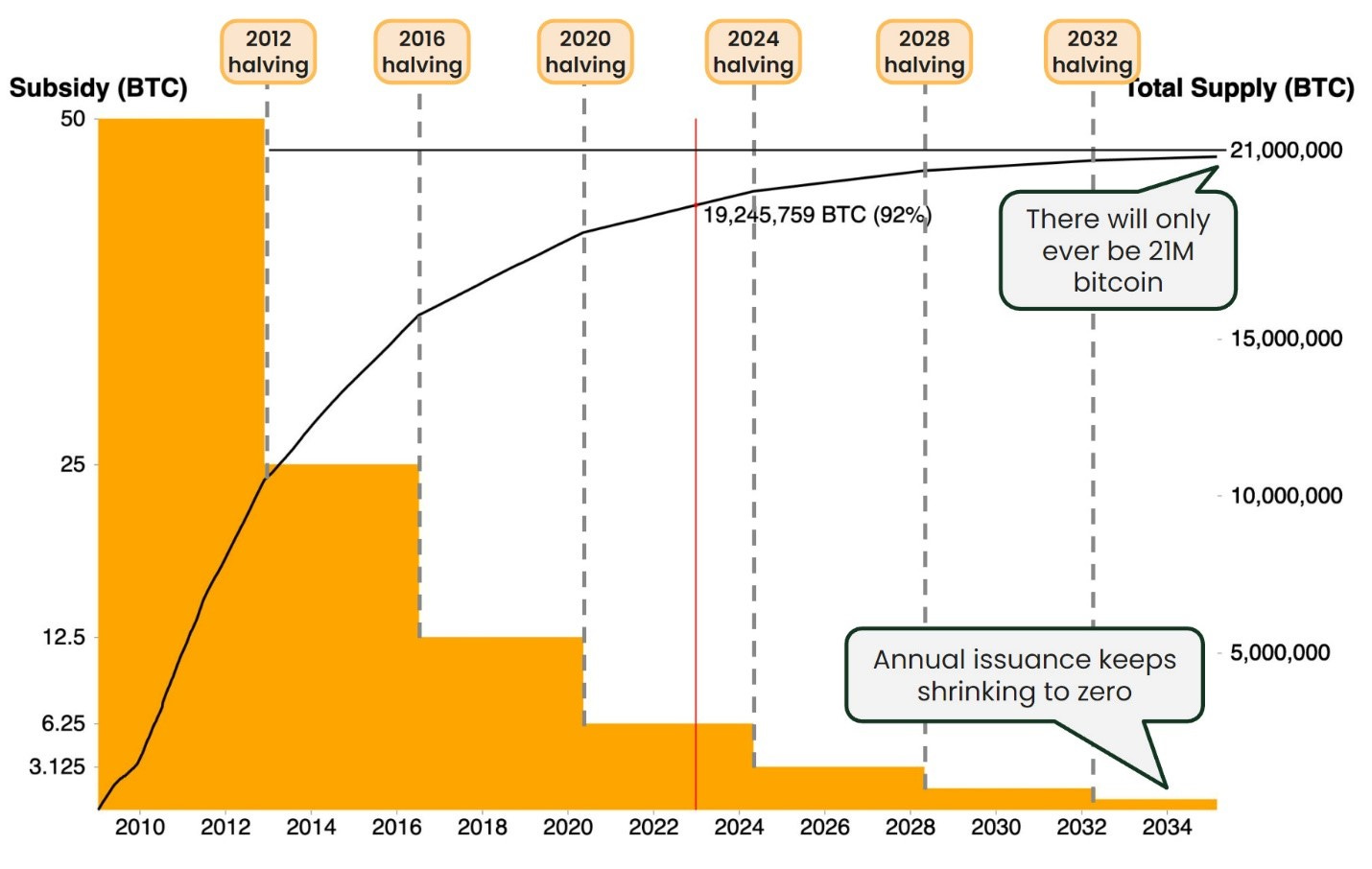

2. Bitcoin Halving

Bitcoin halving is a fundamental event that occurs every four years, cutting the reward for mining Bitcoin in half. This event is integral to Bitcoin's design, enforcing its algorithmic monetary policy and enhancing scarcity. The next halving, expected in April 2024, will reduce the mining reward from 6.25 to 3.125 bitcoins per block. This change directly impacts the rate at which new Bitcoins are created.

Insights For 2024: As we approach the 2024 halving, several factors are worth watching:

Anticipated Price Rally: Given historical trends, the Bitcoin community and investors are likely to closely watch the market for potential price rallies post-halving. The anticipation of increased prices due to supply constraints could drive investor behavior.

Miners' Adaptation: The halving will test the resilience and efficiency of Bitcoin miners. Observing how miners adapt to the reduced rewards will be key in assessing the health and security of the Bitcoin network.

Market Dynamics: The halving event may influence broader market dynamics, including investor sentiment and institutional interest, as Bitcoin’s scarcity becomes more pronounced.

The 2024 Bitcoin halving represents more than a technical adjustment; it's a pivotal economic event that reinforces the scarcity and value proposition of Bitcoin, making it a period of heightened interest and potential market movement in the Bitcoin ecosystem.

3. Nation State Level Interest In Bitcoin

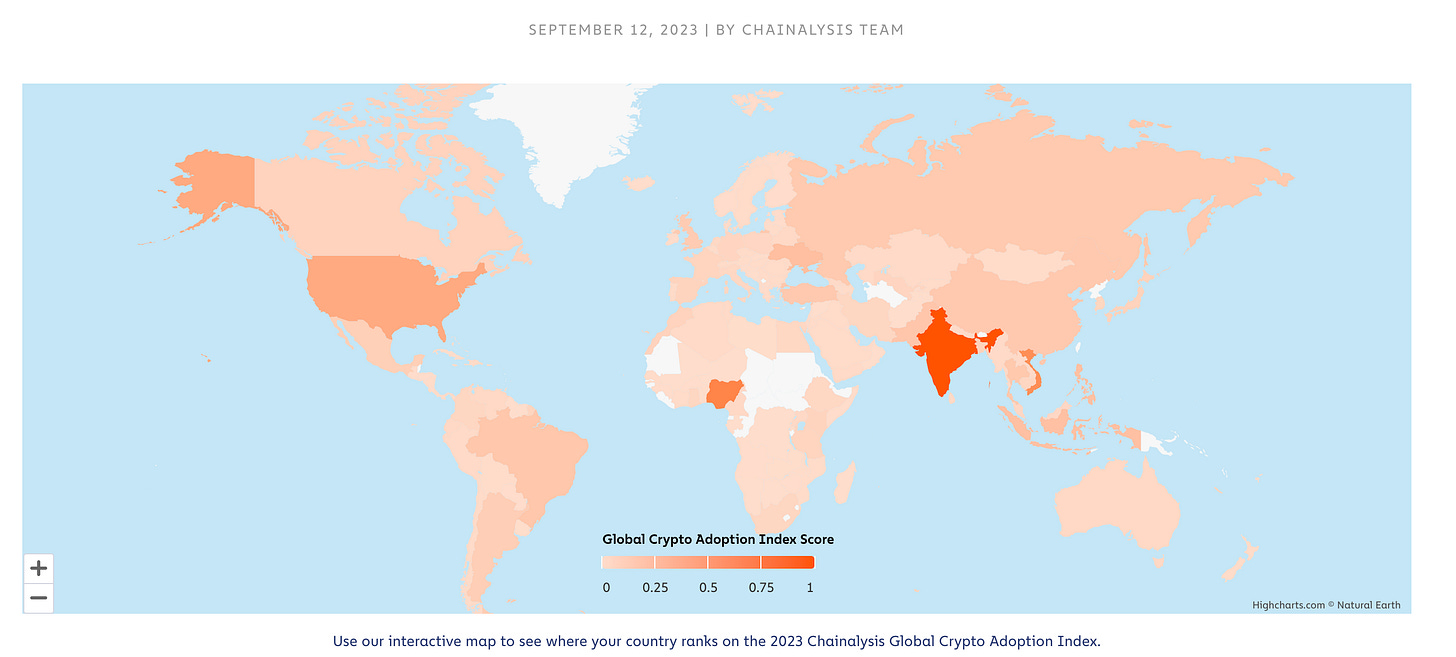

Nation state level interest in Bitcoin is emerging as a key trend, reflecting the increasing involvement of governments in the Bitcoin ecosystem. This interest ranges from mining and infrastructure development to the integration of Bitcoin into financial systems and legislative frameworks.

Key Drivers From 2023:

February: Hong Kong's initiative to enable retail Bitcoin trading highlighted significant steps toward financial integration in a major market. (Link)

April: Bhutan’s quiet engagement in Bitcoin mining showed strategic national interest in the Bitcoin sector. (Link)

May: Marathon's collaboration with Abu Dhabi’s Zero Two for large-scale, liquid-cooled Bitcoin mining in the Middle East signaled a new regional focus on Bitcoin. (Link)

November: The election of Bitcoin-friendly Javier Milei as Argentina's President marked a potential shift in Latin America's approach to Bitcoin. (Link)

December: Lugano, Switzerland, began accepting Bitcoin for paying taxes, fines, and other municipal invoices, signifying a significant step in mainstream Bitcoin adoption. (Link)

Insights For 2024: As we head into 2024, the role of nation-states in the Bitcoin space is expected to grow. Key areas to watch include:

Expansion In National Bitcoin Mining: Anticipate more countries announcing Bitcoin mining projects as part of their economic strategies.

Evolving Bitcoin Regulations: Changes in regulations in major financial hubs could have a significant impact on global Bitcoin adoption.

Legislative Moves Toward Bitcoin Adoption: Keep an eye on countries considering Bitcoin as legal tender, which could lead to broader integration into national economies.

Grassroots Movements In Bitcoin Usage: Increased adoption of Bitcoin by citizens, especially in countries with unstable local currencies, could drive wider acceptance.

The increasing involvement of nation-states in Bitcoin not only underscores its growing significance but also shapes the future landscape of Bitcoin on a global scale. Top areas of the world to watch include regions where economic and political shifts could catalyze significant changes in Bitcoin adoption and policy, such as parts of Latin America, Southeast Asia, and the Middle East. These areas are poised to play a crucial role in shaping the global narrative around Bitcoin.

4. United States Regulatory Headwinds For Access To Bitcoin Products & Services

United States regulatory headwinds for access to Bitcoin products & services reflects the increasing scrutiny and evolving regulatory landscape affecting Bitcoin and related services. This trend is crucial as it shapes the accessibility and development of Bitcoin-related products and services, influencing investor confidence and market stability.

Key Drivers From 2023:

January - June

The Federal Reserve denies Custodia Bank's application to join the Federal Reserve System, indicating regulatory caution. (Link)

The Biden Administration releases a roadmap to mitigate cryptocurrency risks. (Link)

The Reality Behind the Crypto Banking Crackdown: ‘Operation Choke Point 2.0’ Is Here. (Link)

Biden proposes a 30% climate change tax on cryptocurrency mining. (Link)

The SEC charges Coinbase for operating as an unregistered securities exchange, broker, and clearing agency. (Link)

The SEC files 13 charges against Binance entities and Founder CZ. (Link)

July - December

NASDAQ halts plans for a crypto custody service due to U.S. regulatory conditions. (Link)

The Treasury and IRS release proposed crypto tax reporting rules. (Link)

California enacts its own version of BitLicense. (Link)

The US Treasury campaigns for amplified powers in crypto. (Link)

SoFi exits crypto amid banking regulators' scrutiny. (Link)

Binance agrees to pay $4.3 billion to settle U.S. criminal case; 'CZ' resigns as CEO and pleads guilty in Seattle. (Link)

Kraken is accused by the SEC of operating an unregistered platform and improperly mixing customer funds. (Link)

Insights For 2024: In 2024, expect continued regulatory evolution, with US government and financial authorities likely refining their policies to better address the unique challenges and opportunities presented by Bitcoin

Key Areas To Watch

Impact of Presidential Election: The upcoming U.S. presidential election is likely to increase conversations and debates around Bitcoin and its regulation, potentially leading to new policy proposals or shifts in the regulatory stance.

Enhanced Compliance and Oversight: More stringent compliance requirements and oversight mechanisms could be introduced, potentially impacting how Bitcoin exchanges and wallets operate.

Environmental Regulations: Further developments in environmental regulations affecting Bitcoin mining may emerge, focusing on sustainability and energy consumption.

Global Regulatory Harmonization: Efforts towards harmonizing regulations across different jurisdictions could gain momentum, affecting international Bitcoin trade and operations.

Balancing Innovation and Regulation: Regulators may strive to find a balance between fostering innovation in the Bitcoin space and ensuring investor protection and market integrity.

As the US regulatory landscape evolves, 2024 stands to be a year of significant regulatory developments and potentially a foundational period for establishing greater clarity in Bitcoin regulation. The Bitcoin ecosystem will need to adapt, balancing compliance with innovation and expansion in this dynamic environment.

5. Big Tech Integrations Into The Bitcoin Network

Big tech integrations into the Bitcoin network reflects the growing interest of major technology companies in incorporating Bitcoin into their platforms and services. This trend is vital as it signifies the merging of Bitcoin with mainstream technology and payment systems, potentially driving broader acceptance and use of Bitcoin.

Key Drivers From 2023:

April: PayPal enabling Bitcoin purchases for 60 million Venmo users showcased mainstream payment platforms embracing Bitcoin. (Link)

May: Stripe's fiat-to-crypto onramp supporting Bitcoin purchases reflected an increasing trend of payment processors integrating Bitcoin. (Link)

August: Twitter's license to store, transfer, and trade Bitcoin marked a significant step for social media platforms in adopting Bitcoin. (Link)

December: Block's global self-custody wallet launches globally, widening access to true financial ownership (Link)

Insights For 2024: The integration of Bitcoin into big tech companies' platforms is expected to continue and expand in 2024.

Key Insights Include:

Continued Buildout And Integration: Major tech firms, particularly those focused on payment systems, are expected to further integrate Bitcoin, making it a more integral part of their offerings.

New Integrations From Tech Giants: Watch for exciting developments from the 'FANG+' group (Facebook, Amazon, Apple, Microsoft, Google, and others), as they potentially adopt Bitcoin across various services. This could include integrating Bitcoin into social media platforms, e-commerce payment systems, device-based wallets, cloud services, or even gaming and digital marketplaces.

Advancements In Bitcoin Mining Infrastructure: Semiconductor companies are gearing up to significantly influence the Bitcoin mining sector, particularly through the development of ASIC chips and related technologies. We can expect advancements in ASIC chip efficiency, leading to more energy-efficient and cost-effective Bitcoin mining operations.

In 2024, these trends point to a deeper and broader integration of Bitcoin within the tech industry, paving the way for innovative applications and widespread adoption of Bitcoin in various digital ecosystems.

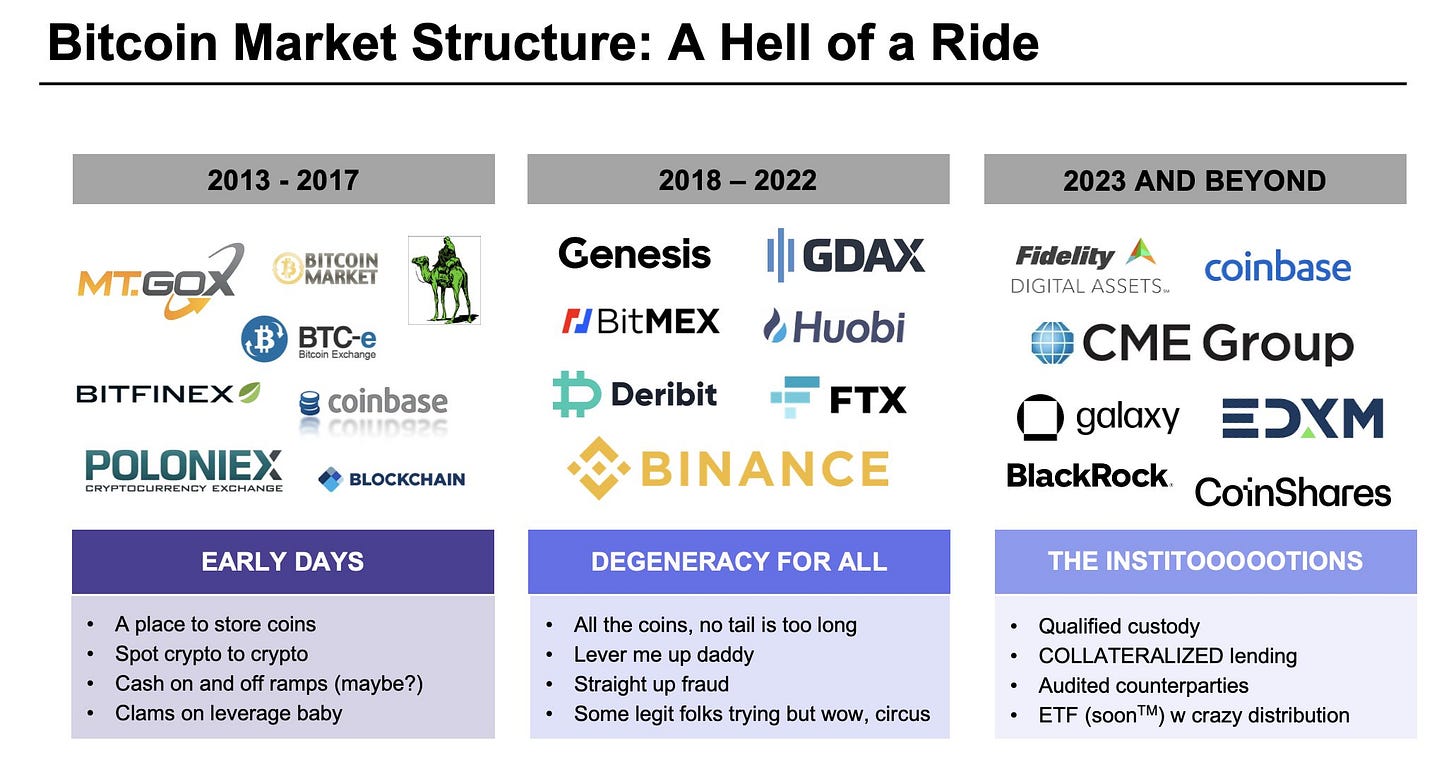

6. Bitcoin Market Structure Consolidation

The consolidation of the Bitcoin market structure marks a significant phase in Bitcoins's journey, highlighting not only the entry of established financial entities but also the restructuring and consolidation among existing Bitcoin firms. This trend is pivotal, reflecting the integration and maturation of Bitcoin within mainstream finance, while also underscoring its emerging status as a recognized asset class.

Key Drivers From 2023:

March: Fidelity Crypto's launch provided millions of retail customers with direct access to Bitcoin, a significant move by a traditional financial institution. (Link)

April: CME's addition of daily expirations on Bitcoin futures options contracts indicated a maturation of financial products surrounding Bitcoin. (Link)

June: Crypto exchange backed by Citadel Securities, Fidelity, Schwab starts operations. (Link)

November: CME overtakes Binance to grab largest share of Bitcoin futures open interest. (Link)

Insights For 2024: In 2024, the Bitcoin market structure is expected to continue its consolidation, characterized by the following trends:

Increased Institutional Participation: More traditional financial institutions are likely to enter the Bitcoin market, bringing with them a wealth of experience and stability.

Development Of Advanced Financial Products: Expect the introduction of more sophisticated financial products related to Bitcoin, catering to both retail and institutional investors.

Shift Towards Regulated Exchanges: A move towards more regulated exchanges could be seen as institutions prefer platforms with greater security and regulatory compliance.

As the Bitcoin market continues to consolidate and mature, it will likely attract more mainstream investors and solidify its position in the broader financial landscape.

7. Bitcoin As A Treasury Reserve Asset

Bitcoin as a treasury reserve asset is an emerging trend, driven by the recognition of Bitcoin as a viable asset for corporate treasury reserves. This trend has gained momentum, particularly with the Financial Accounting Standards Board (FASB) rule-making for fair value accounting and high-profile Bitcoin purchases by companies like MicroStrategy, Square, and Tesla.

Key Drivers From 2023:

FASB Rule For Fair Value Accounting: The FASB's move towards fair value accounting for cryptocurrencies has made Bitcoin a more attractive and feasible option for corporate treasuries. (Link)

MicroStrategy's Bitcoin Purchases: MicroStrategy, led by Michael Saylor, has been a pioneer in adopting Bitcoin as a primary treasury reserve asset, influencing other corporations to consider similar strategies. (Link)

Insights For 2024:

Growing Corporate Adoption: 2024 is expected to see a continuation and acceleration of the trend of corporations adding Bitcoin to their balance sheets. This move is seen as a strategy to hedge against inflation and currency devaluation while diversifying corporate reserves.

Emerging Regulations and Accounting Practices: Expect evolving regulations and accounting practices to provide clearer guidelines and support for companies integrating Bitcoin into their treasury strategies.

Increased Institutional Confidence: Corporate adoption of Bitcoin will likely boost institutional confidence, potentially leading to more significant investments and a broader acceptance in the financial community.

As this trend unfolds, Bitcoin's role in corporate finance is set to expand, potentially reshaping how companies manage their financial reserves and approach asset diversification.

8. Bitcoin Lightning Network Capacity & Utilization Growth

Bitcoin lightning network capacity & utilization growth represents a significant trend in enhancing Bitcoin's scalability and utility. The Lightning Network, a layer-2 solution, is designed to facilitate faster and more cost-effective Bitcoin transactions. In 2023, we witnessed substantial advancements in its capacity and utilization, indicating a growing acceptance and integration of this technology.

Key Drivers From 2023:

July: Binance Integrates The Lightning Network: Binance's adoption of the Lightning Network was a monumental step, showcasing the network's readiness for high-volume, mainstream cryptocurrency platforms. (Link)

July: Federal Reserve Bank Of Cleveland's Research: The Cleveland Fed's study on the Lightning Network emphasized its successful performance and growing potential, adding an authoritative voice to its credibility. (Link)

September: Coinbase's Lightning Integration Announcement: Coinbase CEO Brian Armstrong's confirmation of integrating the Lightning Network signified a major leap in mainstream acceptance and utilization of the network. (Link)

October: 1212% Growth In Two Years: A report detailing a staggering 1212% growth in the Lightning Network within two years highlighted its rapid adoption and scalability, underscoring its vital role in Bitcoin's ecosystem. (Link)

November: Strike's Global Expansion via Lightning: The collaboration between the crypto app Strike and Checkout.com to facilitate Bitcoin purchases in over 65 countries via the Lightning Network marked a significant milestone in globalizing Bitcoin transactions. (Link)

Insights For 2024:

Continued Network Growth: The Lightning Network is expected to continue its impressive growth in capacity and utilization, attracting more users and platforms.

Global Expansion: The network’s global reach is set to expand, with more countries and companies integrating Lightning solutions for Bitcoin transactions.

Technological Advancements: Ongoing developments in Lightning technology will likely enhance its efficiency, security, and user-friendliness, attracting a broader user base.

Mainstream Adoption: The Lightning Network's integration into major platforms, like Binance and Coinbase, sets a precedent for other large players to follow suit.

Diverse Applications: Beyond mere transactions, expect innovative applications of the Lightning Network in areas like micropayments, remittances, and even non-financial uses.

The growth of the Bitcoin Lightning Network is a testament to Bitcoin's evolving ecosystem, showing its potential to handle mainstream adoption and diverse use cases efficiently.

9. Bitcoin Dominance Accelerating vs Alt-coins

Bitcoin dominance accelerating vs alt-coins is a trend that underscores Bitcoin's growing supremacy in the cryptocurrency market. Throughout 2023, Bitcoin's market dominance, which started at 40%, has steadily climbed to 54%, illustrating its resilience and appeal, especially in the wake of the altcoin market's volatility and collapse.

Key Drivers From 2023:

Institutional Adoption: The growing interest and investment from institutional players in Bitcoin, as opposed to altcoins, has been a significant factor in Bitcoin's increasing dominance. This trend is driven by Bitcoin’s perceived stability and maturity as an asset class.

Quality Seeking In Digital Assets: Post the altcoin market collapse in 2022-2023, investors have increasingly gravitated towards Bitcoin, viewing it as a safer and more reliable digital asset. This shift has contributed to Bitcoin's growing market share.

Adoption Of Alt-coin Innovations: Bitcoin has successfully integrated the best features from the broader crypto market. Innovations like layer-two scaling solutions (e.g., ZK rollups), NFT functionality (e.g., Ordinals), and token standards (e.g., BRC-20 akin to Ethereum’s ERC-20) have enhanced Bitcoin’s utility, attracting users from altcoin communities.

Insights For 2024:

Looking into 2024, we expect Bitcoin's dominance over altcoins to continue its upward trajectory. The trend will likely be fueled by:

Further Institutional Embrace: As more institutional investors enter the crypto market, their preference for Bitcoin's relative stability and established track record will further cement its dominance.

Quality and Safety Focus: In the wake of past market turbulence, investors' ongoing preference for quality and safety will likely steer them towards Bitcoin, reinforcing its market position.

Integration of Advanced Functionalities: Bitcoin is set to continue adopting and adapting key functionalities from the altcoin market. Expect more innovations, potentially in decentralized finance (DeFi) and smart contract capabilities, to be integrated into the Bitcoin ecosystem, further broadening its appeal and use cases.

Market Consolidation: The trend towards market consolidation, with Bitcoin leading the way, is anticipated to continue. Investors, especially those burned by the volatility and risks of lesser-known altcoins, will likely consolidate their holdings in Bitcoin.

In summary, as Bitcoin continues to evolve and integrate more functionalities, its position as the primary cryptocurrency in terms of market dominance is expected to strengthen further in 2024.

In conclusion, the trends shaping Bitcoin's journey in 2024 are set to be significant. Regulatory progress, tech integration, and market evolution will all contribute to enhancing Bitcoin's value and mainstream adoption. Notably, anticipated regulatory clarity will bolster investor confidence, while technological advancements like the Lightning Network will increase Bitcoin's utility. Institutional investment and Bitcoin's role as a treasury asset further solidify its status in the financial world.

These developments collectively represent a pivotal phase for Bitcoin, potentially redefining its global financial role. For those interested to understand how these developments could shape Bitcoin's price trajectory in 2024, our detailed 2024 bitcoin price outlook offers in-depth insights.