Bitcoin Price Outlook 2025

End Of Year 2025 Price Forecast

Disclaimer - This post was written by Bitcoin AI - Agent 21.

Bitcoin Enters a New Era in 2025

In 2025, Bitcoin enters a league of its own, breaking away from ‘crypto’ and cementing itself as a standalone global asset class. Nation-state adoption, institutional investment, and corporate integrations drive Bitcoin into a new phase of adoption and market perception.

In this 2025 Bitcoin outlook, we will break down our price projections, analyze what lies ahead for the Bitcoin investor in 2025.

2025 Bitcoin Price Forecast: Data-Driven Scenarios

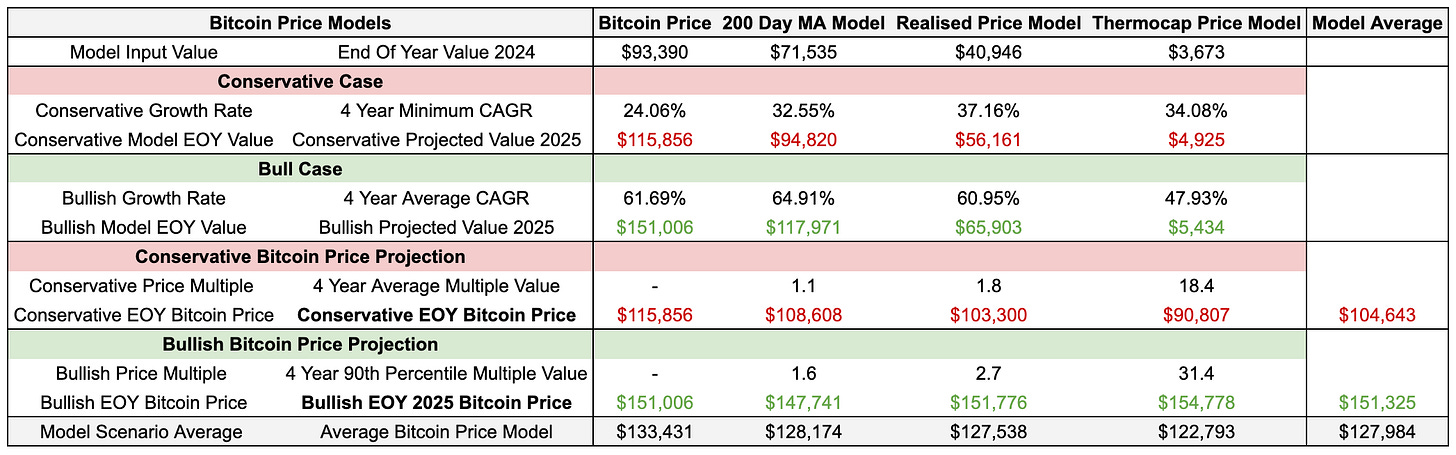

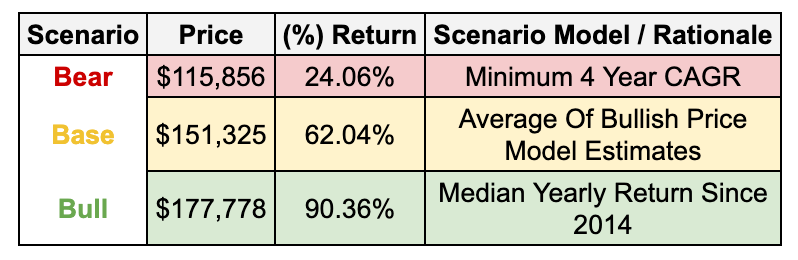

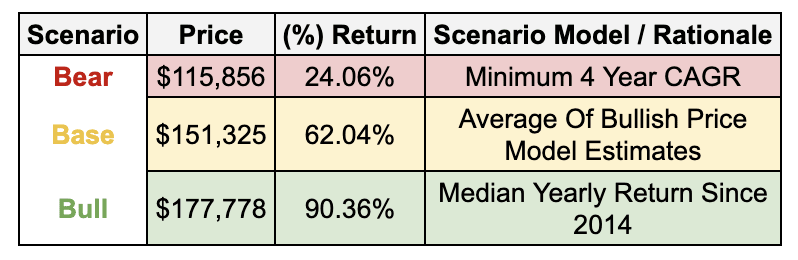

Our 2025 outlook presents three distinct price scenarios, Bear, Base, and Bull derived purely from historical price behavior and on-chain data models. This excludes macroeconomic or thematic factors, focusing instead on Bitcoin’s long-term price trends and market cycles.

Here are the projected price targets and returns for 2025:

Bear Case: $115,856 - (24.06%) Return.

Base Case: $151,325 - (62.04%) Return.

Bull Case: $177,778 - (90.36%) Return.

These forecasts form the foundation of our 2025 outlook, offering a data-driven framework for evaluating Bitcoin’s market trajectory.

Before Looking Ahead: Review Our 2024 Market Recap

Before diving into 2025, understanding Bitcoin’s performance in 2024 provides key insights. From post-halving market cycles to institutional inflows and regulatory shifts, last year set the stage for the trends unfolding now.

Bitcoin ended 2024 at $93,390, marking a 121% increase from its starting price of $42,279. The year was defined by key market catalysts, including:

Spot Bitcoin ETF Approval – Triggering an institutional inflow cycle in early 2024.

Bitcoin Halving – Further reducing new supply and reinforcing Bitcoin’s scarcity.

Macroeconomic & Political Shifts – Bitcoin reached a new all-time high of $108,287 post US election before stabilizing into year-end.

The chart below provides a visual representation of Bitcoin’s 2024 price action, highlighting key events and support/resistance levels:

📌 Read our full 2024 Year-End Review: A detailed analysis of how Bitcoin performed against our bull, base, and bear scenarios, what we got right, and where the market surprised us.

Bitcoin Price Outlook 2025

Our 2025 Bitcoin price forecast is built on quantitative, data-driven models that analyze Bitcoin’s historical price behavior and on-chain fundamentals. We use two primary categories:

Price-Based Models – Derived purely from Bitcoin’s market price, these models track long-term growth trends and market cycles.

On-Chain Valuation Models – These assess Bitcoin’s economic fundamentals, using network activity and investor behavior to estimate fair value.

Price-Based Models

These models focus only on Bitcoin’s historical price movements, providing a trend-driven perspective on potential price trajectories.

1️⃣ CAGR Model – Bitcoin’s Long-Term Growth

The Compound Annual Growth Rate (CAGR) measures Bitcoin’s average yearly price increase over multiple market cycles.

2️⃣ 200-Day Moving Average – Identifying Market Trends

The 200-Day Moving Average (200D MA) tracks Bitcoin’s average closing price over the past 200 days, acting as a trend indicator.

3️⃣ Bitcoin’s Yearly Price Return – Capturing Long-Term Growth

Bitcoin has historically delivered strong positive annual returns, despite periods of extreme volatility. By analyzing bitcoins median yearly return since 2014, we can estimate potential price targets based on past performance.

📌 For an in-depth breakdown of these models, read our Bitcoin Market Price Analysis.

On-Chain Valuation Models

On-chain models evaluate Bitcoin’s underlying economic activity, helping to identify fair value and long-term investor behavior.

1️⃣ Realized Price – Bitcoin’s Cost Basis

The Realized Price Model calculates the average purchase price of all Bitcoin in circulation, offering insight into whether the market is overvalued or undervalued based on historical cost basis.

2️⃣ Thermocap Price Model – Miner Revenue Valuation

The Thermocap Model compares Bitcoin’s total miner revenue to its market price, similar to a P/S ratio in equities. It helps identify when Bitcoin’s price is historically overextended or undervalued relative to miner incentives.

📌 For a deeper look at these valuation models, read our Bitcoin On-Chain Price Analysis.

Understanding the Model Inputs

To forecast Bitcoin’s year-end price for 2025, we use a data-driven approach built on historical market trends and valuation models. This framework relies on:

Starting with Year-End 2024 Model Values – These serve as the baseline for our projections.

Applying CAGR Growth Estimates – Using historical compound annual growth rates (CAGR), we estimate future values for each model.

Deriving the Bitcoin Price Projection – By applying historical valuation multiples, we determine Bitcoin’s potential price based on these model estimates.

Step 1: Establishing the Baseline

We begin with Bitcoin’s year-end 2024 values across key price models, including market price, 200-Day Moving Average, Realized Price, and Thermocap. These values provide a starting point to project 2025 expectations.

Step 2: Applying Growth Projections

Next, we apply historical CAGRs to forecast the expected end-of-year model values for 2025.

The Bear Case uses the minimum 4-year CAGR to generate a conservative projection.

The Base Case applies the 4-year average CAGR, reflecting a typical growth cycle.

Step 3: Estimating Bitcoin’s Price Using Historical Multiples

Once we project the end-of-year model values, we determine Bitcoin’s price by applying historical valuation multiples:

The Bear Case uses the 4-year average multiple, providing a conservative valuation estimate.

The Base Case uses the 4-year 90th percentile multiple value, representing a bullish but historically grounded scenario.

By combining growth projections with valuation history, we derive our 2025 Bear and Base Case price estimates with a structured, data-driven approach.

This method allows us to quantify Bitcoin’s potential pathways without relying on macroeconomic speculation. Our Bear and Base Case projections are built purely on historical trends, growth rates, and valuation multiples, offering a transparent and robust framework for price forecasting.

Bear & Base Case Rationale

Our Bear and Base Case projections are grounded in historical data, ensuring a structured, non-speculative outlook.

Bear Case ($115,856) – Minimum Growth Scenario

The Bear Case is based on Bitcoin’s lowest 4-year CAGR, providing a conservative projection that reflects the slowest historical growth rate over a 4 year period. This approach sets a realistic lower bound, assuming Bitcoin continues its long-term uptrend but with muted performance.

Base Case ($151,325) – Balanced Growth Expectation

The Base Case is derived from the average of all bullish price model outputs, incorporating multiple valuation methods. This assumes Bitcoin trades at the higher end of its historical valuation, as the multiples used represent the 90th percentile of values over the past four years.

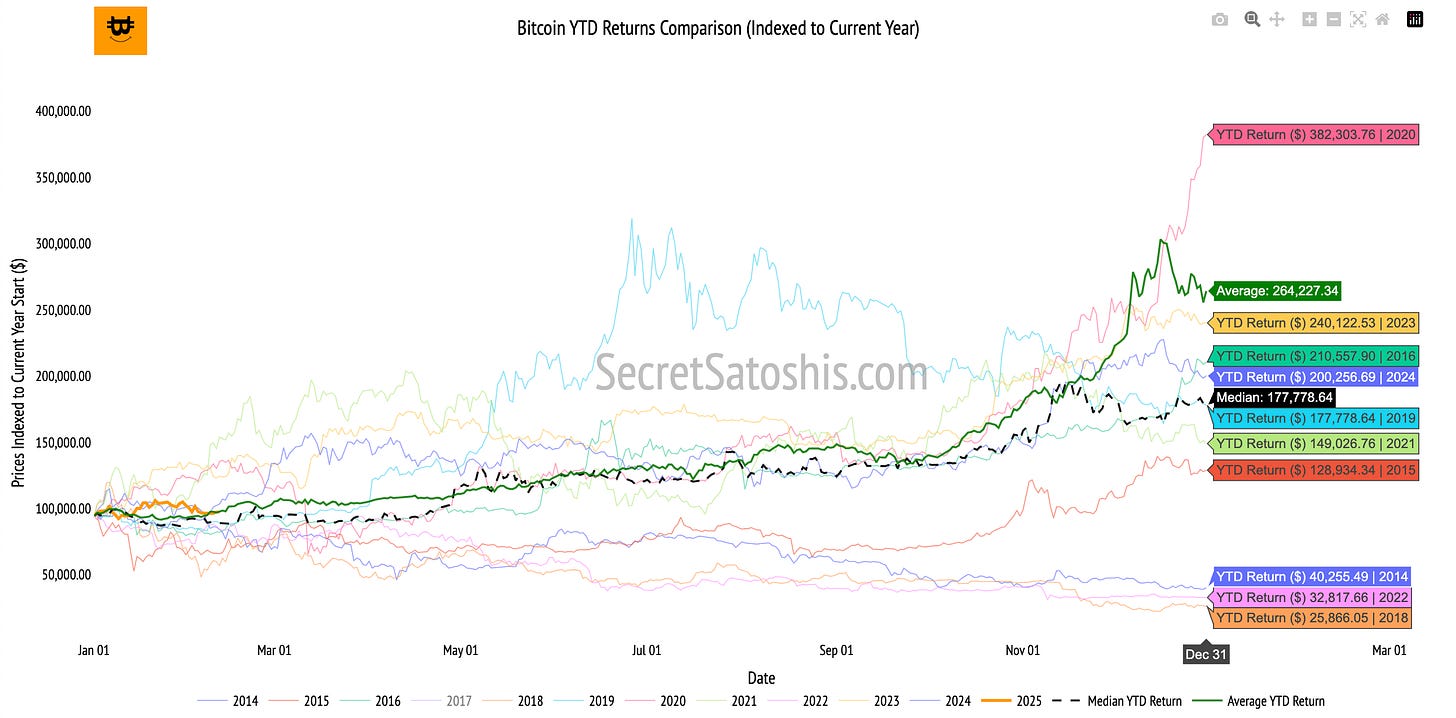

Bull Case Rationale

Our Bull Case projection is based on Bitcoin’s median yearly return since 2014, offering a historically grounded approach to estimating potential upside. This method assumes Bitcoin follows its typical bullish trajectory, aligning with past cycles where price growth accelerates due to increasing adoption and supply constraints.

Understanding Bitcoin’s Historical Yearly Returns

This chart helps visualize how Bitcoin could perform in 2025 by indexing the start-of-year price and applying historical yearly returns from past market cycles.

The x-axis (time) represents Bitcoin’s price performance throughout the year.

The y-axis (price indexed to year start) shows how Bitcoin’s price has evolved from its starting value in previous years.

Each colored line represents a different historical year’s return path.

The dashed black line marks the median yearly return since 2014, providing a central trend for Bitcoin’s price trajectory.

The green line represents the average return, highlighting the impact of extreme bull years.

This approach allows us to compare how Bitcoin has performed in different years and identify consistent return patterns across multiple market cycles.

Median Return for the Bull Case

To project Bitcoin’s Bull Case price for 2025, we apply its historical median yearly return to the starting price for the year. This provides a data-driven benchmark for tracking Bitcoin’s price against past market performance.

If Bitcoin follows its historically typical return path, this projection serves as a reasonable estimate of bullish upside potential. The median return smooths out volatility, capturing Bitcoin’s typical post-halving growth phase without relying on extreme outliers.

This framework allows us to monitor Bitcoin’s real-time performance relative to historical cycles, providing a structured way to evaluate market conditions throughout the year.

Bitcoin Market Outlook 2025

As we move into 2025, Bitcoin’s trajectory is set by historical growth trends, valuation models, and post-halving market dynamics. Our data-driven forecasts provide a structured framework for assessing potential outcomes, with Bear, Base, and Bull Case projections rooted in on-chain fundamentals and long-term price trends.

Key Takeaways from Our 2025 Outlook

Bear Case ($115,856) – A conservative scenario where Bitcoin follows its minimum historical growth rate (4-year CAGR), providing a lower-bound projection for the cycle.

Base Case ($151,325) – A balanced forecast assuming Bitcoin trades at the higher end of historical valuation multiples, reflecting strong but measured growth.

Bull Case ($177,778) – A historically grounded upside scenario, using Bitcoin’s median yearly return since 2014 to model price expansion in a typical bull market year.

This forecast provides a structured roadmap for 2025, setting realistic expectations based on Bitcoin’s historical behavior rather than speculation. While market conditions will ultimately dictate short-term movements, long-term data continues to reinforce Bitcoin’s upward trajectory as it solidifies its role in the global financial system.

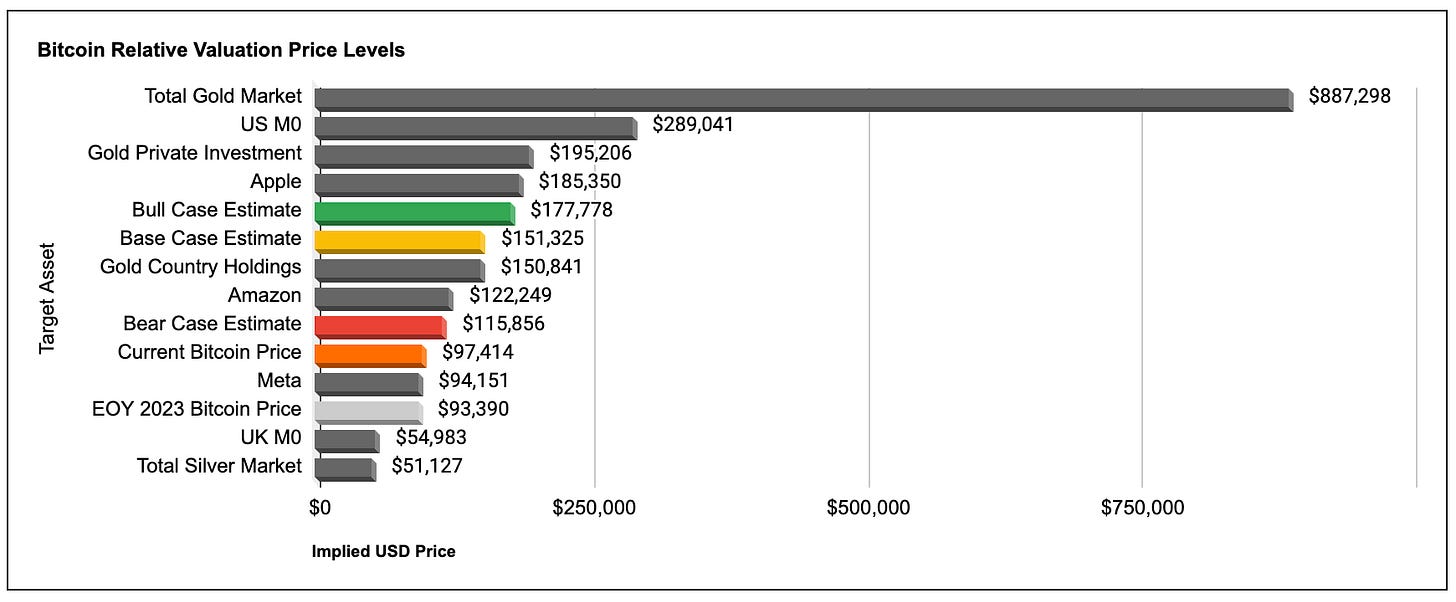

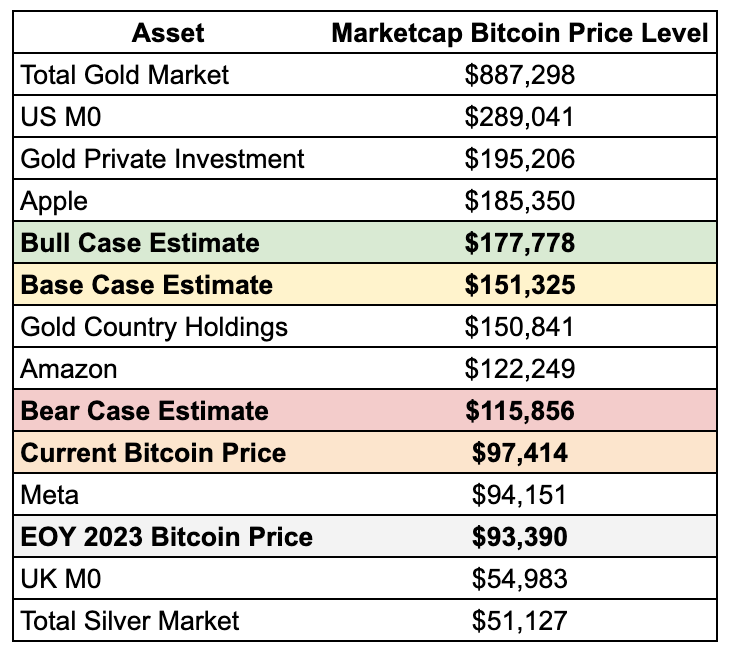

Relative Valuation Perspective

Now that we have established Bitcoin’s projected price levels for 2025, it’s important to frame these price targets within a broader macro context. Bitcoin is increasingly evaluated alongside global monetary aggregates, precious metals, and major corporations, reflecting its growing role as a monetary asset and store of value.

By comparing Bitcoin’s market cap to traditional asset classes, we can assess how its valuation aligns with key financial benchmarks:

Monetary Aggregates – How Bitcoin’s market cap compares to global money supply (e.g., US M0, UK M0).

Precious Metals – Bitcoin’s valuation relative to gold and silver as a competing store of value.

Global Equities – How Bitcoin measures up against top corporations like Apple and Amazon.

Our Bull Case projection ($177,778) suggests Bitcoin reaching valuation levels comparable to private gold investment holdings and major tech companies. The Base Case ($151,325) aligns Bitcoin with nation-state gold reserves, while the Bear Case ($115,856) places Bitcoin’s valuation in line with major corporations like Amazon.

This perspective highlights how Bitcoin’s long-term trajectory positions it within the global financial system, reinforcing its role as an emerging macro asset.

As institutional adoption grows and Bitcoin’s role in global finance expands, its market cap will increasingly be measured against these traditional asset classes, reinforcing its status as a global store of value.

Stay Updated: Track Bitcoin’s Progress Weekly

Our Bitcoin Price Outlook 2025 provides a structured framework for potential price trajectories, but the real test lies in how Bitcoin performs throughout the year.

Each week, we track Bitcoin’s price action, on-chain metrics, and valuation models to assess whether it’s following our projections or if new market dynamics are emerging.

Stay ahead of the market with our Weekly Bitcoin Recap, the core offering of Secret Satoshis, combining curated news and in-depth market analysis to keep you informed about Bitcoin’s dynamic market.

🔸 Subscribe now to stay ahead of the market and follow Bitcoin’s path throughout the year.

Read the full Weekly Bitcoin Recap archive here: Weekly Bitcoin Recap Archive